- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- deductible home Mortgage Interest worksheet

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

deductible home Mortgage Interest worksheet

I sold my home last year, so I have 2 1098 for two different homes. When I file home mortgage interest deduction, the worksheet has combined 2 loans as one to calculate qualified mortgage interest deduction. I thought each home should have $750,000 qualified mortgage interest deduction separately. Is that right? How should I file it in TurboTax Premier? Thanks,

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

deductible home Mortgage Interest worksheet

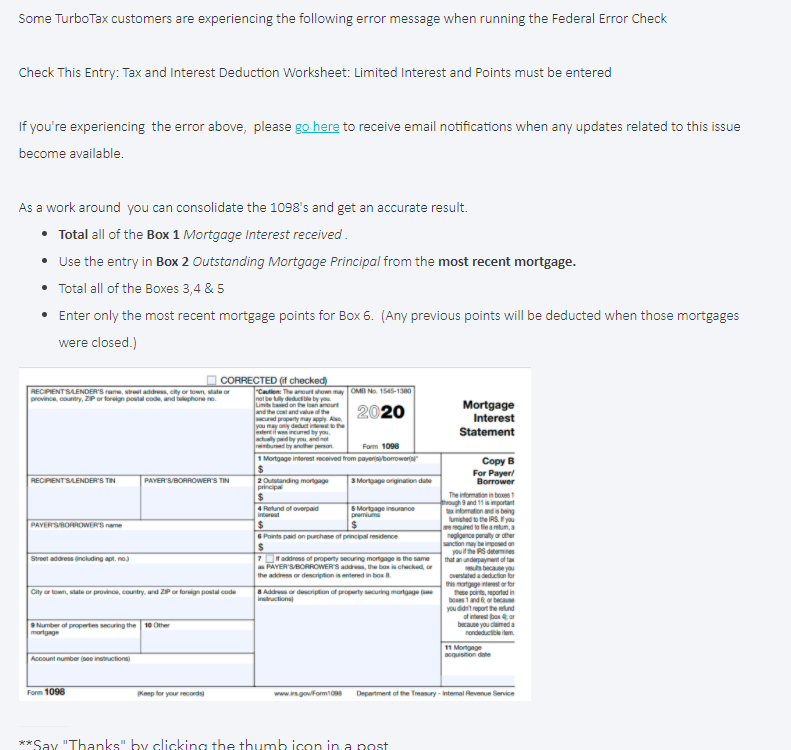

@fan-zhou This issue is well-known. I'm going to share with you a screenshot of the "workaround". It's the best TurboTax has been able to come up with for this year. Thanks for your understanding.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

deductible home Mortgage Interest worksheet

@Kat Thanks for your reply, but the workaround is still not right. I should get all the interest deduction for the one I sold (<750k) and part of interest deduction for the one I have now(>750k). For the workaround, I can only get part of interest deduction for the sold one.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

deductible home Mortgage Interest worksheet

Thanks for reporting your experience, and @Kat for bringing it to us.

We'd like to look at this further, are you able to give us a copy of your tax return with your personal information removed? Here's how--

If you're using TurboTax Desktop follow the directions below:

1. Click into your return.

2. Click Online and select "Send Tax File to Agent".

3. This will generate a message that a diagnostic copy will be created. Click on OK, the tax file gets sanitized and transmitted to us.

4. Please provide the Token Number that was generated onto a response.

If you're using TurboTax Online:

1. Sign into your online account.

2. Locate the Tax Tools on the left hand side of the screen.

3. A Drop down will appear. Click on Share my file with agent.

5. This will generate a message that a diagnostic copy will be created. Click on OK, the tax file gets sanitized and transmitted to us.

6. Please provide the Token Number that was generated onto a response.

Thank you! I hope to hear from you soon.

GabiU

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

TEAMBERA

New Member

ericbeauchesne

New Member

in Education

catdelta

Level 2

breanabooker15

New Member

user17515687217

New Member