- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Can I claim personal property tax on my vehicles in the state of North Carolina?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim personal property tax on my vehicles in the state of North Carolina?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim personal property tax on my vehicles in the state of North Carolina?

Yes. In North Carolina, you can deduct the Vehicle Property Tax you paid on your vehicles.

You can enter this expense under Deductions and Credits, in the section Cars and Other Things That You Own.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim personal property tax on my vehicles in the state of North Carolina?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim personal property tax on my vehicles in the state of North Carolina?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim personal property tax on my vehicles in the state of North Carolina?

The Car Reg Fee entries are accepted, but no change shows in the Fed Tax Due. Could it be because I live in NC? TT help says NC is not a state that charges property tax based on the value of the car (but NC actually does)?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim personal property tax on my vehicles in the state of North Carolina?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim personal property tax on my vehicles in the state of North Carolina?

If you are asking if they can be included on your NC return, the answer is no. NC changed the law several years ago and you can no longer deduct personal property taxes on the NC return even though you can deduct them on your federal return.

From the instructions from NC

No itemized deductions included on federal,Schedule A (Form 1040) are allowed as N.C. itemized deductions except qualified home mortgage interest (excluding mortgage insurance premiums), real estate property taxes, charitable contributions, medical and dental expenses, and repayment of claim of right income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim personal property tax on my vehicles in the state of North Carolina?

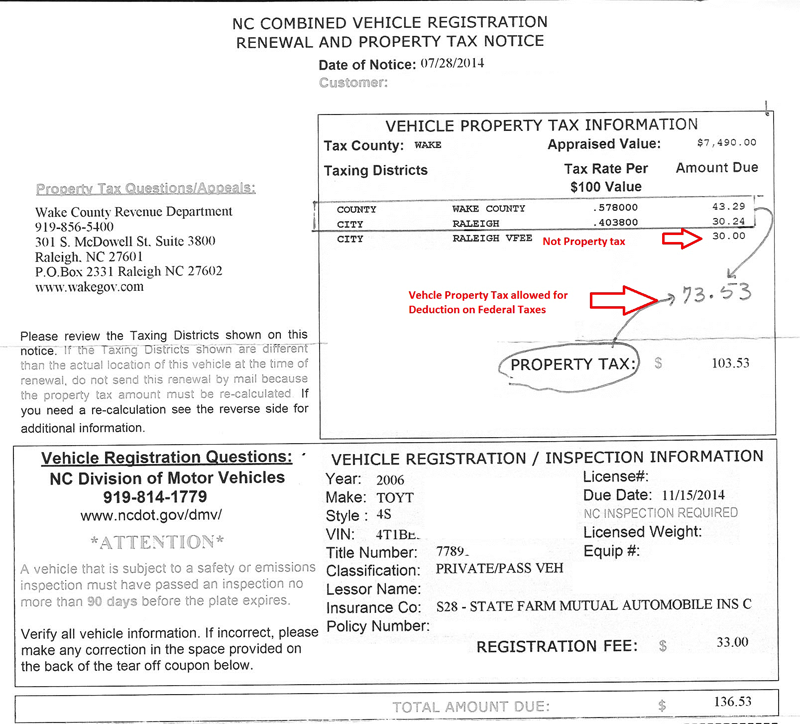

This is what I see on TurboTax for NC. Only county tax can be included it appears, not the city tax, or registration fee. Someone please let me know if this is correct. Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim personal property tax on my vehicles in the state of North Carolina?

Only the vehicle property tax you paid to your North Carolina county on your vehicles is deductible as an itemized deduction on your federal return, but make your entry on the screen that you’ve displayed.

Sometimes these fees are named different things in different states.

Please see the TurboTax Help article Is my car registration fee deductible? for more information.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim personal property tax on my vehicles in the state of North Carolina?

Further question...

The Receipt of Pad Fees shows:

License

Prop. Tax

Veh. Fee

and below that it shows Total Property Tax

So do I put the Prop. Tax fee only or the Total Property Tax fee which includes the Veh. Fee?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim personal property tax on my vehicles in the state of North Carolina?

The personal Property Tax for the vehicle is deductible. Use the Property Tax fee.

Your car registration fee is deductible if it's a yearly fee based on the value of your vehicle and you itemize your deductions. You can't deduct the total amount you paid, only the portion of the fee that's based on your vehicle's value.

{edited 4/17/2023 | 6:45 AM PST}

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim personal property tax on my vehicles in the state of North Carolina?

I guess in the end it didn't matter anyway. Nothing changed since I have the standard deduction.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim personal property tax on my vehicles in the state of North Carolina?

Yeah, you have to be careful...the NCDMV improperly puts in a total property tax that cannot be used as-is.

The flat Vehicle "Fee" is NOT allowed as a Federal deduction.

___

Old example, but it still looks the same.

__________

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim personal property tax on my vehicles in the state of North Carolina?

Thank you! 🙏

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

justine626

Level 1

tharrill77

Returning Member

kare2k13

Level 4

davidttotten

New Member

phipbo

Returning Member