- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

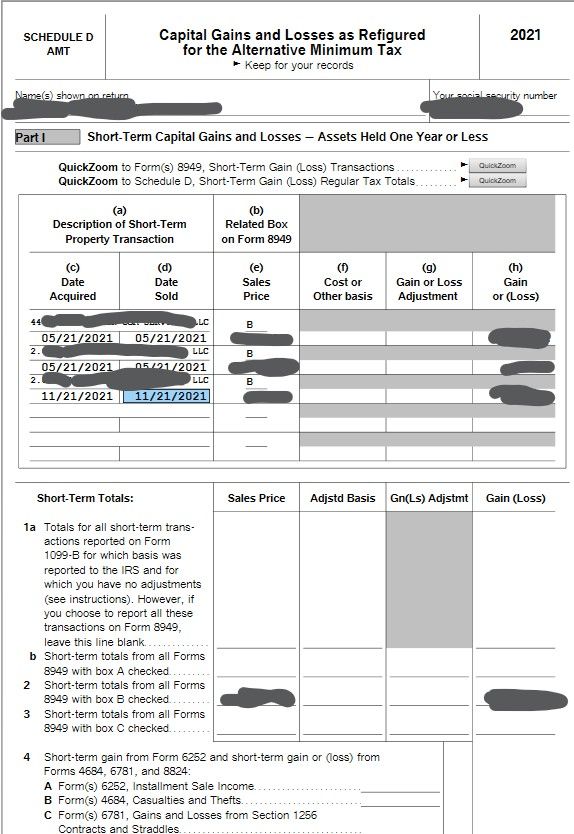

Update: I was able to use the step-by-step forms to trace this amount from 6251 back to it's origin on Schedule D.

I believe the problem is that my husband receives part of his compensation from work as vested stock which he receives every 6 months. We sell it right away. This is part of his income on the W-2.

It seems like we also had to enter it onto Schedule D, and it is getting double-counted.

I had already entered them in as RSU's on the W-2 interview.

It seems like we have located the source of the additional income. So now I have to figure out how to not get it double-counted.

August 11, 2022

1:44 PM