- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Bug with refinancing a large mortgage

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug with refinancing a large mortgage

Looks like this is still an ongoing issue for 2022 Tax Year.

Anyone at TurboTax have a solution, or want to update the software so people don't lose their deduction for mortgage interest because the software calculates the balance incorrectly?

Seems to be applying to windows and Mac. Making a synthetic form won't allow me to deduct the points from my last refinance. Please fix this.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug with refinancing a large mortgage

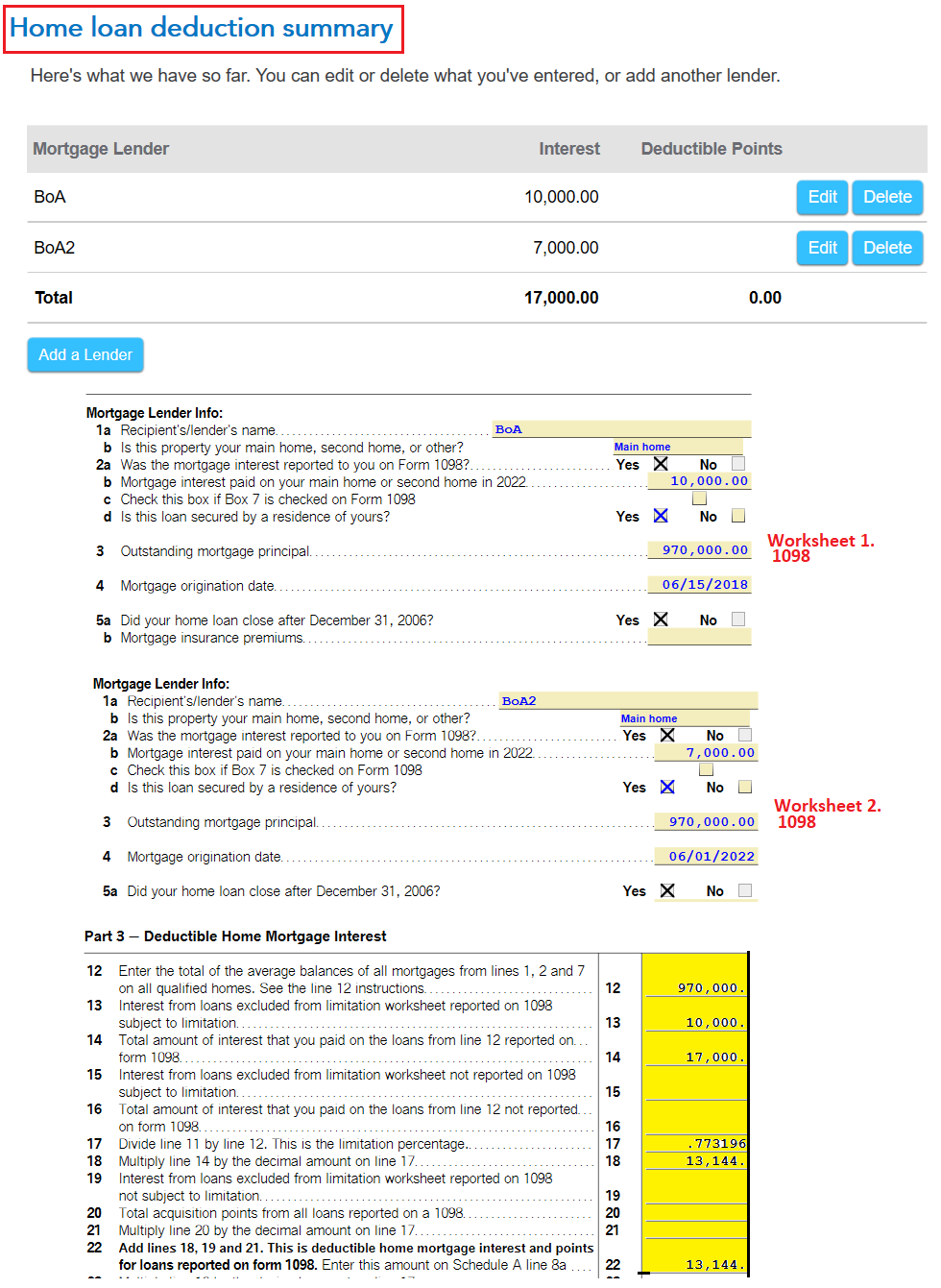

When using the example you linked to from TurboTax Community I entered the mortgages ($970,000) on two different loans with a combined mortgage interest total of $17,000, $10,000 on one 1098 and $7,000 on the other. When answering the questions for each 1098, and a mortgage origination date of 06/01/2018 for the original loan and 6/01/2022 for the second refinance loan, the interest calculated is correct using the $750,000 mortgage limit ($750k/$970k = 77.32% ). I did not include any points on this scenario.

This was performed using the TurboTax CD/Download Windows version. All of the questions need to be answered correctly for each loan.

- Important to answer 'Yes' or 'No' to this question based on the 1098 you are entering. 'Let's see if this is the most recent form for this loan'.

- For the original loan the answer should be no.

- For the refinanced loan the answer should be yes.

Here are the steps in full and this article may help you as well: How to handle multiple 1098s

- Open your TurboTax Return > Search (upper right) > type 1098 > Click the Jump to... link

- You will arrive at the 'Home loan deduction summary' > Select Edit next to your first 1098

- Enter the bank or financial institution name > Continue > Select Primary Home > Continue

- Select 'No or Yes' on 'Do any of these situations apply?' (I selected no) > Continue

- Enter the information from your 1098 as it appears (I entered Boxes 1,2,3. Property taxes paid)

- Continue > 'Yes' this property is secured by a property of mine. > Continue

- Select 'I have no points to deduct for this loan' (this was my selection - answer for your situation)

- Continue > 'Let's see if this is the most recent loan' (see the notes about this above) > Continue

- 'Let's get some details about this loan' answer correctly (I answered This loan is neither of these')

- 'Yes or No' 'Have you used the money from this loan exclusively on this home?' (I answered yes)

- Continue to the Home loan deduction summary and repeat for the refinanced loan 1098.

See the images below and please update here if you have more questions.

[Edited: 02/21/2023 | 1:34p PST] @GoneSailin74

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug with refinancing a large mortgage

Well, I'm working with the TurboTax for Mac version.

Followed the deduction process for two loans, with the original purchase date of the property in 2012.

I put in Interest paid on the first and the second loan. I answered the refinanced question correctly.

I don't have that view in the Mac version of TT Premier.

Now, I'd also like to point out that TT isn't asking or handling amortized points correctly either. If I refinance with the same bank, I need to book keep the old loans points along with the new loans points.

Here are the details of the screen shots of the worksheets, Schedule A, and the 1040. There's a problem.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug with refinancing a large mortgage

Here's the 1040, the photo didn't upload correctly on the previous post.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug with refinancing a large mortgage

You are correct than when refinanced with the same bank, the points are continued. Your screen shots look like you have answered correctly but clearly they are not carrying through.

Because you seem to understand the rules and what should be, I am going to suggest you skip the worksheets. Instead, just enter one correct total to carry to the form. Use a mortgage balance below the $750,000 and enter the correct amounts for the program to input on the sch A.

As you know, only the form goes to the IRS with the total. The worksheets are just used within the program. The IRS will match up 1098 interest forms and compare it to your schedule A. The IRS can see the mortgage amounts on the interest forms but not on sch A.

Home Mortgage Interest Deduction - IRS

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug with refinancing a large mortgage

So, how many people using turbo tax aren’t noticing?

this has been a problem for multiple years. I had the same issue in 2020.

could someone at TT please fix this?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

megestrain

Level 1

dbowman

New Member

iauojfiuh0238hc

New Member

etees18

New Member

john11840

Level 1