Special depreciation is an expense allowance you take on assets you purchased that allows you to deduct a large portion of all of the cost of the asset in the year you put it into service in your business. If you never took any special depreciation, then the allowance amount would be $0, so you can enter that when requested in TurboTax.

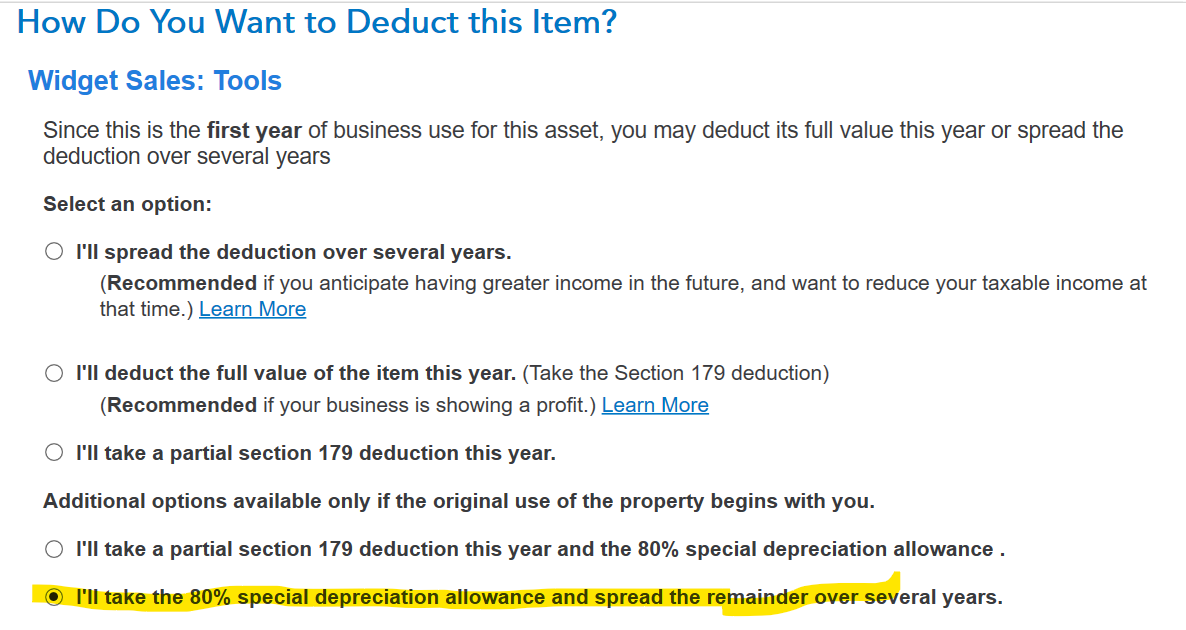

Also, you may need to go back and edit the asset entry you did in TurboTax. You may see an option to take the special depreciation on the screen that says "How Do You Want to Deduct this Item?" If so, you can uncheck that box and that may resolve your issue.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"