- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- HDHP/HSA contributions of half of 2022 are resulting in additional tax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HDHP/HSA contributions of half of 2022 are resulting in additional tax

I request your advice:

1. I had a non-HDHP plan until June 2022 before I joined my current company.

2. I switched to HDHP plan after I joined in June 2022, contributed to HSA in PayFlex and used it only for medical expenses.

3. I switched to non-HDHP plan in Jan 2023.

4. I closed my PayFlex account in June 2023.

5. I received 1099-SA form for 2023.

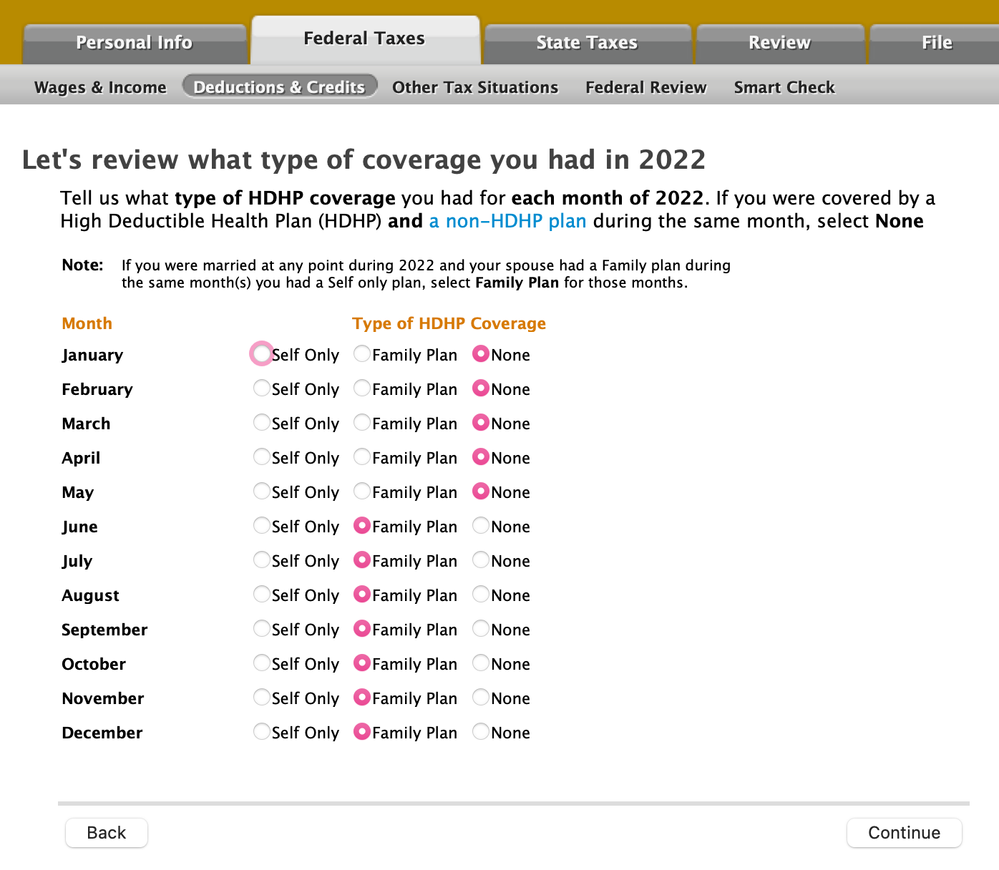

While filing my taxes now, I see a screen "Let's review what type of coverage you had in 2022." Title says "Type of HDHP Coverage" It lists each month from Jan to December and asks me to choose a) Self only, b) Family plan or c) None for each.

I am confused by the instruction: "If you were covered by a HDHP and a non-HDHP plan during the same month, select none"

I had included my spouse in both HDHP plan for first half of 2022 and non-HDHP plan for 2nd half of 2022. I did not have both during the same month. So should I choose "none" or should I choose "Family plan" for Jan to May?

If I choose "none", my taxes owed increase.

I had spent my HSA only for medical reasons. So I am surprised that I am owing taxes. Please advise how to go about and why TT is asking me for info about 2022 now. Thank you.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HDHP/HSA contributions of half of 2022 are resulting in additional tax

"So should I choose "none" or should I choose "Family plan" for Jan to May?" - You should choose Family, because you had the Family HDHP policy with no conflicting coverage.

But I need to ask you something: what was the exact message that you got that you reported as "Let's review what type of coverage you had in 2022." There are several similar messages, but with different results.

Also note that TurboTax is asking about 2022 because it thinks that maybe you used the "last-month rule" in 2022, which would have required you to have maintained HDHP coverage for all of 2023.

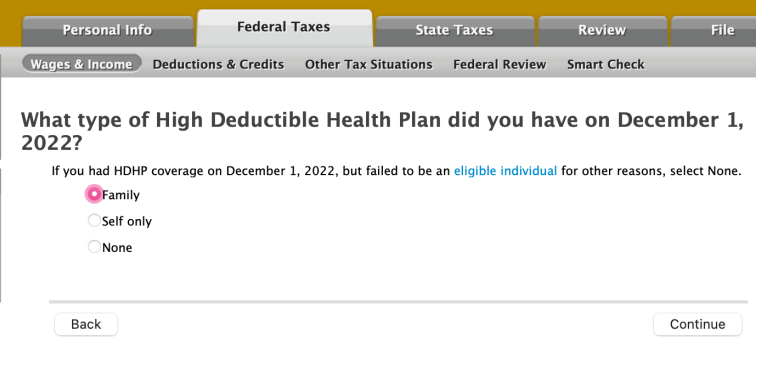

Was this question that triggered this discussion about 2022 this, "What type of High Deductible Health Plan (HDHP) did [name] have on December 1, 2022?"?

Also, did your spouse have an HSA (sounds like NO)? If the question above referred to your spouse, just answer NONE since it does not apply to a spouse who does not have an HSA.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HDHP/HSA contributions of half of 2022 are resulting in additional tax

Thank you so much Bill! I have a few follow-up questions:

1. You wrote : "You should choose Family, because you had the Family HDHP policy with no conflicting coverage. "

Me:

1. I joined my current company on May 31st, 2022.

2. I signed up for HDHP plan (+spouse as dependent) after I was eligible for enrollment which may have taken some time after I joined. My first contribution to HSA in Payflex was on 15th July 2022 and last contribution was on 30th December 2022.

3. During the medical enrollment end of 2022, I chose a non-HDHP plan for 2023 which became effective from 1st Jan 2023. So I (+spouse) have been on non-HDHP plan from Jan 2023 until now.

4. I used my HSA only for eligible medical purposes and not for anything else.

5. I closed my HSA PayFlex account on 9th July 2023.

6. I received 1099-SA from Payflex to file taxes for 2023.

7. While filing taxes for 2023, TurboTax asked me “What type of High Deductive Health Plan did you have on Dec 1st, 2022? “ . I had to choose “Family plan” as I think my HDHP coverage ended only on December 31st, 2022, right? Or should I choose No?

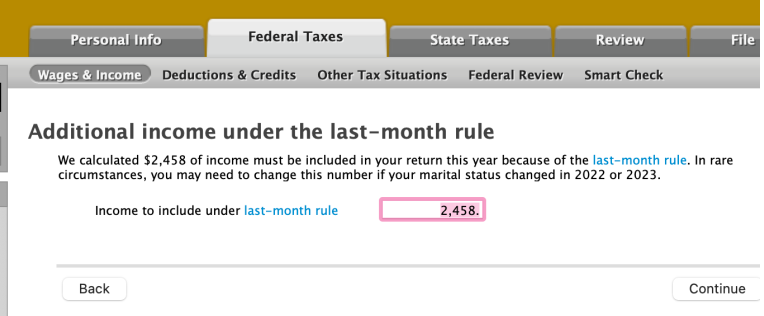

8. TurboTax shows “Additional income under the last-month rule” : We calculated $2,458 of income must be included in your return this year because of the last-month rule

Would you still recommend choosing "Family" from Jan to May 2022? That was my whole confusion because the message says that I should choose "none" only if I had HDHP and non-HDHP plan during the same month which is not true. I am not finding the option to choose for non-HDHP plan from Jan to May 2022.

2) Yes, you are so right as I chose Yes for this question, "What type of High Deductible Health Plan (HDHP) did [name] have on December 1, 2022?"?

- Should I choose No to avoid all this? Is it ok to do that because I had HDHP until end of Dec 2022.

3) "Also, did your spouse have an HSA (sounds like NO)? If the question above referred to your spouse, just answer NONE since it does not apply to a spouse who does not have an HSA."

- Yes, because I had included my spouse as my dependent in all my medical plans.

I very much appreciate your guidance. Thanks a lot again!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HDHP/HSA contributions of half of 2022 are resulting in additional tax

"Do you still recommend choosing "Family" from Jan to May 2022? " - No, that was my mistake - I thought you said that you had HDHP coverage in the first part of the year. Thank you for catching that.

NONE is what you enter if (1) you had no HDHP coverage, or (2) you had HDHP coverage with conflicting coverage (like Medicare or another non-HDHP policy, or (3) you were not eligible to contribute to an HSA because you could be claimed as a dependent. This means that you have the choice of valid Self or valid Family or everything else, which is called NONE.

#2. No, you are exactly the sort of person who must answer the question about December 1, 2022, because you might have used the last-month rule. The last-month rule means that if you have HDHP coverage on December 2022 (or what the previous year was), your annual HSA contribution limit is whatever the maximum is, as if you had HDHP coverage for every month of the year. But, the catch is that you have to keep the HDHP coverage for the next twelve months.

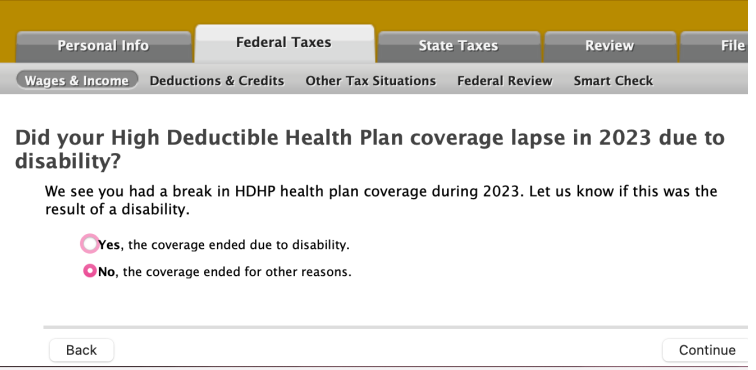

The "lapse" is that you did not maintain HDHP coverage into 2023. Now you have to answer a lot of questions about what you did in 2022 so that TurboTax can figure out if you owe a penalty for contributing in 2022 more than what your month by month contribution limit would have allowed.

So, yes, you may end up with "additional income under the last-month rule".

#3. An HSA is owned by an individual just like an IRA. Note that it may seem like you have a joint HSA because both of you can contribute to yours and both of you can pay expenses out of yours, but the fact is, that the HSA belongs to you and you alone.

In reference to why I said this above, if your spouse does not have an HSA, then when you are asked what type of HDHP your spouse had on December 1, 2022, just answer NONE - for your spouse only. You have to answer "Family" and go through all those questions.

When you are 55+, it may pay for your spouse to have a separate HSA from yours.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HDHP/HSA contributions of half of 2022 are resulting in additional tax

Thank you very much for the information Bill! If I understand your advice right,

1) Please confirm if you meant that everything I entered (as per the screen shots I sent) is accurate and

2) I owe taxes for 2023, right?

3) Is it because I had contributed 7300 (eligible max. contribution for a whole year) for 2022, but was only enrolled in HDHP for half the year in 2022, and did not continue HDHP in 2023?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HDHP/HSA contributions of half of 2022 are resulting in additional tax

1. The screens look right, assuming that you are choosing the smaller circle, not the larger one.

2. You will owe additional taxes for the last-month rule in 2023. Whether or not you will "owe" taxes at filing depends on other things like how much withholding you had.

Note that you owe money for the last-month rule in 2023, because you had extra tax savings in 2022 in using the last-month rule.

3. Yes, it's called "failure to maintain HDHP coverage".

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HDHP/HSA contributions of half of 2022 are resulting in additional tax

Thank you. Sorry that I did not understand - "assuming that you are choosing the smaller circle, not the larger one. " Please help confirm which circle you meant. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HDHP/HSA contributions of half of 2022 are resulting in additional tax

Look at the first screenshot - there is one large pink circle and for each month a smaller diameter circle. On the other screen shots, these circles are overlaying each other...I guess in retrospect that the smaller circles are the ones that you intended.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

ColoRock

Level 1

20tflbtt20

New Member

hartski1

New Member

bluon

New Member

kiks_722

Level 1