- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- How do I remove the natural disaster relief?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I remove the natural disaster relief?

I d like to quote this reply hereinafter, and I followed it and removed it.

To find the disaster tax relief question, try the following steps:

- Go to Wages & Income at the top of the screen (or Personal > Personal Income)

- Click I'll choose what I work on

- Scroll to the bottom of the section without making any changes and click Done with Income

- Continue moving forward until you see a question about whether you took a disaster distribution in 2020 and select 'No'

- Run the Federal Review again to see if the error has cleared

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I remove the natural disaster relief?

Thank you, I made it!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I remove the natural disaster relief?

I followed this. The box had "update" not start in the box. I answered the question no. This did not work.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I remove the natural disaster relief?

@William 6 wrote:

I followed this. The box had "update" not start in the box. I answered the question no. This did not work.

Try this procedure -

If you did not take a disaster distribution from your pension funds between 2018 and 2020, there may be a question that needs to be reviewed. Follow these steps.

- Go to Federal / Wages & Income.

- Scroll down to Wrap up income.

- Continue.

- At the screen Did you take a disaster distribution at any time between 2018 and 2020? answer No.

Now watch the headings under Federal closely.

- When you are in Deductions & Credits.

- Scroll down and click on Wrap up tax breaks.

- Then you are in Other Tax Situations.

- Scroll down and click on Let's keep going.

- Continue through to Federal Review.

If you've tried the previous steps and you did not resolve the question about the disaster distributions in 2020, then try the steps listed below

Go to Wages & Income

-

Scroll down to "Retirement Plans and Social Security

-

Select IRA, 401(K) Pension Plan Withdrawals(1099-R) = Continue (you don't need to add any income forms)

-

Have you ever taken a disaster distribution before 2021? = Yes (even if you didn't)

-

Did either of you take a disaster distribution at any time between 2018 and 2022? = No

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I remove the natural disaster relief?

Thank you This seemed to work.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I remove the natural disaster relief?

If I did take a disaster relief distribution, how do I resolve this so I can file my taxes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I remove the natural disaster relief?

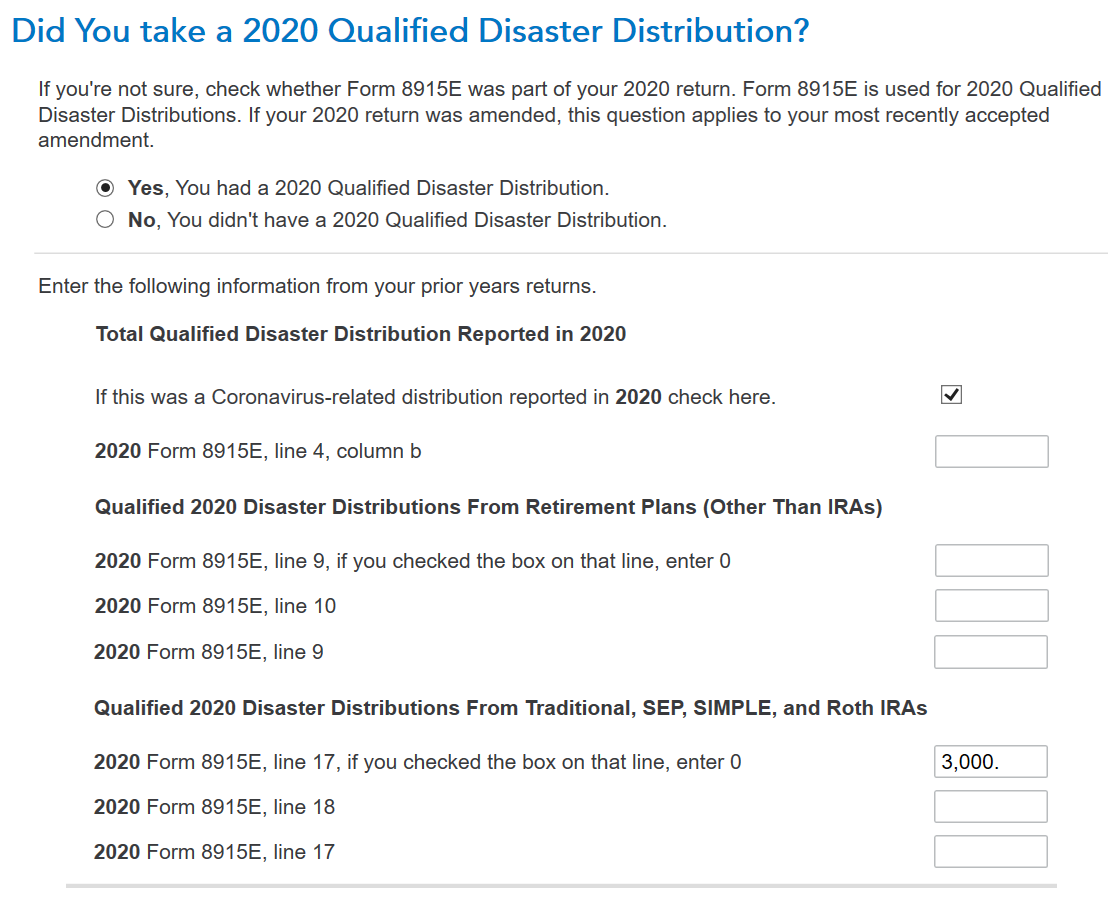

Review the steps and see the images below. The following steps should be used to enter your COVID qualifying distribution. Do Not enter a FEMA code because this doesn't have one. You must have your Form 8915-E from your 2020 tax return.

- Wages & Income > Retirement Plans and Social Security >

- IRA, 401(k), Pension Plan Withdrawals (1099-R) > Start, Revisit or Update > Continue

- Answer Yes 'Have you ever taken a disaster distribution before 2021?

- Answer Yes, You had a 2020 Qualified Disaster Distribution

- Complete the Information using your 2020 Tax return > Continue (use either section but not both (Pension or IRA depending on your situation)

- Enter any amount you may have repaid in 2021, if applicable

- Finish the entry for your spouse if applicable or just click Continue

- Complete any additional retirement questions as you move through this section

- Continue until you have finished and returned back to the Wages & Income Screen.

- Do NOT stop and change sections without completing it.

If the 2020 distribution was from an account that was Not an IRA

- 2020 Form 8915E Line 9 - Enter 1/3 of the amount from the 2020 distribution in both boxes for Line 9

If the 2020 distribution was from an IRA account

- 2020 Form 8915E Line 17 - Enter 1/3 of the amount from the 2020 distribution in both boxes for Line 17

Do not enter anything in the other boxes, leave them blank (empty)

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I remove the natural disaster relief?

After I say yes to the distribution it says You'll need to revisit this area because changes related to qualified distributions were not available. The program will not allow me to file my taxes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I remove the natural disaster relief?

If you a took a Disaster Distribution from your retirement account in 2021, the IRS just recently finished updating the qualifying disasters.

Go back through that section so you can indicate which disaster you took a qualified distribution for.

Here's a List of 2021 Qualified Disasters from the IRS.

If this does not apply to you, you can Delete Form 8915-E from your return.

@PB16

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I remove the natural disaster relief?

I have followed previous guidance on how to move past the disaster relief question but when the program reviews my federal inputs the program is still registering I've selected yes to the disaster relief question on the federal information worksheet. Because I have already paid the turbo tax fees the program will not let me clear my return and start over. I have spoken with two turbo tax agents and we have not been able to move past this question.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I remove the natural disaster relief?

I tried this but it is still popping up, is there any other way I went through the entire file and had someone from turbo tax assist me and they couldn't figure it out

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I remove the natural disaster relief?

There are two places you may be asked about natural disasters, retirement distributions and casualty losses sections:

- To get back to the natural disaster question(s) in TurboTax, go through the Retirement Income section. If you search for 1099-R, then click the Jump to 1099-R link in the search results, you will be taken to the retirement section. If you don't have any 1099-R forms, answer NO to the first question. The next questions will be about disaster distributions.

- If you have started a casualty loss form and need to remove it, search for ''natural disaster'' in the search box and use the Jump to natural disaster link to be taken to those questions. @tmg23 @gorgina

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I remove the natural disaster relief?

What did you do to remove it

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I remove the natural disaster relief?

Please clarify by putting the exact error you are seeing and we can help you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I remove the natural disaster relief?

Hi Dawn,

I spoke with a rep last night and they stated that Turbo tax is working on a bug fix for this issue. Apparently it is a widespread issue and the goal is to fix the bug by end of week.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ericasteven2017

New Member

KELC

Level 1

wphannibal

New Member

sbschad19

New Member

lishlou25-5

New Member