- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

@alohadoggie wrote:

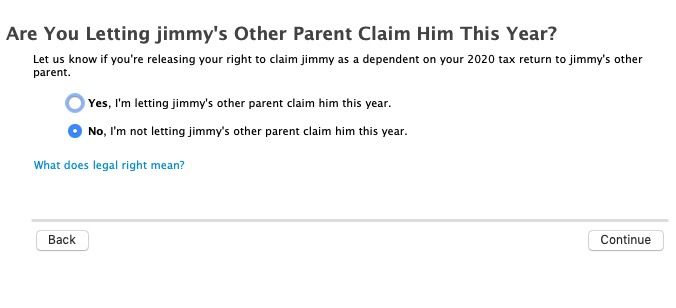

I found the question unnecessary and misleading since it led me to the incorrect result. The previous questions have already established per IRS definition that I am the custodial parent since no other written agreements apply. Perhaps it should ask first if anyone else has a legal right before asking if it has been waived. I found it odd is all.

TurboTax follows the IRS rules.

See “Children of divorced or separated parents or parents who live apart” in IRS Pub 501 for full information.

https://www.irs.gov/publications/p501#en_US_2018_publink1000220904

As I said - I do not know why they changed that question but it is necessary. Just because you answer NO to the custody agreement question does not mean that the other parent cannot claim.

Desktop versions ask the question this way that I think makes more sense.