- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

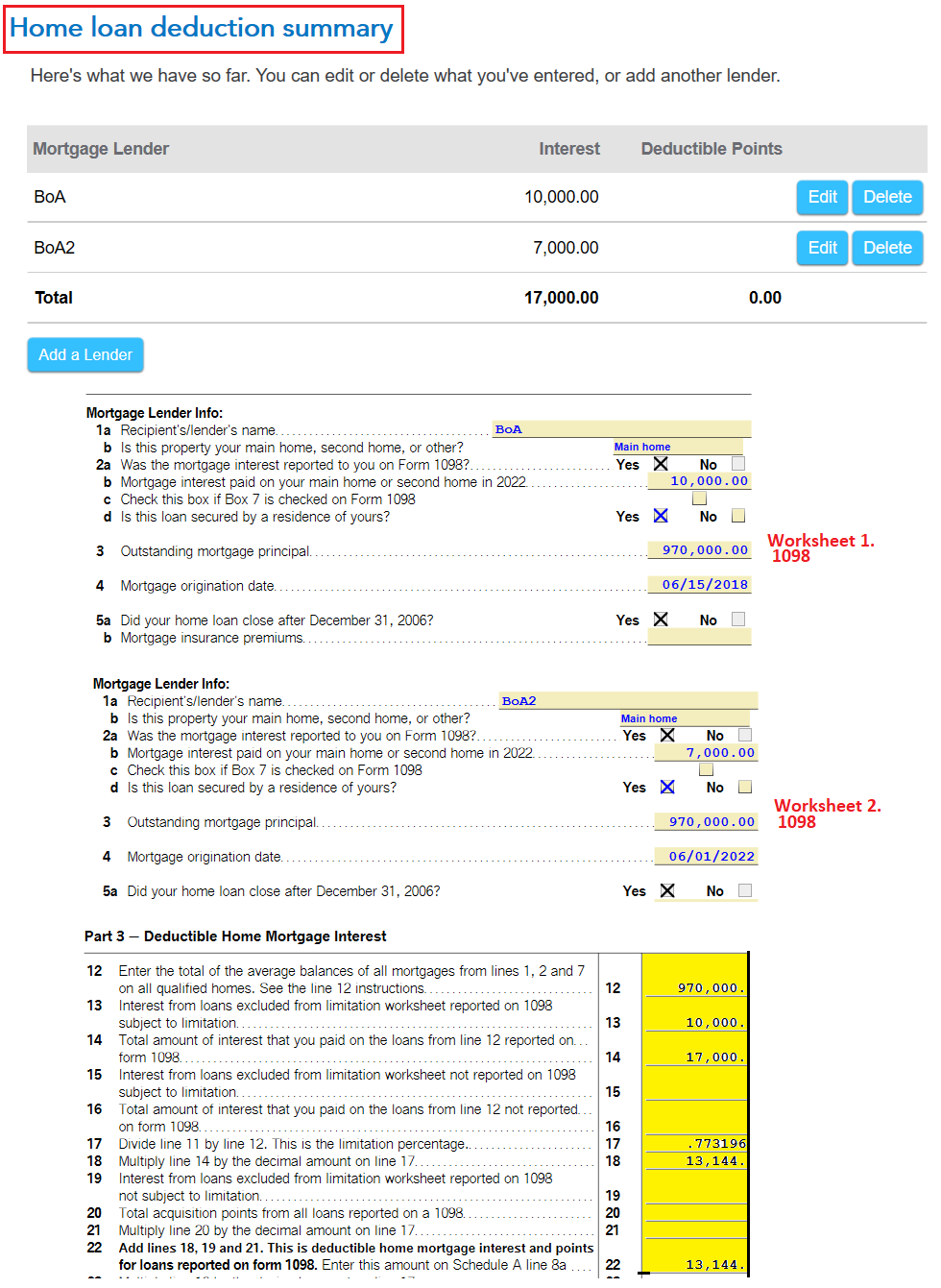

When using the example you linked to from TurboTax Community I entered the mortgages ($970,000) on two different loans with a combined mortgage interest total of $17,000, $10,000 on one 1098 and $7,000 on the other. When answering the questions for each 1098, and a mortgage origination date of 06/01/2018 for the original loan and 6/01/2022 for the second refinance loan, the interest calculated is correct using the $750,000 mortgage limit ($750k/$970k = 77.32% ). I did not include any points on this scenario.

This was performed using the TurboTax CD/Download Windows version. All of the questions need to be answered correctly for each loan.

- Important to answer 'Yes' or 'No' to this question based on the 1098 you are entering. 'Let's see if this is the most recent form for this loan'.

- For the original loan the answer should be no.

- For the refinanced loan the answer should be yes.

Here are the steps in full and this article may help you as well: How to handle multiple 1098s

- Open your TurboTax Return > Search (upper right) > type 1098 > Click the Jump to... link

- You will arrive at the 'Home loan deduction summary' > Select Edit next to your first 1098

- Enter the bank or financial institution name > Continue > Select Primary Home > Continue

- Select 'No or Yes' on 'Do any of these situations apply?' (I selected no) > Continue

- Enter the information from your 1098 as it appears (I entered Boxes 1,2,3. Property taxes paid)

- Continue > 'Yes' this property is secured by a property of mine. > Continue

- Select 'I have no points to deduct for this loan' (this was my selection - answer for your situation)

- Continue > 'Let's see if this is the most recent loan' (see the notes about this above) > Continue

- 'Let's get some details about this loan' answer correctly (I answered This loan is neither of these')

- 'Yes or No' 'Have you used the money from this loan exclusively on this home?' (I answered yes)

- Continue to the Home loan deduction summary and repeat for the refinanced loan 1098.

See the images below and please update here if you have more questions.

[Edited: 02/21/2023 | 1:34p PST] @GoneSailin74

**Mark the post that answers your question by clicking on "Mark as Best Answer"