- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- How do I enter mileage for personal aircraft use for business? Aircraft is not listed under "vehicle" mileage, and I see no other place to enter this expense.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter mileage for personal aircraft use for business? Aircraft is not listed under "vehicle" mileage, and I see no other place to enter this expense.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter mileage for personal aircraft use for business? Aircraft is not listed under "vehicle" mileage, and I see no other place to enter this expense.

You won't see a specific place to enter aircraft mileage as a business expense, either on a Form 1040, Schedule C (self-employment), or a business entity tax return, such as Form 1120, 1120S, or 1065.

Business mileage, per the IRS, is really for wheeled ground transportation -- think of cars and trucks. For your aircraft, you'll need to enter the actual expenses of operation. There is no standard business mileage rate for air travel as far as it pertains to personal aircraft operation.

Where you record the actual aircraft operating expenses (crew, fuel, maintenance, insurance, airport fees, etc.) is somewhat left up to your discretion. One suggestion, after totaling up your expense receipts, is to report this on a business expense line for "other." You can then name your own category. (Please see the screen capture images attached to this answer for a visual aid.)

TurboTax has a place near the end of the business interview where you'll have the opportunity to input these "other" expenses.

Thanks for asking this important question and safe flying!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter mileage for personal aircraft use for business? Aircraft is not listed under "vehicle" mileage, and I see no other place to enter this expense.

Is that not a standard way of expensing personal aircraft use?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter mileage for personal aircraft use for business? Aircraft is not listed under "vehicle" mileage, and I see no other place to enter this expense.

In particular, although the GSA does indeed have a great deal of specific and helpful information to offer, please keep in mind that the GSA webpage we are viewing is one that lists "Privately Owned Vehicle Mileage Reimbursement Rates."

That is, the GSA figure is the dollar amount, per mile, that the private owner of an aircraft might legally expect the government to pay (i.e., reimburse) them for the aircraft's use in travel for purposes of official government business. This is not quite the same thing as the IRS providing us, as taxpayers, with an average cost of operating a ground vehicle per mile, for purposes of income tax expensing.

The GSA figure might approximate your actual operating costs per mile, and then it again it might not (I suppose that would depend on your particular aircraft). The proper tax approach, however, with aircraft, is to use actual operating costs, if you have those records and can distill that down to a final annual figure. In lieu of complete recordkeeping, the IRS does have provisions for what to do in case you don't have records for a particular tax item. Invoking them could allow you to use the GSA number as an expense approximation; in lieu of anything more accurate. But, if you can calculate actual figures, I would respectfully advise you to use those (provable) costs as being the more correct method, from a tax-accounting perspective.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter mileage for personal aircraft use for business? Aircraft is not listed under "vehicle" mileage, and I see no other place to enter this expense.

For additional information, see:

<a rel="nofollow" target="_blank" href="https://www.nbaa.org/admin/taxes/depreciation/">https://www.nbaa.org/admin/taxes/depreciation/</a>

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter mileage for personal aircraft use for business? Aircraft is not listed under "vehicle" mileage, and I see no other place to enter this expense.

I have exactly this question, and have for years used the GSA rate as a per mile rate, using the GSA instructions. The reason we use packages like Turbotax is to minimize the amount of time we waste in filing income tax. The question is not how we should do it, that is answered. The question is simple: how do we use Turbotax to use this value for this vehicle?

Concerning your comment on the GSA vis a vis the IRS: The IRS land vehicle mileage rates exactly parallel the GSA rates and have for as long as I can remember.

Therefore, it would be reasonable for a Tax Court to follow the same pattern, and I don't think the IRS would be in a favored position with that court if it tried to argue differently, particularly when the GSA likely understates the actual cost of flying per mile. The reason we use standard rates for occasional use of private automobiles in furtherance of business and take the standard mileage deduction is for convenience and efficiency. So it is with small private and occasionally used aircraft.

Concerning your comment on re the "proper tax approach to aircraft, is to use the actual operating costs..." I submit that this is also precisely true for private automobiles too. The reason we don't is it is simply too expensive in terms of time and effort to do so, which is why the IRS allows us to use "standard mileage deductions," which they most likely, based on the historical correlation with the GSA POV rates, obtain from the GSA analyses and permit us to use. I respectfully submit that the IRS would be hard pressed to argue a legal position that using GSA data to determine standard land vehicle mileage rates in lieu of actual operating costs is somehow different than using the same data in air vehicles.

Concerning your thoughts on whether GSA rates reflect the cost of the aircraft, my operating costs (very approximated) vary significantly on how many total flight hours I fly (indirect fixed expenses), as well as my direct expenses. Thus, the GSA rate is a reasonable approximation, and even if not, I am willing to accept a small increase in taxes, compared to the cost of my time and mental well being of maintaining even more records and exposing myself to additional work effort and risk of errors. With the GSA standard rate, I simply take the mileage and multiply it by the number and I'm done. This is all we are asking, and why we buy programs like TurboTax.

The NBAA is primarily concerned with large corporate aircraft operators, with costs expressed in hundreds or thousands per hour, not small single engine operators, such as the OP and myself. The reason we use standard mileage rate deductions for automobiles is much the same as we would for privately owned aircraft. It is simply not worth the extra record keeping effort to do any differently, despite the fact we might be able to save a few bucks by keeping the actual maintenance records. We are talking about a $30k asset, not a $3M asset with the cost of a pilot and copilot, corporate flight department, etc, (which is much more common in the NBAA's picture). The first word of the above referenced web site state, "Aircraft that are owned and operated by businesses." The OP (and I, for sure) are using a personally owned aircraft for an occasional business trip., much the same way I would use my personal car. The aircraft in question is not owned by the business, not operated by the business, and is not leased to the business.

I do not wish to claim depreciation expense for my private aircraft, for that would entail yet another set of complex record keeping requirements, and it would be improper under a variety of rules, not the least of which is the aircraft is primarily a personal pleasure aircraft and is not insured as a business asset, with the insurance coverage only for "occasional flights in furtherance of a business, incidental to the ordinary pleasure and personal business use of insured aircraft." The increased cost of insurance for a aircraft used primarily in a business is more than 5 times the cost for the same liability and hull limits. Yes, it's deductible too, but the deduction does not offset the cost differential. Especially of the aircraft is used less than 10% for business purposes.

Further there are other ramifications for listing a personal aircraft as a depreciable business asset, that being, recapture of personal use. If the use of an aircraft for personal activities is 90% of the flight hours and business only 10%, then the business would have to charge back the costs of personal operations of the aircraft, and pay more tax on the business income from the personal/private use of the aircraft (imputed income?). For a 50 year old aircraft, with a book value of $35k, depreciated on a 5 year schedule, you are talking less than $7,000 over 5 years, then what? It's fully depreciated.

So, in many cases, it makes much more sense to not use the NBAA's recommendations for aircraft PRIMARILY used for pleasure and private (non-deductable) business, and only use the GSA flat rate for deductable business use of the aircraft. My aircraft insurance increase would more than outweigh any depreciation expense, and that expense would be subject to recapture on sale of the asset, as well, incurring yet another tax.

There is yet another concern for declaring a personal aircraft a business asset. The IRS Chief Counsel ruled in 2012, that the PRIMARY use of an aircraft is governing. This means that using your recommendation could create problems if an aircraft owner elected to follow NBAA's advice inappropriately, depreciated the aircraft, expensed the hanger, maintenance, inspections etc, for a couple of business flights a year consuming 20 flight hours on an aircraft flown for personal and pleasure use of 200 hours per year. It is far harder for an auditor to argue with a standard GSA rate which can easily be demonstrated to understate the actual per mile cost of the aircraft, if necessary, even though the GSA and the IRS are separate agencies, I suspect the Tax Court would be at least interested in hearing how the GSA arrived at its numbers.

So, regardless of Turbotax's thoughts on this matter, as a new user, I am going to use the GSA rate, and now the question is how do I do it? This year it is $1.15/statute mile, regardless of the cost to operate the aircraft.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter mileage for personal aircraft use for business? Aircraft is not listed under "vehicle" mileage, and I see no other place to enter this expense.

Thank you for your articulate and detailed response. You hit on some very valid considerations. I'm using the same table for my QB data entry. It's just so much simpler than keeping/finding all the receipts for every single thing. My Foreflight logs the NM and I can do the conversion to SM, plus each trip is is my flight log for evidence if audited. Thanks for taking the time to explain this in such detail.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter mileage for personal aircraft use for business? Aircraft is not listed under "vehicle" mileage, and I see no other place to enter this expense.

GSA does list a standard mileage reimbursement

The GSA is not a taxing authority and has no authority over the IRS. While the GSA may have a standard reimbursement rate, they have no say on the tax deduction in any way, shape, form or fashion.

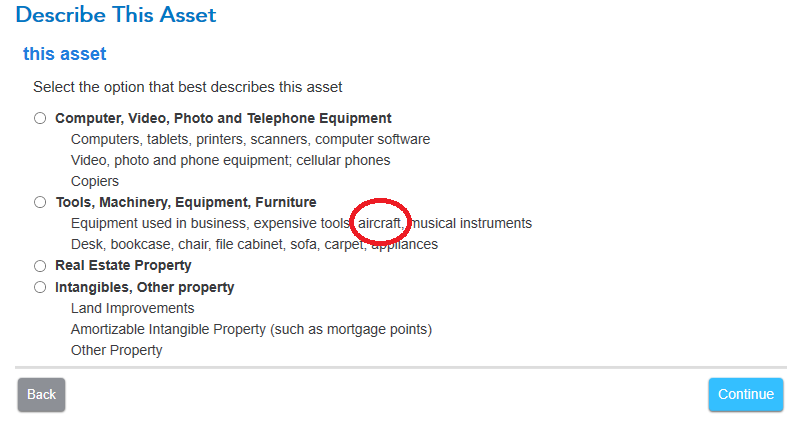

Now from what I see in TurboTax, an aircraft is reported in the Business Assets section as circled in red in the below image. The aircraft is depreciated over 7.years. Unless your business produces a taxable profit that is more than what you paid for the craft, taking the SDA or SEC179 deduction is a waste of time and will NOT benefit you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter mileage for personal aircraft use for business? Aircraft is not listed under "vehicle" mileage, and I see no other place to enter this expense.

I'm using the GSA reimbursement for my personal aircraft that I'm flying to get to a work location. Using it like a car, only its a plane 😉 I'm not claiming mileage that I drive to get to my hanger, that would seem wrong, only the flight miles. Of course, I'll have separate expenses for Uber once at my destination. But it's not a company plane, it's not my business asset, it's a personally owned vehicle (POV), which is why the GSA seems like a great resource for quantifying a standard reimbursement amount.

When I enter this reimbursement into QB I will post it as an expense under business travel - mileage reimbursement. Just the same way I would do it if I were to drive there.

Am I not thinking about this in the right way? Help me understand if you have any insight into how I'm thinking about this....

Cheers

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter mileage for personal aircraft use for business? Aircraft is not listed under "vehicle" mileage, and I see no other place to enter this expense.

Actual expenses must be used unless there is some other provision in the Tax Code, Regulations or other official tax guidance. There is a provision for things like the Standard Mileage Rate for vehicles, but there is NOT a provision to use a GSA amount for airplanes as a tax deduction.

So actual expenses must be used.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter mileage for personal aircraft use for business? Aircraft is not listed under "vehicle" mileage, and I see no other place to enter this expense.

We disagree.

IRS rules Sec. 162 permits deductions: "[t]here shall be allowed as a deduction all the ordinary and necessary expenses paid or incurred during the taxable year in carrying on any trade or business...."

IRS rules and the Courts have ruled on ordinary and necessary and have included in these expenses travel by air. See Marshall v. Commissioner, 1992.

The only remaining question is what is reasonable? The Tax code is silent on this but the courts are not. Automobile operators/owners are permitted but not required to deduct all maintenance, acquisition (depreciation/Sec 179 expense), and operating expenses. Or they can take the standard mileage rate, which reimburses them at a lower rate than if they did the above.

So, what is reasonable? The GSA mission is to operate the government efficiently and provide its agencies among other things, office space, supplies and equipment, and transportation as economically as feasible and this includes the IRS. It has for this purpose established a schedule of reimbursement for privately owned vehicles, which the IRS conveniently uses for determining a shortcut for deducting automobile expense. The tax code does not mandate how I determine a reasonable expense, as far as I can see, and I am permitted by Section 162 to deduct it as long as it meets the above tests, including reasonableness. I claim the GSA POV standard mileage rate meets the reasonableness test, although I do not know their methods, I do know their rate understates my actual operating costs, let alone the rest of the package.

If the IRS were to argue and disallow a deduction based on the GSA recommended rate for aircraft, it would also face the very real argument that it must likewise disallow the deduction based on the per mile rate for automobiles, which would be to the tax payers advantage in that most automobiles will be able to claim a greater deduction than the standard mileage rate, at the expense of tens of hours, if not more, of additional paper work/record keeping each year.

If the IRS were to dispute the GSA POV recommendation, then there would be no problem with me or like situated taxpayers simply amending my old 1040/Sched C's to use the other method, and after paying an accountant to do this, I might make enough to buy a cup of coffee from the additional refund, or maybe a new coffeemaker that grinds its own beans. The IRS, on the other hand will spend a lot more time on my return and TurboTax would make more money by requiring me to buy an more sophisticated version.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter mileage for personal aircraft use for business? Aircraft is not listed under "vehicle" mileage, and I see no other place to enter this expense.

@taxaction-3 wrote:We disagree.

IRS rules Sec. 162 permits deductions: "[t]here shall be allowed as a deduction all the ordinary and necessary expenses paid or incurred during the taxable year in carrying on any trade or business...."

The deduction is for "expenses paid or incurred". Paid. Not based on an estimated average.

As I said before, actual expenses must be used unless there is a provision otherwise.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter mileage for personal aircraft use for business? Aircraft is not listed under "vehicle" mileage, and I see no other place to enter this expense.

When I receive mileage reimbursement for driving I've only ever been told that I need to keep a log of the mileage. So I keep a pocket calendar with notes regarding car mileage. My Foreflight service and my flight log act as my proof of length of trip and actual flights taken. Why aren't these both considered the same evidence to substantiate my expense?

This is the link to the resource I'm using. It includes motorcycles as well as personal aircraft. It is an official website of the US Government.

I did check AOPA website, unfortunately, everything with a link had been taken out of service. Error found... So no help there. I am seeing that the reimbursement rate is acceptable in the moment of the event/trip/etc... however it looks like https://www.pilotsofamerica.com/community/threads/mileage-deduction-for-business-use-of-a-personal-a... POA has specified that at the end of the year, those reimbursements need to be reconciled against actual expenses and corrected for accuracy. This system makes it easy for your company to reimburse you for the expense and puts the burden of accuracy on the pilot at tax-filing time. Not what I wanted to hear ...

Are these really two different conversations; one for the business - and how to efficiently/consistently reimburse the employee for the mileage (GSA guidelines) and the other for the pilot claiming earnings/listing expenses on his personal return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter mileage for personal aircraft use for business? Aircraft is not listed under "vehicle" mileage, and I see no other place to enter this expense.

@WTF4 wrote:When I receive mileage reimbursement for driving I've only ever been told that I need to keep a log of the mileage. So I keep a pocket calendar with notes regarding car mileage. My Foreflight service and my flight log act as my proof of length of trip and actual flights taken. Why aren't these both considered the same evidence to substantiate my expense?

As I pointed out above, Tax Code and Regulations require actual expenses for a deduction, unless there is a provision that says otherwise. There is a provision for a Standard Mileage Rate for automobiles. There is not a provision for a standard rate for airplanes.

Section 274 requires substantiation for the expenses, and that requirement is rather strict for "Listed Property". Personal-use airplanes are includes as Listed Property, and required detailed substantiation, including actual expenses.

@WTF4 wrote:

Are these really two different conversations; one for the business - and how to efficiently/consistently reimburse the employee for the mileage (GSA guidelines) and the other for the pilot claiming earnings/listing expenses on his personal return?

Maybe. First, the GSA amounts are for what the government is allowed to reimburse its employees. The GSA isn't directly tax related, those are just government amounts for government employees. Non-government employers are not 'bound' by those reimbursement amounts.

However, for tax purposes, reimbursing employees have different rules than for deductions for your own business. For example, you are allowed to reimburse employees for lodging (hotels, etc.) using the GSA amounts. The business can deduct those amounts because that is the amount they actually paid the employees. But you are not allowed to use those lodging amounts for your own personal business, because that is not the amount you actually paid, and there is no provision in the tax rules to use another amount.

As for reimbursing employees for air miles, offhand I'm not sure what the Regulations say in regards to that and would look to research it if I came across that situation. It is quite possible that is allowed. But if it were allowed, the same rules apply. The business could use that as a deduction because that is what was actually paid to the employee. But that would not be allowed as a deduction for your personal business because that is not what was actually paid.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter mileage for personal aircraft use for business? Aircraft is not listed under "vehicle" mileage, and I see no other place to enter this expense.

I'm not sure there are two different questions, but there may be two different deductions involved.

The argument for full expensing and depreciation of vehicles does have its place. When I ran a Part 135 air taxi operation out of Detroit, we used leased airplanes and paid air crew a salary based on a per mile rate. The customers paid for freight or passage based on a distance in miles, the specific airplane used and any ground/layover time the airplane spent waiting beyond a reasonable amount. For those operations it simply makes sense to garner as large a deduction as is permitted by law. This would not be the GSA rate!

As far as the listed property argument, so are automobiles. The key factor is: are they used more than 50% in the business.

On the other hand, taking a reasonable deduction which can be back calculated if need be to show it is, if anything in the government's favor, for a personally owned and operated airplane (Part 91, pleasure and business), seems very reasonable to me and I think if push came to shove, would certainly meet the reasonableness test the Tax Courts have consistently upheld. Flight and nav logs provide the necessary documentation and the logbook is an adequate contemporaneous record of the trip. If the business purpose of the trip is also noted, it may be a complete record, but I keep other expense reports, just in case.

Consider GSA schedules further: The GSA publishes a lodging and meals per diem schedule, which the IRS uses to calculate reasonableness of lodging and meal allowances. In Chicago, this is $229/day lodging, Meals and incidentals $76 per day. If I stay at the Ritz-Carleton I lose a a few bucks a day, the Drake, I'm ahead. I suspect this rate will suffer greatly due to current events in the next iteration. IRS Pub 463 discusses exactly this: For travel expense away from home, for meals you can use, the actual expense, or a Standard Rate to determine the 50% deduction. If you use actual expense, you must keep records (meaning receipts, I think). Under the Standard meal/lodging allowance, you must keep records of the business purpose of the trip, location and dates. Namely, an expense report. You can deduct more, and likely would if you actually added the expenses and tips, or accept the federal per diem rate and call it a day, provided you actually write a contemporaneous expense report for each trip. I keep my hotel receipts, but use the per diem as it simplifies my record keeping.

The IRS specifically references GSA per diem rates in Pub 463 as acceptable for standard rate reimbursement. I think that the IRS does not write a specific pub for occasional personal use of aircraft is the vast majority of air travelers use the airlines, not the family Cessna. For those few that do, it is not worth their effort as nearly all NBAA (turbine/turboprop powered) aircraft will use the full tax code to maximize their rather significant deductible costs, while we have very limited costs.

I think there is ample precedent throughout the IRS publications to make an solid argument, if called upon to do so, that the GSA is eminently qualified to determine a reasonable per mile cost, that cost is provable and does understate the overall operating and ownership costs, and therefore it is acceptable for a less than 50% business use, and certainly for a less than 10% business use. It is reasonable to use that cost as the cost of my time for the 21+ hours of annual record keeping far outweighs any additional tax savings I might otherwise be entitled to. Now, if I buy an MU-2, I might have a different approach.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

EdT72

New Member

asrogers

New Member

Mary625

Level 2

risman

Level 2

evltal

Returning Member