- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Deductible Home Mortgage Interest Worksheet

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductible Home Mortgage Interest Worksheet

I refinanced once - and my mortgage was also sold from one bank to another in 2019 - so I received 3 1098 Forms.

However, on the Deductible Home Mortgage Interest Worksheet, TurboTax adds the full amount of all 3 loans together (even though 2 of them have been paid off) to calculate the average balance of all home acquisition debt (part 2, line 2), so my debt appears 3 x larger than it should and now exceeds the loan limit, resulting in a limited interest deduction.

How do I fix this? Do I just manually adjust the total home acquisition debt to the new mortgage balance as of 01/01/2020?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductible Home Mortgage Interest Worksheet

Since you have multiple mortgage interest entries, verify that your entries are correct for the following:

- Outstanding mortgage principal as of 1/1/2019

- Mortgage origination date

- Mortgage acquisition date (if applicable)

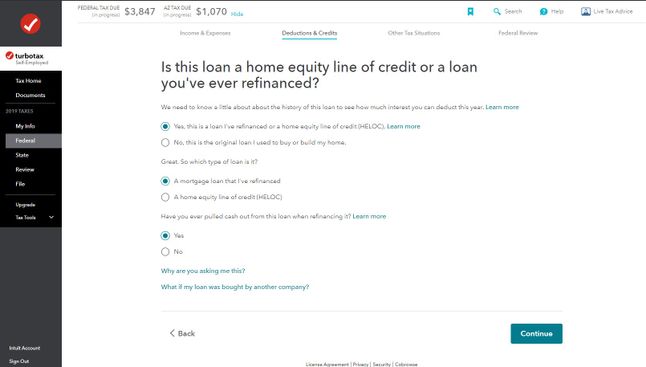

- For the refinanced loan make sure you marked "Yes" to the question "Is this loan a home equity line of credit or a loan you've ever refinanced?"

TurboTax uses this information to calculate your mortgage interest deduction. Please see this TurboTax article for more information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductible Home Mortgage Interest Worksheet

Thank you for your reply @BarbaraW22 . I double-checked to ensure that I entered all the information correctly in regards to the points you mentioned. Fortunately, for the federal return, TurboTax asks if the mortgage limit applies to me (my mortgage balance is below the limit, so I can answer 'no' and the full mortgage interest is deducted). However, on my California return, TurboTax is still adding the balances for all 3 "versions" of my mortgage in 2019 (the original, the refinance, and the transfer) on the 540/540NR Deductible Home Mortgage Interest Worksheet. As a result, the total "home acquisition debt on the date it was last secured by [my] home" is 3x the actual balance, and it limits the amount of mortgage interest deducted on my state return.

However, TT does allow me to manually adjust the "Total Home Acquisition Debt and Grandfathered Debt." To correct the miscalculation, could I enter the outstanding mortgage principal as of 1/1/2019 there?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductible Home Mortgage Interest Worksheet

Hi,

I'm running into the exact same issue. I have three (3) 1098 forms. On the California State Return, under "California Mortgage Information" - there is a field "Total of your home acquisition debt on the date it was last secured by your home(s)". TurboTax is taking the mortgage amounts from all three (3) 1098 forms and adding them together. I cannot find a way to correct this. Please advise. Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductible Home Mortgage Interest Worksheet

I am having the same issue. I refinanced my home using the same finance company; so i have two 1098s. I didn't take any money out. It was a VA streamlined refinance. Should be simple. TurboTax is adding the loans together and putting me over the $750K limit. I went from having a $3,500 refund to owing $300.

I've tried numerous iterations in TurboTax to get past this issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductible Home Mortgage Interest Worksheet

I'm having the same issue as everyone else, this is clearly a bug within TurboTax. Could you please have someone look into it and address the issue? I'm unable to file until this is corrected. I have used TurboTax for many years and gone through refinances before and never had this issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductible Home Mortgage Interest Worksheet

I'm having a similar problem with a new mortgage on a second home. The mortgage was transferred to a second service company during the year so I received 2 1098's. Each 1098 shows the outstanding mortgage principal and TT appears to be adding the two amounts when considering the mortgage limit. That (double) amount plus the remaining principal on my first home mortgage pushes me over the limit for deductibility. I have not found a way to resolve this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductible Home Mortgage Interest Worksheet

bumping this since no definitive answer has been provided.

I've seen other threads suggesting that $0 or $1 should be entered in Box 2 for loans that had been refinanced/transferred, but that is not what my 1098's have in Box 2. I made sure to select the option that states that these loans had been refinanced, but it is still adding all the balances together as if they are each new mortgages. The only thing I can think of to do at this point is manually adjust the total home acquisition debt .

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductible Home Mortgage Interest Worksheet

Best solution is to START OVER. After numerous attempts over many days, I gave up and started a from scratch with a new return. I went to the Mortgage Interest part first. I put "$0.00" in Box 2 for the 2nd loan (refinance). This worked for me.

Too bad the TurboTax software has this Bug for 2019.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductible Home Mortgage Interest Worksheet

If the loan was moved to a different lender in 2019 and you have two 1098's to enter:

First, delete both 1098's.

Enter the older loan first, enter box 2 as it is reported,

THERE WILL BE A SCREEN ASKING "WAS THIS LOAN PAID OFF OR SOLD IN 2019?" CLICK "YES"

(this screen will not appear if you go back and edit)

Continue through the interview

Next, enter the second 1098

If box 2 is blank, enter zero, otherwise enter what is in box 2.

Continue through the interview questions. Do not select that it is a HELC.

Since you clicked that the first 1098 was paid off or refinanced with a different lender, the mortgage balances (box 2) will not be added together.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductible Home Mortgage Interest Worksheet

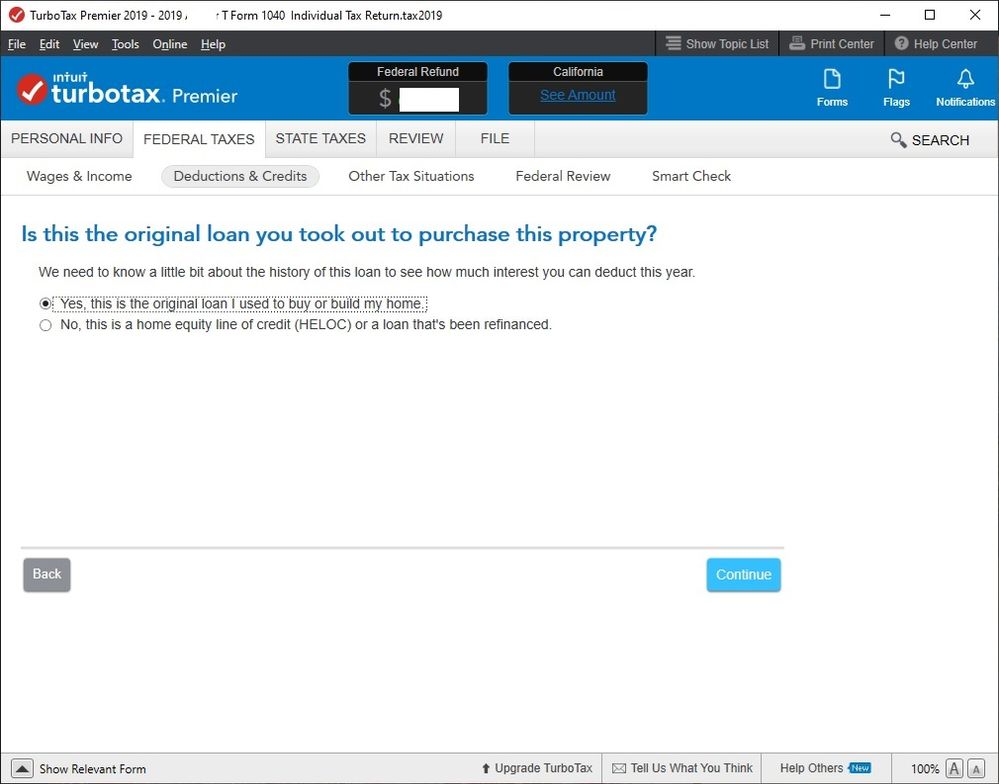

@KrisD15 Thanks for your reply. Unfortunately, the question, "Was this loan paid off or sold in 2019?" never comes up for me. I've tried deleting all my 1098's and reentered everything multiple times, but no luck. These are the only follow-up questions I get:

1. "Is this loan secured by a property of yours?" (Yes)

2. "Is this the original loan you took out to purchase this property?

Answer choices:

a. Yes, this is the original loan I used to buy or build my home.

b. No, this is a HELOC or a loan that's been refinanced

I've tried answering the questions in every possible combination of answers I can think of, and every time, I have the same result - my loans are still added together, as before.

Anything else we can try?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductible Home Mortgage Interest Worksheet

I’m in the same boat. No matter what combination I select/enter, I can’t get the “Was this loan paid off or sold in 2019?" To appear.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductible Home Mortgage Interest Worksheet

Here are the steps to access the question: "Was this loan paid off or refinanced with a different lender in 2019?"

- Click on Edit/Add next to Mortgage Interest and Refinancing, then click on Review next to the bank name.

- Click Continue. Select "None of these apply" to the question Do any of these uncommon situations apply to your loan

- Verify that your Outstanding Mortgage Principal (Box 2) and Mortgage Origination Date (Box 3) have the correct information on the screen "Let's get the details..." Click Continue.

- Answer the question Did you pay points when you took out the loan? Click Continue.

- Then you will get to the screen Was this loan paid off or refinanced with a different lender in 2019?

Please note: The Origination Date in Box 3 should differentiate an Original Loan 1098 from a Refinanced Loan 1098, so the loan balances would not be added together. When entering your original loan 1098, DON'T select 'this loan has been refinanced' (even if it has).

When you enter your Refinanced Loan 1098, indicate YES this loan has been refinanced. Then you will ve able to indicate whether the entire loan amount was used to 'buy, build or improve' your main home or you took CASH OUT in addition to refinancing the old loan.

[Edited 02/04/20 | 12:44pm PST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductible Home Mortgage Interest Worksheet

Ok...I must be totally missing something. I follow steps 1-4 just fine, however we diverge on step 5. I'm getting the following screen.

When I select "Yes this is the original loan i used by buy my house," I am taken right tot the Congrats you get a tax break screen without the Payoff screen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductible Home Mortgage Interest Worksheet

I am in the exact same situation. Certainly Intuit will take this bug seriously in short order.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

TEAMBERA

New Member

ericbeauchesne

New Member

in Education

catdelta

Level 2

breanabooker15

New Member

user17515687217

New Member