- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Foreign Tax Credit: the system is not allowing me to enter amount of foreign taxes paid. It is referring me back to Wages and Salaries, but this is already complete?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax Credit: the system is not allowing me to enter amount of foreign taxes paid. It is referring me back to Wages and Salaries, but this is already complete?

The link doesn't work

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax Credit: the system is not allowing me to enter amount of foreign taxes paid. It is referring me back to Wages and Salaries, but this is already complete?

To clarify, which link doesn't work?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax Credit: the system is not allowing me to enter amount of foreign taxes paid. It is referring me back to Wages and Salaries, but this is already complete?

I have the similar taxes paid with colinmoseley. I need to pay the Income Tax and the compulsory Pension Fund in Malaysia. Do I add both of them and enter in the 'Reduction in Foreign Taxes' page/ step?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax Credit: the system is not allowing me to enter amount of foreign taxes paid. It is referring me back to Wages and Salaries, but this is already complete?

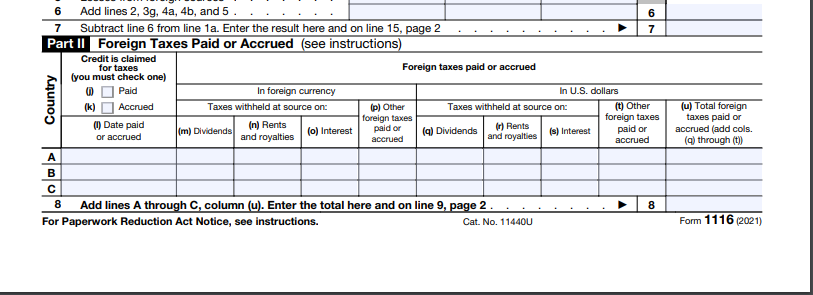

You would enter them separately. There is a box A, B, and C on Form 1116. You can enter the Income Tax on one line then the Pension Fund Tax on the next line or vice versa.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax Credit: the system is not allowing me to enter amount of foreign taxes paid. It is referring me back to Wages and Salaries, but this is already complete?

I'm having the same problem and that link takes me to a page that says: We're sorry, we can't find the page you requested

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax Credit: the system is not allowing me to enter amount of foreign taxes paid. It is referring me back to Wages and Salaries, but this is already complete?

Sorry I didn't realize that when you reply to a post there is no pointer or reference generated to that post, which is pretty lame. Any way there is a previous post that says:

After long call with TT support and going back and forth, we finally have solution/workaround. You need to follow exact steps documented in this link https://ttlc.intuit.com/community/tax-topics/help/where-do-i-enter-the-foreign-tax-credit-form-1116-....

This link does not work.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax Credit: the system is not allowing me to enter amount of foreign taxes paid. It is referring me back to Wages and Salaries, but this is already complete?

I'm using the desktop program and have less than $600 of foreign tax paid as shown on my Schwab 1099-DIV. Since I'm filing a joint return, I think I should be able to take the Foreign Tax Credit without filling out form 1116. But I can't figure out how to tell TurboTax what my foreign dividend income was or how much foreign tax was paid. Any help would be appreciated.

It looks like this has been a problem with the software for two years. It also appears that people have been able to talk to TurboTax experts. Is there an added fee for this or is the phone number so well hidden now that nobody can find it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax Credit: the system is not allowing me to enter amount of foreign taxes paid. It is referring me back to Wages and Salaries, but this is already complete?

Regarding my previous post, I did find the contact number and was on the phone with a very nice agent for over an hour. After all that time, the only thing she could suggest was that I manually enter values into form 1116 and see if that works. I guess I will try that, but I shouldn't have to fill out this form since my tax is under $600. I tried to bring up Schedule 3 and manually enter the credit there but it would not allow me to enter any values. This is quite frustrating since my case should not be that special--surely other people have under $600 in foreign tax paid on dividends but have no other foreign income? Unless I'm missing something, this clearly looks like a software bug and based on the posts here it has been known and unaddressed for two years.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax Credit: the system is not allowing me to enter amount of foreign taxes paid. It is referring me back to Wages and Salaries, but this is already complete?

On the Charles Schwab Year-End-Summary, you will find the Foreign tax paid and income summary. That lists the foreign tax paid and the dividend amounts.

With regard to the foreign tax credit issue.

Go to Forms Mode.

The exemption is not utilized if there are any carryovers from TY2020. In the left pane, check to see if you can locate Form 1116 Copy1 and under it the 1116 comp. Wks. If it is there you will see a vertical red line.

If it is not there, then there are no carryovers. Next locate in the left pane Schedule B and under it the Form 1099-Div. Click on it and it will come up on the right pane. You will see the amounts in various boxes, but the important one is box 7, foreign tax paid. If you see it, TT sees it.

Next in the left pane locate Form 1040 and click on it to bring it up. Scroll down to line 18. This is the tax before any credits. The exemption credit is on line 20. The important thing is the amount on line 18 minus the amount on line 20 cannot go below zero. Thus if line 18 is already zero, then line 20 is zero. If line 18 is not sufficient to use the entire amount on line 20, then the unused portion will be lost instead of carried over unless special actions are taken which can be provided if needed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax Credit: the system is not allowing me to enter amount of foreign taxes paid. It is referring me back to Wages and Salaries, but this is already complete?

You have a 1099-DIV with foreign tax on it (box 7)? If so, just do a Search (upper right) for 1099-div and click on the jump-to link. Mac users must use the Topics List to find 1099-div. On the search just hit Enter after typing 1099-div; ignore all the suggested search terms.

When you enter the first four boxes, you will also need to check the box "My form has info in more than just these boxes" if you have foreign tax in box 7.

When you check that box, a dozen more boxes will appear. Enter your foreign tax paid in box 7 and then Continue.

This way, you don't need to know your foreign income, and you avoid using Forms mode to make entries on the 1116 (which should be avoided if possible).

If this doesn't work for you, tell me what the issue is.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax Credit: the system is not allowing me to enter amount of foreign taxes paid. It is referring me back to Wages and Salaries, but this is already complete?

That's it! Thank you.

An hour on the phone yesterday did not provide such good advice! It's hard to believe having stock in a foreign company that returns dividends is all that uncommon.

Also, your answer has made clear another confusion. The TurboTax interview asked me more than once about values that I "entered on Form 1099-DIV". Form 1099-DIV is something I receive from my brokerage; I don't enter anything on it. I think what is being referred to is the TurboTax Form 1099-DIV worksheet. A clarification of that language would have been most helpful.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax Credit: the system is not allowing me to enter amount of foreign taxes paid. It is referring me back to Wages and Salaries, but this is already complete?

anyone having issues entering the foreign tax credit? TT won't let me do so. I tells me to go back to the income section and everything has been entered correctly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax Credit: the system is not allowing me to enter amount of foreign taxes paid. It is referring me back to Wages and Salaries, but this is already complete?

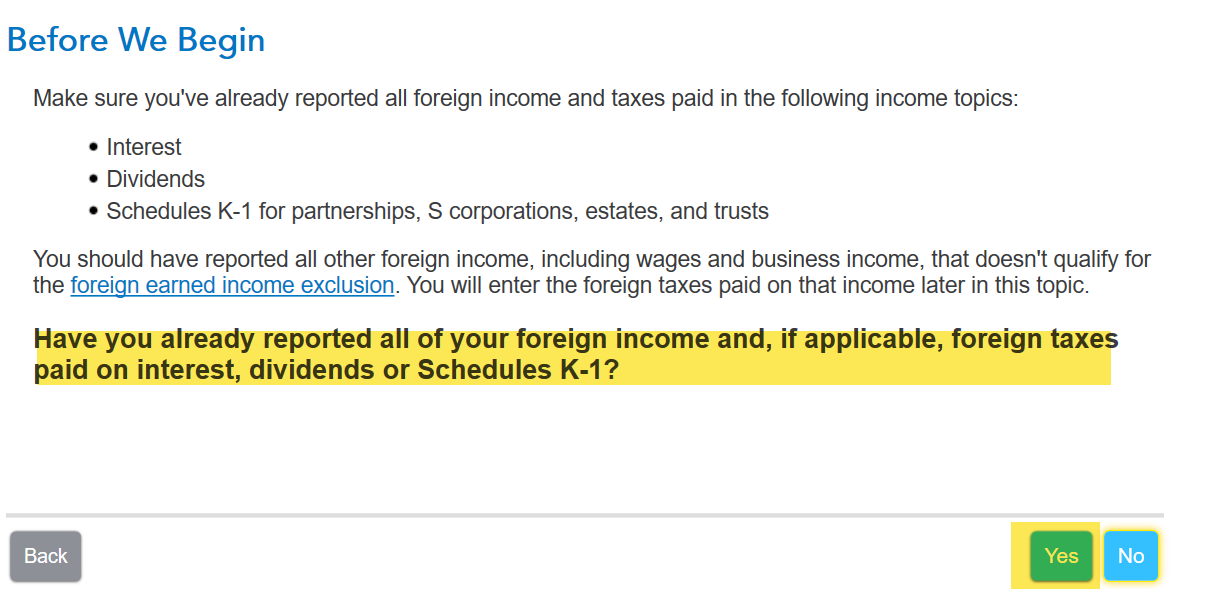

You may be answering "no" to the question Have you already reported all of your foreign income and, if applicable, foreign taxes paid on interest, dividends or Schedule K-1? You need to answer "yes" to the question to advance forward in the foreign taxes section to enter your foreign taxes paid not reported on those forms:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

NICKS4HD

New Member

linkwalls

New Member

gehrkecarollyn

New Member

leeyounique

New Member

suridasika

New Member