- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Child tax credit qualification

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Child tax credit qualification

Turbo tax is saying my child doesn’t qualify for the child tax credit but qualifies for the other dependent credit. I’m very confused. I didn’t receive the advanced child tax credit when I should’ve qualified.

I file head of household, single mom. my child is 8. Nobody else could/would’ve claimed my child.

how do I correct this??

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Child tax credit qualification

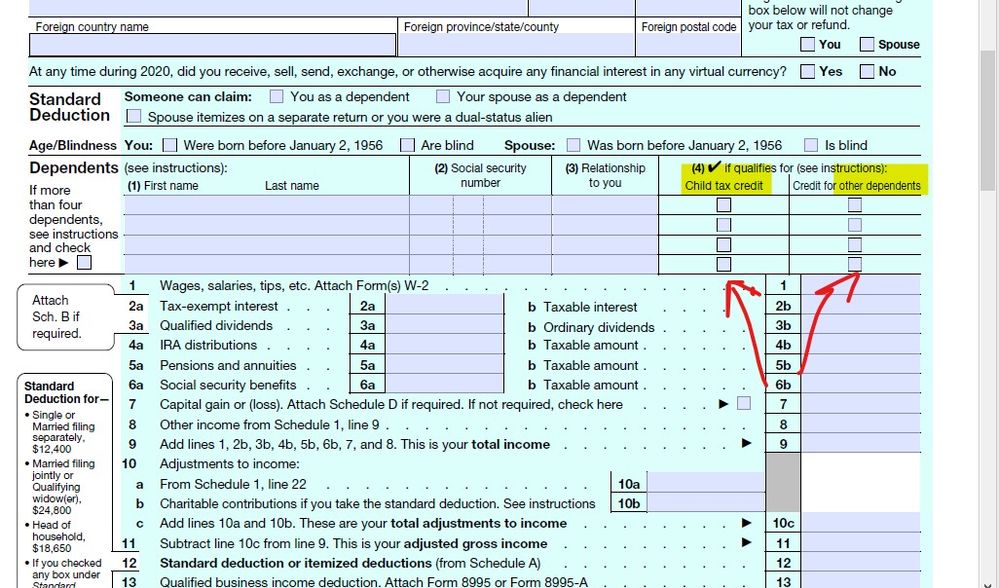

Look at your form 1040 ... which box is marked for the child ?

Did you indicate the child was being claimed by the other parent ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Child tax credit qualification

I did accidentally click “credit for other dependents” I tried to amend it but turbo tax just keeps saying she doesn’t qualify but doesn’t tell me why she doesn’t qualify for the child tax credit.

there isn’t another parent who could’ve claimed her.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Child tax credit qualification

go back through all the questions for the dependent. make sure that the question did (dependent's first name) pay more than 1/2 their living expenses is answered "no"

don't know what version you're using but if other than the free version contact support if you can get the CTC to work

Contact Customer Service

5am-5pm Pacific Time (8-8 Eastern) Monday - Friday

https://support.turbotax.intuit.com/contact

the other thing you can try is to delete the worksheet for the dependent then go back and re-enter. carefully read each question. also visit the CTC section

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jigga27

New Member

user17526056321

New Member

user17525286356

New Member

Raph

Community Manager

in Events

Jenlynnsmith85

New Member