- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Excess social security withholding

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess social security withholding

I think things are correct, I don't think it's a bug that deleting and reimporting the W2s will correct.

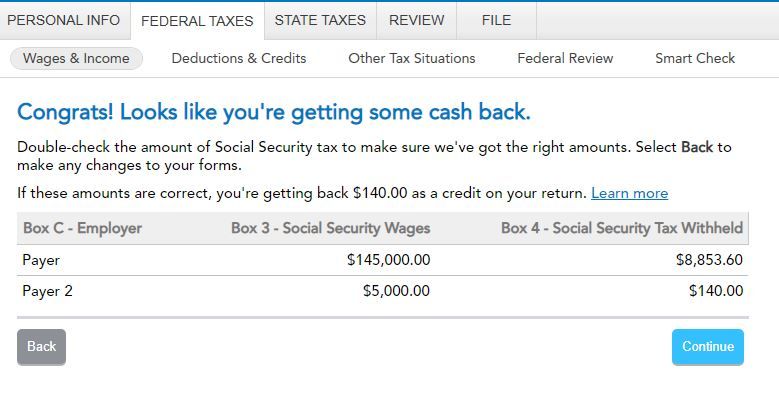

One employer withheld the maximum SS amount possible in a year, 8853.60

The other employer withheld an additional 140.12 in SS.

Therefore, my wife was overwithheld. However, it seems like based on other posts I've seen that rather than enter the 140 dollars in as a credit on Schedule 3, which Turbotax doesn't even allow anymore, the IRS wants us to take it up with one of the employers, ask for a 140 dollar refund and get and file a corrected W2.

If Turbotax did allow me to use that line on Schedule 3 where I could ask for a credit, it seems like the IRS would then send a letter asking for clarification.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess social security withholding

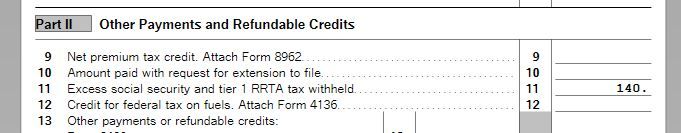

@klw085 TurboTax does enter the excess SS taxes withheld on Schedule 3 Line 11.

I just went through and created two W-2's with one using the max SS taxes and the other with $140

There is something else going on with your return. The suggestion to delete the W-2 and re-enter was good for a start in the investigation.

Screenshots -

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess social security withholding

DoninGA, I did what you asked and you are correct. That cleared up the issue. That's fantastic because having to go to my wife's payroll department and ask them to issue a refund and corrected W2 would have been a huge pain. I guess it really was a bug in Turbotax then that others mentioned.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess social security withholding

The issue that most of these folks are having with it not showing up on line 11, schedule 3..?

SoFar...that situation has almost always been the case of two employers, but both employers using the same Payroll Agent for issuing their W-2 forms. Soemtimes,when the two companies use the payroll agent , both W-2 forms have the same employer EIN (the payroll Agent's EIN)....then that results in the W-2's appearing to come from the same employer...when they really are not.

A few years ago, TTX had a way to indicate it was two different employers using the same payroll agent...and get the SS refund...but that was stopped. Not sure why, but I suspect it was either because there were too many errors with people "claiming" it was the payroll agent issue, or perhaps the IRS wanted TTX to stop allowing e-files with that situation, and the IRS really wanted to see those filings on paper to deal with them separately themselves.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess social security withholding

Did you delete the W2 and re add it? No there wasn't a bug. You must have entered the W2 wrong. Like under the wrong spouse.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess social security withholding

i.e.....check both W-2 forms too, to make sure you aren't using the same employer's EIN on both forms....unless perhaps her W-2 forms were in the same "Payroll Agent" situation.

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

henkelcameron8

New Member

cdtucker629

New Member

dabbsj58

New Member

lewholt2

New Member

g30anderson

New Member