- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Thank you so much Bill! I have a few follow-up questions:

1. You wrote : "You should choose Family, because you had the Family HDHP policy with no conflicting coverage. "

Me:

1. I joined my current company on May 31st, 2022.

2. I signed up for HDHP plan (+spouse as dependent) after I was eligible for enrollment which may have taken some time after I joined. My first contribution to HSA in Payflex was on 15th July 2022 and last contribution was on 30th December 2022.

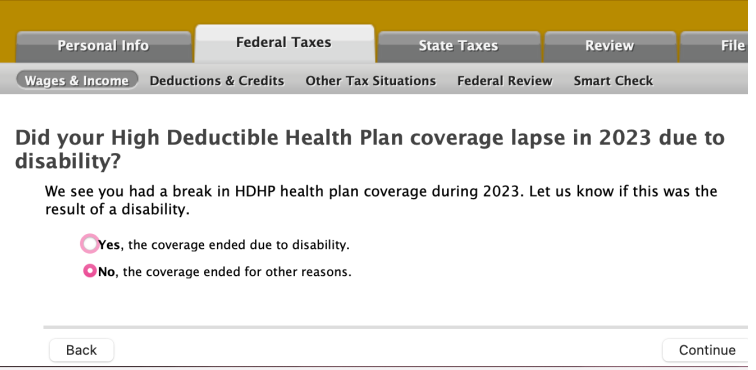

3. During the medical enrollment end of 2022, I chose a non-HDHP plan for 2023 which became effective from 1st Jan 2023. So I (+spouse) have been on non-HDHP plan from Jan 2023 until now.

4. I used my HSA only for eligible medical purposes and not for anything else.

5. I closed my HSA PayFlex account on 9th July 2023.

6. I received 1099-SA from Payflex to file taxes for 2023.

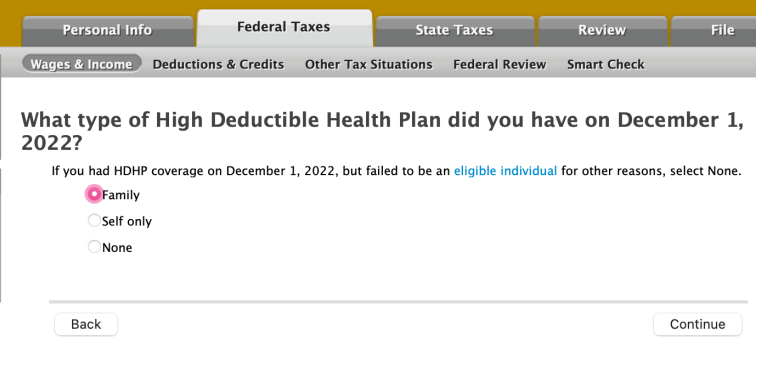

7. While filing taxes for 2023, TurboTax asked me “What type of High Deductive Health Plan did you have on Dec 1st, 2022? “ . I had to choose “Family plan” as I think my HDHP coverage ended only on December 31st, 2022, right? Or should I choose No?

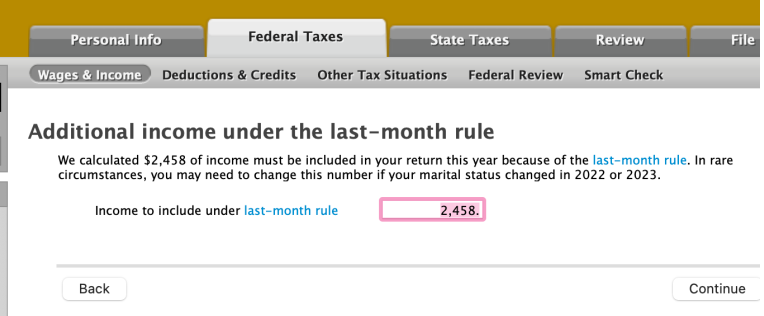

8. TurboTax shows “Additional income under the last-month rule” : We calculated $2,458 of income must be included in your return this year because of the last-month rule

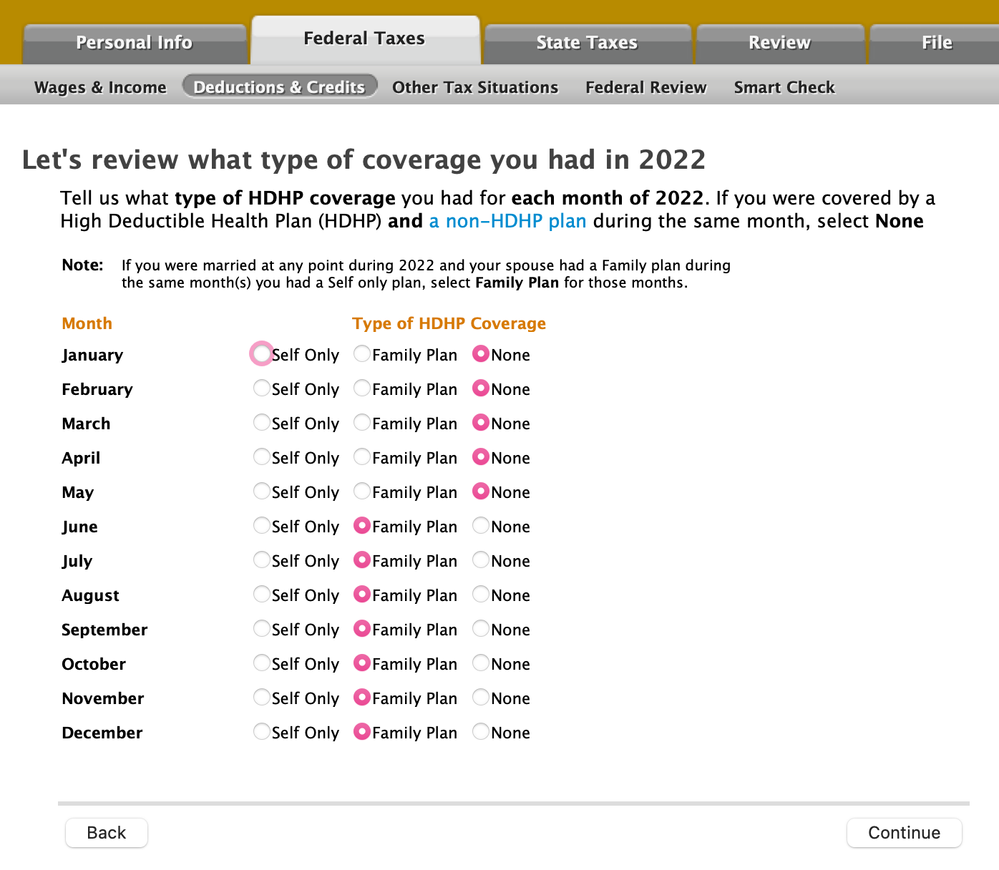

Would you still recommend choosing "Family" from Jan to May 2022? That was my whole confusion because the message says that I should choose "none" only if I had HDHP and non-HDHP plan during the same month which is not true. I am not finding the option to choose for non-HDHP plan from Jan to May 2022.

2) Yes, you are so right as I chose Yes for this question, "What type of High Deductible Health Plan (HDHP) did [name] have on December 1, 2022?"?

- Should I choose No to avoid all this? Is it ok to do that because I had HDHP until end of Dec 2022.

3) "Also, did your spouse have an HSA (sounds like NO)? If the question above referred to your spouse, just answer NONE since it does not apply to a spouse who does not have an HSA."

- Yes, because I had included my spouse as my dependent in all my medical plans.

I very much appreciate your guidance. Thanks a lot again!