- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Form 5695-Biomass

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 5695-Biomass

When will TurboTax 2021 be updated to reflect the 26% credit for wood stoves etc. rather than the previous limit? The form itself has the line for biomass but neither step-by-step nor the worksheet allows data entry. Thanks in advance for an answer.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 5695-Biomass

The full presentation for the Biomass credit may not be operational yet. There was a significant change in the form for where it shows that biomass credit this year, vs last year....so they may not yet have it programmed in for the 2021 change.

Right now, the IRS forms availability page isn't updated to show anything at all right at this moment...completely blank (1:37PM eastern) so they may be updating the list, but check it tomorrow to see when the Form 5695 will be fully available:

IRS forms availability table for TurboTax individual (personal) tax products (intuit.com)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 5695-Biomass

Thank you very much SteamTrain.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 5695-Biomass

The forms update site says 5695 will be available Feb. 3. Thanks again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 5695-Biomass

It is Feb 10, and still not biomass stove solution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 5695-Biomass

@tankerx wrote:

It is Feb 10, and still not biomass stove solution.

Both the TurboTax online editions and the TurboTax desktop edition have entry of a Biomass Fuel property on the Form 5695.

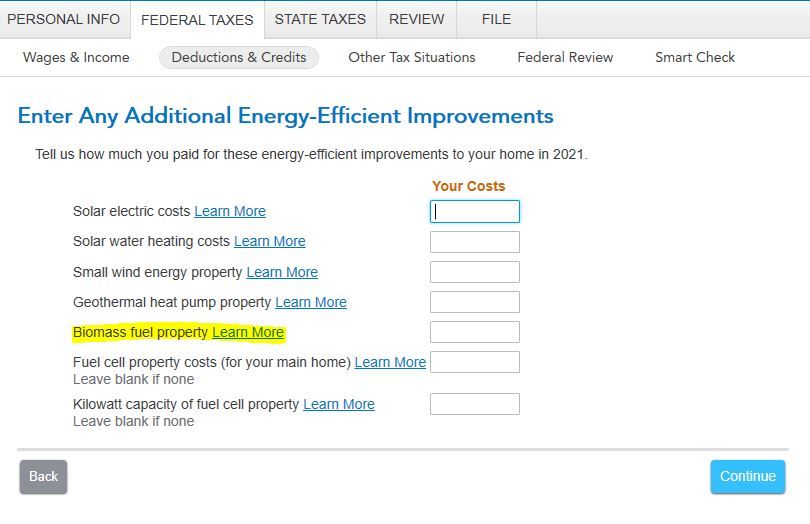

When in the Home Energy Credit section of the program you do Not enter the Biomass Fuel property on the screen labeled Tell Us How Much You Paid for Energy-Saving Improvements and do Not enter the cost in the box labeled Energy-Efficient Building Property. Continue past the screen and answer the questions on the following screens until you land on the screen Enter Any Additional Energy-Efficient Improvements. Enter your cost of the Biomass Fuel property in the box labeled Biomass fuel property. This will make the property eligible for the 26% energy credit on your tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 5695-Biomass

Disregard, update just hit.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.