- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Giant AMT Tax Added (an Error?) Something is being double-counted

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Giant AMT Tax Added (an Error?) Something is being double-counted

Hi Turbo Tax,

I had prepared 99% of my return in APril and sent in my pre-payment that was estimated at that time.

Now it's August, and I am reviewing in preparation to file. I noticed that turbo tax is now saying I owe an additional $$$ giant AMT bill. I think this is an error

It is a little opaque to see how Turbo Tax may be calculating this information, but it seems to say I had a large disposition of assets. I think this may be double-counting some stock that was given to my husband through his job and already reported as our W-2 income.

How can I review and correct this?

Thank you,

Emily

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Giant AMT Tax Added (an Error?) Something is being double-counted

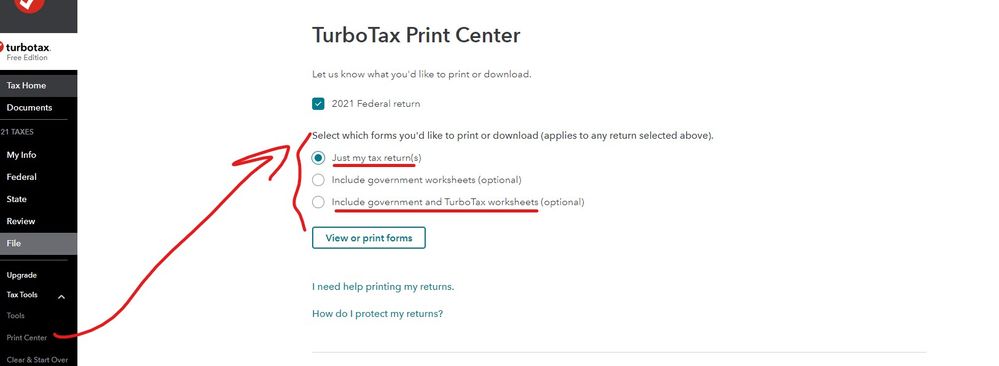

Review the entire return before you file ... use the PRINT CENTER under the TOOLS section ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Giant AMT Tax Added (an Error?) Something is being double-counted

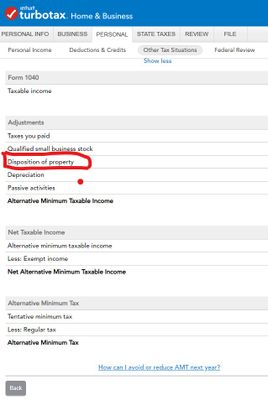

especially review form 6251 which is the form on which the AMT is calculated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Giant AMT Tax Added (an Error?) Something is being double-counted

Hi Champ. Yes, I did review that it it said I had over $150K of Disposition of assets.

I did not sell any stock or real estate, so I am trying to find out what this is from. Can I dig into this number?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Giant AMT Tax Added (an Error?) Something is being double-counted

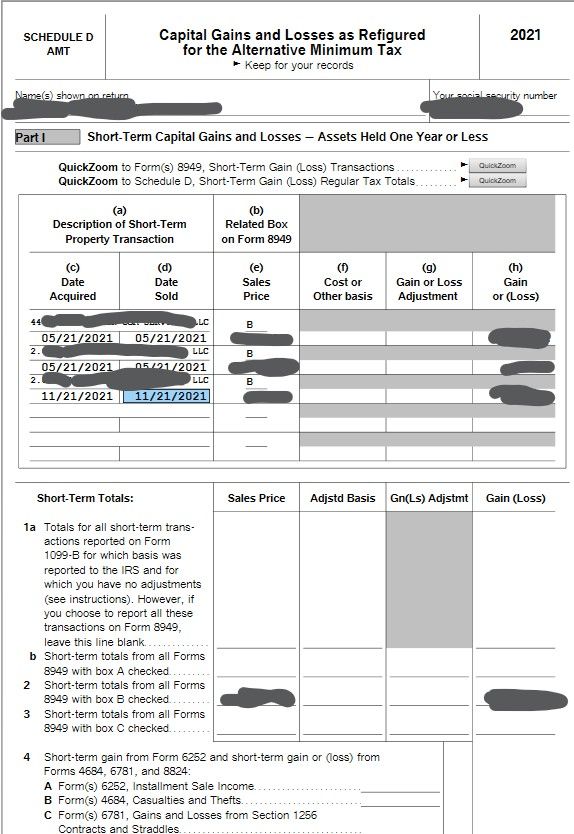

Update: I was able to use the step-by-step forms to trace this amount from 6251 back to it's origin on Schedule D.

I believe the problem is that my husband receives part of his compensation from work as vested stock which he receives every 6 months. We sell it right away. This is part of his income on the W-2.

It seems like we also had to enter it onto Schedule D, and it is getting double-counted.

I had already entered them in as RSU's on the W-2 interview.

It seems like we have located the source of the additional income. So now I have to figure out how to not get it double-counted.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Giant AMT Tax Added (an Error?) Something is being double-counted

@Emily-2Q2Q - why is there no cost basis on Schedule D? is that the problem? if the RSUs are recorded in the W-2 and you sell the shares as soon as they vest, the gain / loss on sale should be rather small. The cost basis should be the same as what is recorded in the W-2 as income. is there really two sales on 5/21 or is that a duplicate?

just ideas to persue.,

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.