- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Amending K-1 for S-Corporation

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amending K-1 for S-Corporation

I filed taxes for my husband's 2023 return for an S-corp using TurboTax Desktop for Businesses. Everything is correct except on the k-1 worksheet I forgot to enter the repayment of loans to shareholders (box 16e on the k-1). The repayment is listed on the stockholder debt and basis limitation worksheet. The only place I forgot it is the k-1 worksheet where it feeds to the k-1. I tried to amend the tax return and when I fixed it, it did fix the K-1, but it didn't say I needed to amend it, it still says my federal tax return was accepted at the end. It only gave me the option to amend my state return. I know this is incorrect because our personal tax return was rejected for having incorrect information on form 7203 (where I listed the repayment). How do I fix the k-1 for the federal return?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amending K-1 for S-Corporation

I found my answer. It is not an amendment until after the filing deadline, it is a superseded return. In either case, it must be mailed in.

https://www.irs.gov/businesses/corporations/amended-and-superseding-corporate-returns

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amending K-1 for S-Corporation

Please clarify if you clicked the option to Amend a Filed Return when you opened TurboTax. If the e-file confirmation is still displayed, you may have changed the original return rather than creating an amended return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amending K-1 for S-Corporation

I did. However, a message popped up about how to amend the state and maybe I clicked out of the "Amend" when I followed the state instructions. I'm going to undo what I did and start over. I'll let you know if that was the fix.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amending K-1 for S-Corporation

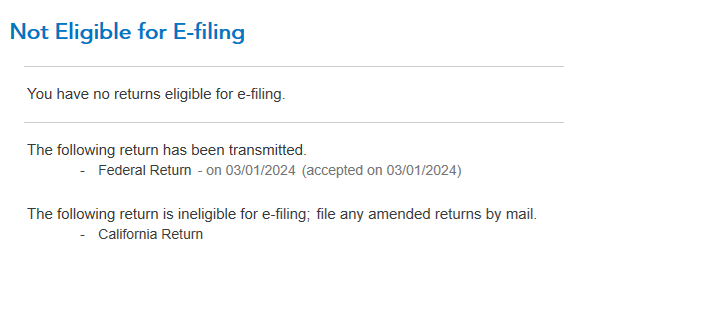

It's the same. It tells me to mail the amended state and that the federal return was accepted on 3/1/2024. I clearly marked amend throughout the federal return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amending K-1 for S-Corporation

Did you receive an email confirmation for the amended federal return?

Are you able to print the California amended return so it can be mailed? The Forms Availability Table for California indicates that Schedule X for amended returns is not supported for e-filing. This is a TurboTax limitation.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amending K-1 for S-Corporation

The original return was filed on 3/1/2024. I went through all the steps last night and today to amend the return and it only says to print and mail the state amended return. It says nothing for the federal except what you see. It doesn't even give me the option to file an amended federal return (only state) even though I went through all the steps. The K-1 and Federal return 1120S say, "amended" if I look at my copies now, but TurboTax isn't prompting me to send anything to the IRS. That's why I'm here. What do I do? Just mail it? I just think that Turbo Tax should have prepared something for me to send as it did for the state.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amending K-1 for S-Corporation

I found my answer. It is not an amendment until after the filing deadline, it is a superseded return. In either case, it must be mailed in.

https://www.irs.gov/businesses/corporations/amended-and-superseding-corporate-returns

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amending K-1 for S-Corporation

Did you ever get help with this problem? I am having the same problem and have been trying to find where I could get help from turbo tax, like tech help. I have read so many comments about people not able to amend their returns. It could be a glitch. But still Turbo tax says right on their site that they have 24/7 help. I can not find any help. Without the amendment working, I am stuck.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amending K-1 for S-Corporation

I never got help, followed all the steps to amend the return, and mailed them both to each proper address (it's different for amendments) with a short explanation. I had to request permission from the state of California to mail it instead of e-file first. Of course, an amendment to our corporation and the K-1 also meant an amendment to our personal taxes (because they had been filed already). So I mailed them all separately. I only received confirmation about our personal tax amendment, the gov't never said anything about the business amendment.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rockypointlocal

New Member

ajahearn

Level 1

matto1

Level 2

lauraso

New Member

nbostick7

New Member