- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Federal return: Under the summary “Deduction & Credits” section, what is shown in the software for federal and state income tax withholdings are different than what I entered from my W2. The local in...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

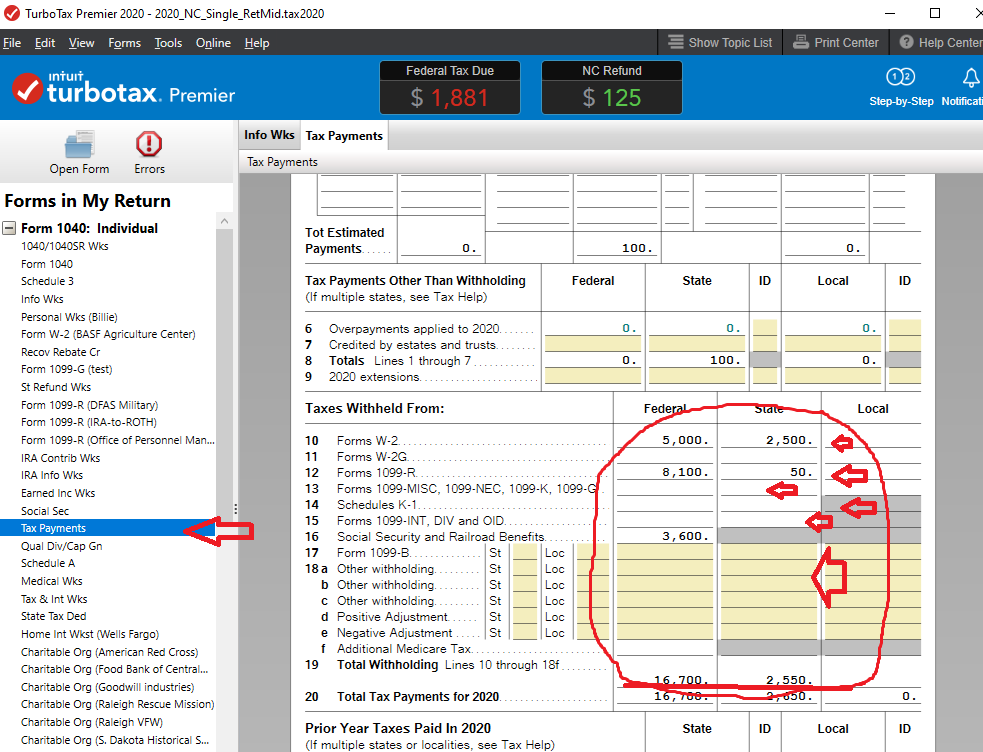

Federal return: Under the summary “Deduction & Credits” section, what is shown in the software for federal and state income tax withholdings are different than what I entered from my W2. The local income tax is correct.

How and why is the software coming up with different numbers? Thanks for any feedback.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal return: Under the summary “Deduction & Credits” section, what is shown in the software for federal and state income tax withholdings are different than what I entered from my W2. The local income tax is correct.

IF..if you are using the Desktop software.

...............(Can also get with the Online software, but a bit more involved)

-----------------

Anyhow...with the Desktop software :

Switch to "Forms Mode" and open the Federal Tax Payments Worksheet.

That worksheet breaks down all the withholding by form type...and you can see if it came from some form you didn't consider. IF any line there is wrong, you would go back to those form-types and check each for entry errors.

___________________________

_____________________________

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal return: Under the summary “Deduction & Credits” section, what is shown in the software for federal and state income tax withholdings are different than what I entered from my W2. The local income tax is correct.

Is that one single W-2 the absolute only source of income you reported on your tax return? (probably not) Keep in mind that what you're looking at is a "summary", not a "all the fine details" screen. The summary will include any taxes paid to the IRS/state by any means. For example, if you paid estimated taxes to the IRS, that amount is included in the summary.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal return: Under the summary “Deduction & Credits” section, what is shown in the software for federal and state income tax withholdings are different than what I entered from my W2. The local income tax is correct.

IF..if you are using the Desktop software.

...............(Can also get with the Online software, but a bit more involved)

-----------------

Anyhow...with the Desktop software :

Switch to "Forms Mode" and open the Federal Tax Payments Worksheet.

That worksheet breaks down all the withholding by form type...and you can see if it came from some form you didn't consider. IF any line there is wrong, you would go back to those form-types and check each for entry errors.

___________________________

_____________________________

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

djpmarconi

Level 1

user17550205713

New Member

rtoler

Returning Member

bobking13

New Member

botin_bo

New Member