- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

@tankerx wrote:

It is Feb 10, and still not biomass stove solution.

Both the TurboTax online editions and the TurboTax desktop edition have entry of a Biomass Fuel property on the Form 5695.

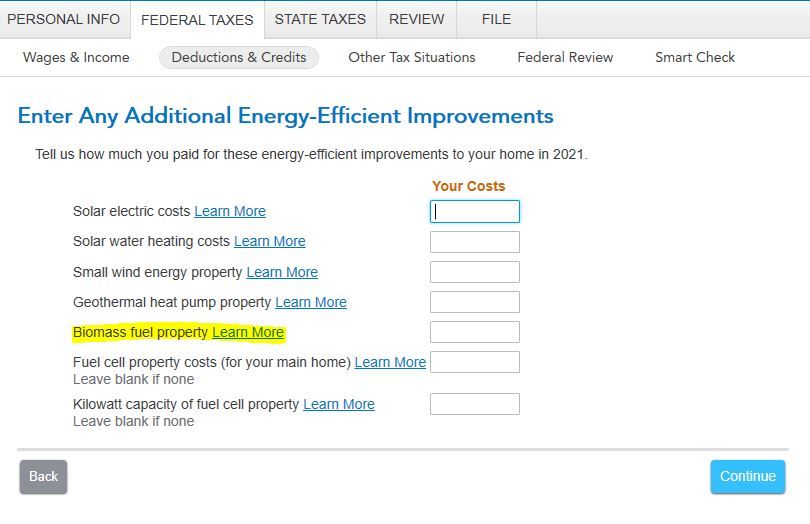

When in the Home Energy Credit section of the program you do Not enter the Biomass Fuel property on the screen labeled Tell Us How Much You Paid for Energy-Saving Improvements and do Not enter the cost in the box labeled Energy-Efficient Building Property. Continue past the screen and answer the questions on the following screens until you land on the screen Enter Any Additional Energy-Efficient Improvements. Enter your cost of the Biomass Fuel property in the box labeled Biomass fuel property. This will make the property eligible for the 26% energy credit on your tax return.