- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Foreign bank account interest

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign bank account interest

On the 1099-INT, how should I enter?

Box 6 would be $100. What about in box 1? Is it a $900 or $1000?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign bank account interest

Report the total amount of foreign interest income on your foreign bank account ($1,000 in your example) as Box 1 interest income (in USD) and not the net interest income received ($900).

You can include this under the 1099-INT section. Just make sure that you include this amount in USD. Also, if you paid any foreign taxes on this interest income, you will be able to take a Foreign Tax Credit for taxes paid on income that is also taxed in the US.

The Internal Revenue Service has no official exchange rate. In general, use the exchange rate prevailing (i.e., the spot rate) when you received the income. Please refer to the following IRS links for more information about Foreign Currency and Currency Exchange Rates and Yearly Average Currency Exchange Rates

To enter foreign interest income in TurboTax Online (for TurboTax Online sign-in, click Here , then select "Take Me to My Return") or Desktop, please follow these steps:

- Once you are in your tax return, click on the “Federal Taxes” tab ("Personal" tab in TurboTax Home & Business)

- Next click on “Wages & Income” ("Personal Income" in TurboTax Home & Business)

- Next click on “I’ll choose what I work on” (jump to full list)

- Scroll down the screen until to come to the section “Interest and Dividends”

- Choose “ Interest on 1099-INT” and select “start’

- Select "I'll type it in myself"

- Enter the name of the foreign bank, the amount (in USD) in box 1

- Check the box "My form has info in more than just box 1 (this is uncommon)".

- Enter any foreign taxes paid in box 6 (screenshot)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign bank account interest

Report the total amount of foreign interest income on your foreign bank account ($1,000 in your example) as Box 1 interest income (in USD) and not the net interest income received ($900).

You can include this under the 1099-INT section. Just make sure that you include this amount in USD. Also, if you paid any foreign taxes on this interest income, you will be able to take a Foreign Tax Credit for taxes paid on income that is also taxed in the US.

The Internal Revenue Service has no official exchange rate. In general, use the exchange rate prevailing (i.e., the spot rate) when you received the income. Please refer to the following IRS links for more information about Foreign Currency and Currency Exchange Rates and Yearly Average Currency Exchange Rates

To enter foreign interest income in TurboTax Online (for TurboTax Online sign-in, click Here , then select "Take Me to My Return") or Desktop, please follow these steps:

- Once you are in your tax return, click on the “Federal Taxes” tab ("Personal" tab in TurboTax Home & Business)

- Next click on “Wages & Income” ("Personal Income" in TurboTax Home & Business)

- Next click on “I’ll choose what I work on” (jump to full list)

- Scroll down the screen until to come to the section “Interest and Dividends”

- Choose “ Interest on 1099-INT” and select “start’

- Select "I'll type it in myself"

- Enter the name of the foreign bank, the amount (in USD) in box 1

- Check the box "My form has info in more than just box 1 (this is uncommon)".

- Enter any foreign taxes paid in box 6 (screenshot)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign bank account interest

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign bank account interest

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign bank account interest

I have the same question. The foreign interest should be treated as foreign income in Form 1116 when computing the foreign tax credit. Right now turbotax treated as domestic income which reduce the avaible foreign tax credit. Do you find way to correct this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign bank account interest

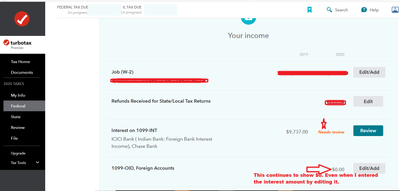

Have been using this same procedure for the past 8 years. But this Year, TurboTax is flagging it as "Needs review" besides the "Interest on 1099-INT" in the "Wages and income" section.

I have attached a screen shot. As you can see in the attached image, I was able to do it for 2019 (and have always been able to add it for precious years). But this Year, it does not accept it, because it INSISTS on mentioning the FEIN number for the Foreign bank, when I try to EDIT this section, which is not possible, since FEIN is relevant only for US banks and not for foreign banks(as they don't have any FEIN number).

Also, as you can see there is a specific option called "1099-OID, Foreign Accounts". Ever after I entered all these details there, but finally as you can see in the screen shot, TurboTax shows as $0.0 as Income for that section. (which would mean, I won't be paying tax on the interest earned from foreign bank)

Note: I already tried deleting the entries and manually typing them again. But that didn't work. It still insists for the FEIN number.

Please help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign bank account interest

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

hpccpatest

Level 2

nnickrod112

New Member

Solsti

New Member

srtadi

Returning Member

Dan S9

Level 1