- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

GSA does list a standard mileage reimbursement

The GSA is not a taxing authority and has no authority over the IRS. While the GSA may have a standard reimbursement rate, they have no say on the tax deduction in any way, shape, form or fashion.

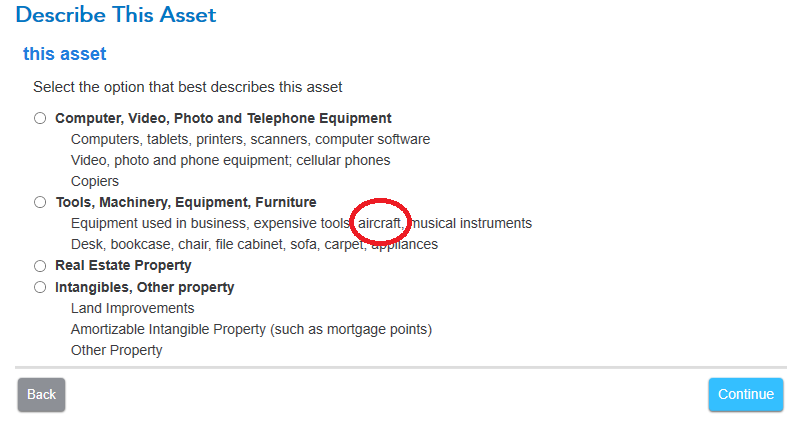

Now from what I see in TurboTax, an aircraft is reported in the Business Assets section as circled in red in the below image. The aircraft is depreciated over 7.years. Unless your business produces a taxable profit that is more than what you paid for the craft, taking the SDA or SEC179 deduction is a waste of time and will NOT benefit you.

September 11, 2020

7:46 AM