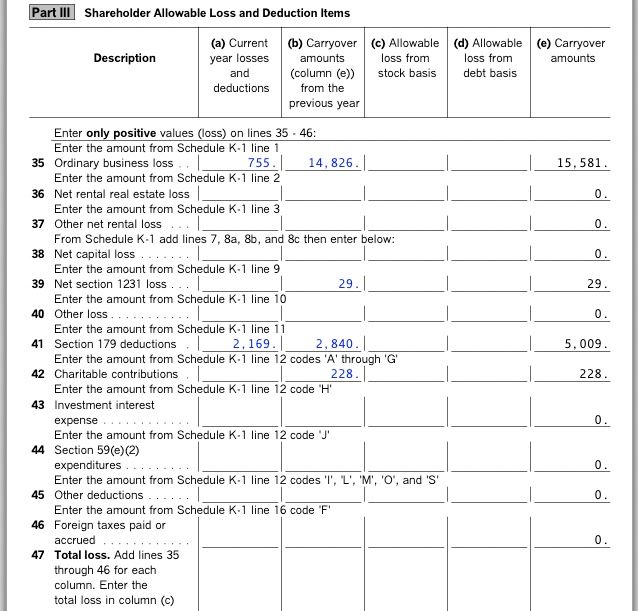

I see that similar questions have been asked before but I didn't see an answer to my specific question so will ask again. On my Schedule K-1 (1120-S), I have losses (ordinary business loss, Section 179 expense) for the current year that are completely disallowed for 2024 and will be carried forward to 2025. When using TurboTax to input my K-1, everything appears to be listed correctly with the entire loss listed as carryover:

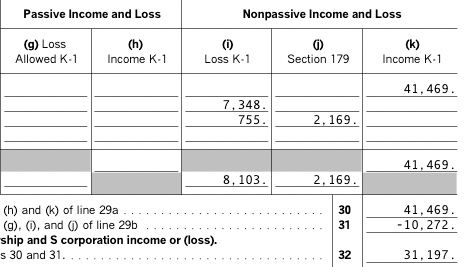

So all appears in order. However, when I go back to review my Schedule E after completing my taxes, all those losses are now taken from my income in the current year, leaving me with a greater refund than I should be allowed:

So, it's the $2169 and the $755 that are incorrectly being imported into the Schedule E. And even though I can see it, I can't make any changes to it. Does anyone know why this is happening or how to get around it? My business basis is listed correctly. My plan right now is to print out everything and make selective edits to the Schedule E and other lines that flow from it. Thanks.