in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Filing MFS to qualify for FAFSA Benefts

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing MFS to qualify for FAFSA Benefts

I want to know if filing MFS is a good strategy on the idea that a lower income would qualify me to receive FAFSA funds for my college bound kid?

The only reason I want to file MFS is my husband got a considerable bump in his income last yeat that my son who's a College sophomore didn't get awarded any Fafsa funds.

I was given advice that I can legally file MFS to depend solely on my income and add my son as my dependent. In that way, I can claim a lower income when filing his FAFSA. I don't want to do things illegally and I was hoping this strategy works.

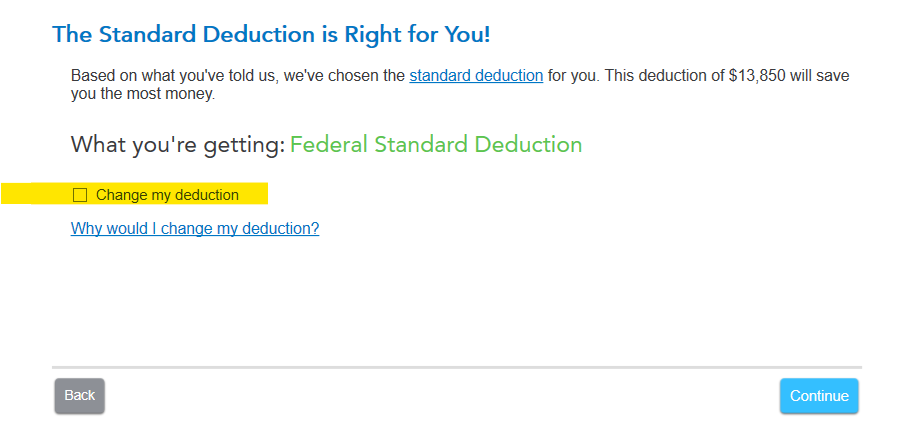

We refinanced my home last year, so when we itemized, I was willing to give my husband all the credit for the 1098 mortgage, and I claim zero, but TT automatically picks standard deduction. So, that means my husband can't claim the 1098 credit if he files standard also. If he files itemized, I can't file itemized.

That's my dilemma.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing MFS to qualify for FAFSA Benefts

1. Probably not. The FAFSA asks for the income of both parents. Your husband may not be the father so that is a factor. I suggest you learn more about the rules of FAFSA and ways to optimize the aid available.

2. You can file MFS or MFJ when you are married. Filing MFS is much harsher and eliminates a lot of credits. A few minutes to go through the IRS quick filing status quiz for your federal return would be your best option. You may want to read this post.

3. You can both itemize. Tell the program that you want to change your deduction to itemize rather than taking the standard deduction.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17544847578

Level 1

ajm2281

Level 1

anita-castro6186

New Member

dithe982

New Member

MissMLB

Level 2