- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Child custodian - Turbotax saying I am not the custodian

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Child custodian - Turbotax saying I am not the custodian

A little help please-- I am married but filing separately this year. I entered my son as a dependent this way:

How many months stayed with you: 7 (more than half the days of year)

Did he pay more than 50% of own expenses: No

Do you have a custody agreement? No.

Let us know which parent he spent the most nights with in 2020: (Yes) Me.

Has his other parent waived their legal right to you so you can claim him as a dependent on your return this year (yes/no)?

I entered "No" - and Turbotax responded "It turns out he doesn't qualify as your dependent". What???

As stayed with me more than half the year, I am the custodian from the IRS' perspective, and should not need a legal right to be released to me.

Why does TurboTax say he does not quality as a dependent? How else should I proceed?

We could fill out a 8332 but the 8332 is for the IRS-determined custodian (me) to release a claim to exemption to the non-custodian - - Not for the non-custodian to release claim to the custodian. Or is it?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Child custodian - Turbotax saying I am not the custodian

@alohadoggie wrote:

I found the question unnecessary and misleading since it led me to the incorrect result. The previous questions have already established per IRS definition that I am the custodial parent since no other written agreements apply. Perhaps it should ask first if anyone else has a legal right before asking if it has been waived. I found it odd is all.

TurboTax follows the IRS rules.

See “Children of divorced or separated parents or parents who live apart” in IRS Pub 501 for full information.

https://www.irs.gov/publications/p501#en_US_2018_publink1000220904

As I said - I do not know why they changed that question but it is necessary. Just because you answer NO to the custody agreement question does not mean that the other parent cannot claim.

Desktop versions ask the question this way that I think makes more sense.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Child custodian - Turbotax saying I am not the custodian

That "no" answer is keeping you from claiming your child when you said the other parent is not giving up the right to claim the child.

Are you filing married filing separately or as Head of Household? Do you still live with your spouse? And if you do why are you filing separate returns and giving up child related credits that you lose when you file MFS?

Am I Head of Household?

https://ttlc.intuit.com/questions/1894553-do-i-qualify-for-head-of-household

https://ttlc.intuit.com/questions/2900097-what-is-a-qualifying-person-for-head-of-household

If you qualify as Head of Household, when you enter your filing status (single or married filing separately) into MyInfo, and then enter your qualifying dependent, TurboTax will offer HOH as your filing status.

If you were legally married at the end of 2020 your filing choices are married filing jointly or married filing separately.

Married Filing Jointly is usually better, even if one spouse had little or no income. When you file a joint return, you and your spouse will get the married filing jointly standard deduction of $24,800 (+$1300 for each spouse 65 or older) You are eligible for more credits including education credits, earned income credit, child and dependent care credit, and a larger income limit to receive the child tax credit.

If you choose to file married filing separately, both spouses have to file the same way—either you both itemize or you both use standard deduction. Your tax rate will be higher than on a joint return. Some of the special rules for filing separately include: you cannot get earned income credit, education credits, adoption credits, or deductions for student loan interest. A higher percent of your Social Security benefits may be taxable. Your limit for SALT (state and local taxes and sales tax) will be only $5000 per spouse. In many cases you will not be able to take the child and dependent care credit. The amount you can contribute to a retirement account will be affected. If you live in a community property state, you will be required to provide additional information regarding your spouse’s income. ( Community property states: AZ, CA, ID, LA, NV, NM, TX, WA, WI)

If you are using online TurboTax to prepare your returns, you will need to prepare two separate returns and pay twice.

https://ttlc.intuit.com/questions/1894449-married-filing-jointly-vs-married-filing-separately

https://ttlc.intuit.com/questions/1901162-married-filing-separately-in-community-property-states

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Child custodian - Turbotax saying I am not the custodian

I checked the On Demand Tax Guidance but none of the following situations apply:

Top Ten Reasons Why a Child or Relative Wouldn't Qualify as a Dependent:

1. The person isn't a citizen or legal resident of the United States, nor a resident of Canada or Mexico

2. The person provided more than half of their own support for the year.

3. You told us another relative in your household will be claiming them this year.

4. The child's other parent is claiming them on their tax return this year.

5. The person lived with you for less than 7 months, and another with whom they lived more than 6 months qualifies to claim them.

6. The person lived with you less than 7 months, and you indicated you provided less than half their support.

7. You told us the person's income was over $4,300.

8. You said there was someone else who qualifies to claim this person as a dependent.

9. The person is married and filing a joint return with their spouse to claim more than just a refund of tax withheld.

10. You said they were not a full-time student, and that their income was over $4,300 or you did not provide more than half their support for the year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Child custodian - Turbotax saying I am not the custodian

Has his other parent waived their legal right to you so you can claim him as a dependent on your return this year (yes/no)?

I entered "No" - and Turbotax responded "It turns out he doesn't qualify as your dependent". What???

You must answer "yes" or you are telling TurboTax that you do not have the right to claim, the other parent does.

(Poor question wording in the online version - the desktop version asks the question a different way.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Child custodian - Turbotax saying I am not the custodian

Thank you.

My question is more of an intellectual curiosity about Turbotax's logic, since I know what the ultimate result should be.

I take it that the Turbotax question on waiving legal right is simply a poor redundant question or poor logic. (to answer your Q, yes - separate residences and Turbotax suggested HoH. I have no questions or concerns about it). It is easy to change my response to satisfy TurboTax by answering Yes "the legal right is waived" and that's fine all around. I found the question unnecessary and misleading since it led me to the incorrect result. The previous questions have already established per IRS definition that I am the custodial parent since no other written agreements apply. Perhaps it should ask first if anyone else has a legal right before asking if it has been waived. I found it odd is all.

Again, thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Child custodian - Turbotax saying I am not the custodian

@alohadoggie wrote:

I found the question unnecessary and misleading since it led me to the incorrect result. The previous questions have already established per IRS definition that I am the custodial parent since no other written agreements apply. Perhaps it should ask first if anyone else has a legal right before asking if it has been waived. I found it odd is all.

TurboTax follows the IRS rules.

See “Children of divorced or separated parents or parents who live apart” in IRS Pub 501 for full information.

https://www.irs.gov/publications/p501#en_US_2018_publink1000220904

As I said - I do not know why they changed that question but it is necessary. Just because you answer NO to the custody agreement question does not mean that the other parent cannot claim.

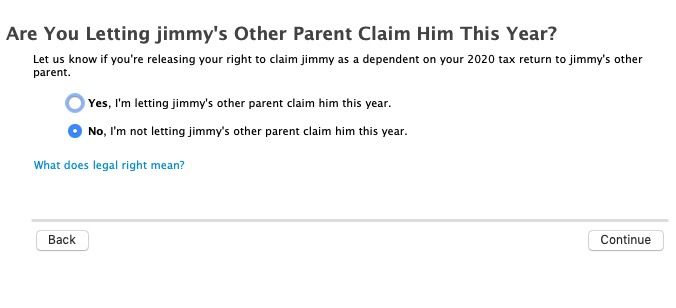

Desktop versions ask the question this way that I think makes more sense.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Child custodian - Turbotax saying I am not the custodian

@macuser_22 Thank you, I agree. The desktop version turns the question around and makes perfect sense-

Are you letting someone else claim Jimmy? Great question.

- But asking if someone else is allowing me to claim him when I don't need their permission. Not so much. Have a great Easter

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

rwdanko

New Member

KarenL

Employee Tax Expert

BryanCUFF

New Member

ZayMimiEli3

New Member

15dc083676f9

New Member