- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Can't input personal property taxes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can't input personal property taxes

I'm trying to load personal property and real estate tax information and boxes won't allow input.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can't input personal property taxes

All of your input needs to be entered in the Federal section of the return.

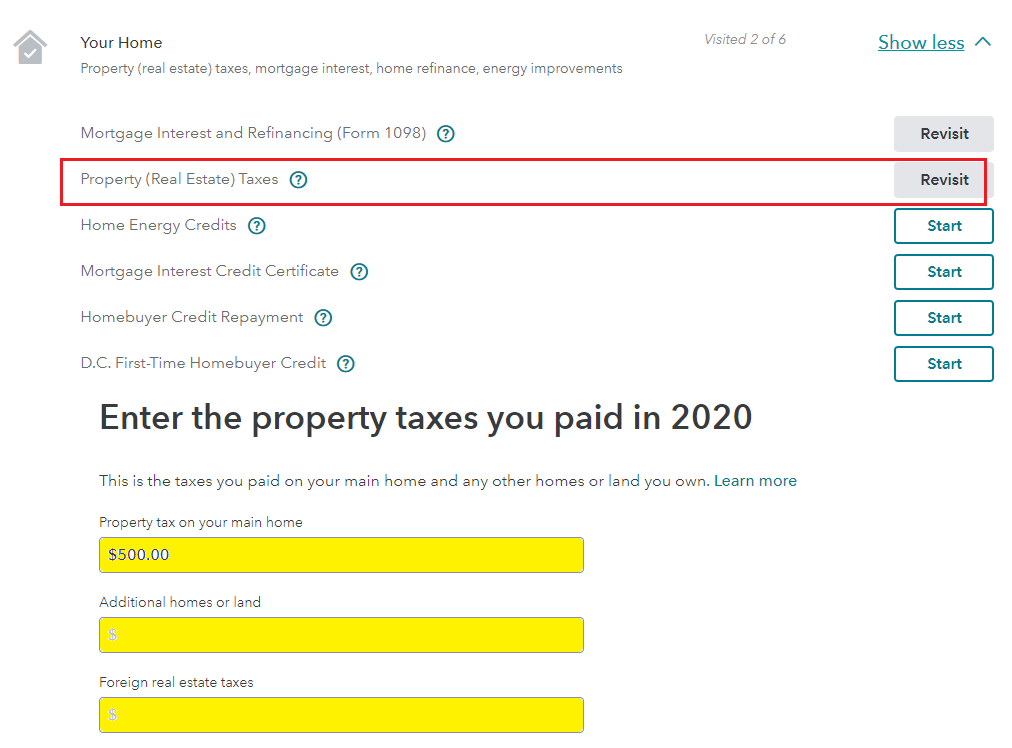

- Go to the Federal section in the left panel

- Select Deductions & Credits

- Go to All tax breaks, select Your Home

- Select Property (Real Estate) Taxes

- Select Start to enter your information.

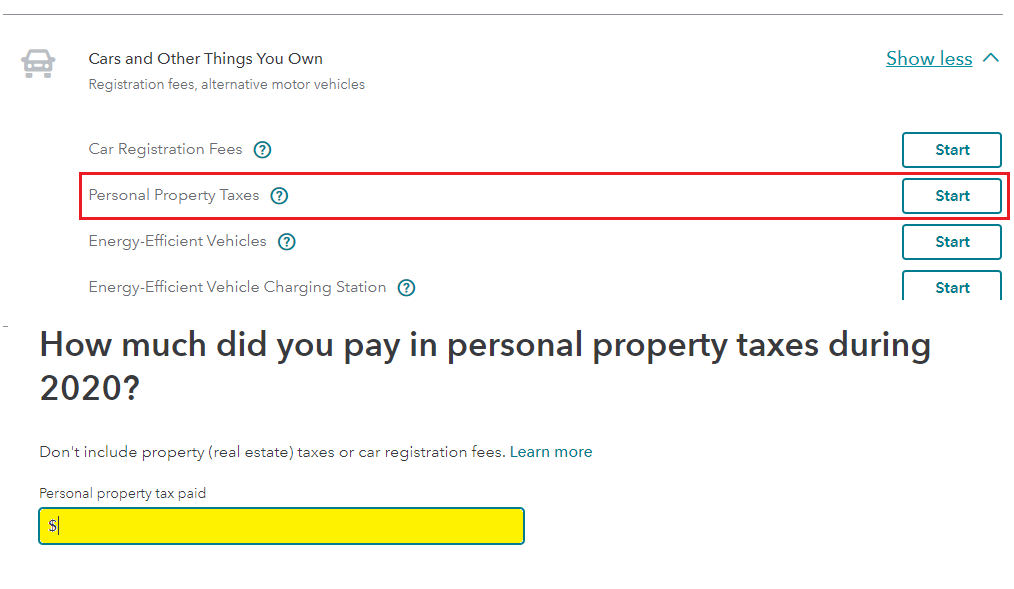

For the personal property taxes, you will follow the same procedure as above, but instead of Your Home, you will select Cars and Other Things You Own.

Please comment if you are still having issues.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can't input personal property taxes

I have received the same information from you twice now. When I follow all the steps you outline, I cannot make an entry in any of the real estate or personal property tax boxes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can't input personal property taxes

I found the issue. When information was imported from 2019, I had used the "supporting information" feature in 2019 and so for 2020, TurboTax was expecting me to update that supporting information. Issue is resolved.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can't input personal property taxes

The instructions are complete and I will add some images below for you to see. Before you try again you should complete certain actions.

- Close your TurboTax return.

- Clear cache and cookies, as well as browsing history from your browser (it helps in so many ways to remove any unwanted data).

- Perform the same steps provided by @JotikaT2

- See the images below (TurboTax Desktop is the same flow)

Itemizing deductions can provide a greater impact with the lowest and best tax results if they are greater than your standard deduction.

- $12,400 Single and Married filing separately

- $24,800 Married filing jointly

- $18,650 Head of Household

- Additional amounts for age or blindness

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jackkgan

Level 5

kim-gundler

New Member

kemp5774

New Member

michelleroett

New Member

vithlanisamay

Returning Member