- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Does anyone know why my vehicle is being put on 4562 when I claim my business miles? I do not want to depreciate my vehicle. I want to add my info onto my schedule C

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does anyone know why my vehicle is being put on 4562 when I claim my business miles? I do not want to depreciate my vehicle. I want to add my info onto my schedule C

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does anyone know why my vehicle is being put on 4562 when I claim my business miles? I do not want to depreciate my vehicle. I want to add my info onto my schedule C

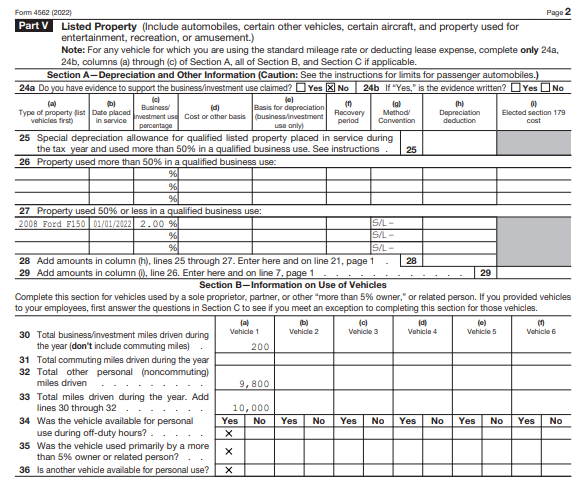

Are you seeing the vehicle listed in Part V Listed Property? Listed property is property that can be used for business and personal use and has special recordkeeping requirements.

If you are claiming business miles on a vehicle within a self-employment activity, as a listed property, you are required to disclose information about the listed property. That is done on page 2 of IRS form 4562 Depreciation and Amortization.

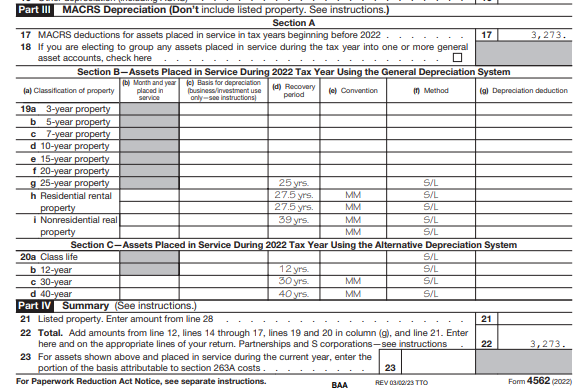

If you are claiming actual expenses and depreciating the vehicle, the depreciation will be noted on page 1 of IRS form 4562 Depreciation and Amortization in Part III and / or Part IV.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ripepi

New Member

fkinnard

New Member

jack

New Member

user17525224124

New Member

MBSC

Level 3