- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- 2020 tax audit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 tax audit

I am being audited on my 2020 return, for my mortgage interest deduction.

I filled out the deductible home mortgage Interest Worksheet, but the software does not seem to have corrected the interest applied by the factor on line 15.

Not only must I explain this to an IRS inspector, but I am trying to understand why it happened.

I have used TurboTax for over 20 years and never had an issue like this.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 tax audit

@grich01R - I also have the Deluxe version for 2020 (CD / download).....i was able to replicate the bug..... I punched in each loan via the step-x-step process and after completing the 2nd loan, Turbo tax stated "you are getting a deduction of $26,000", but when I look at the Schedule A, there is $37,000 posted!

I was able to pull up the Deductible Home Mortgage Interest Worksheet and it correctly calculated 71% and $26,000 of interest. it states this interest should be applied to Line 8a of Schedule A, but when I look at Schedule A, line 8a has $37,000.

I tried 4 use cases and here is the problem: if NEITHER average loan balance EXCEEDS the cap for its time frame, the result is incorrect. and this is EXACTLY what @grich01R has on his tax return

use cases: I punched these 4 permutations into Deluxe download for 2020. In three cases, the reduced interest correctly posted to Schedule A. In one case - which is similar to @grich01R 's case, the reduced interest did NOT correctly post to Schedule A, even though the Work sheet calculated the reduced interst with the instuction to apply the result to Schedule A

Pre 12.15.17 loan $1,000,000 and post 12.15.17 loan $750,000 incorrect result (neither loan exceeds its respective cap)

Pre 12.15.17 loan $1,000,001 and post 12.15.17 loan $750,000 - correct result (one loan above its cap)

Pre 12.15.17 loan $1,000,000 and post 12.15.17 $750,001 - correct result (one loan above its cap)

Pre 12.15.17 loan $1,000,001 and post 12.15.17 $750,001 - correct result (both loans above its respective cap)

Definately a bug!!!!! I suspect affects every taxpayer who had multiple loans with one prior to 12/15/17 and one after 12/15/17, and neither loan was above the cap for its respective time frame has the bug.

if you contact TT Support, I wonder what their response is......

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 tax audit

we can't see your return or worksheets.

you can deal with the IRS yourself, hire a tax pro or

The Audit Defense service is provided by TaxResources, Inc., also called TaxAudit.com, in partnership with TurboTax. If you paid for Audit Defense and you received a notice, call TaxResources, Inc. at 877-829-9695, or report your notice on their website at http://intuit.taxaudit.com/. Do not contact the tax agency until you have spoken to TaxResources. They may contact them on your behalf.

if Turbotax erred in its calculation toy can file a claim for the penalties and interest.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 tax audit

We may be able to assist you in determining what the correct deduction and tax would have been, if you provide us with more details. But we can’t see your actual tax return. Do you have more than $750,000 of mortgage balance and the IRS is questioning your adjustment? Do you have home equity debt? What does the IRS think you did incorrectly?

Is this an in person audit, or did you receive a letter from the IRS that proposes a tax adjustment? A letter is not a true audit. If you agree that the original calculation was incorrect and the new calculation is correct, you can just pay the requested amount. If you believe that you gave TurboTax correct information but the program calculated your deduction incorrectly, you always owe your own correct tax, but you can apply to the TurboTax guaranteed to cover any penalties and interest. If you believe the IRS letter is incorrect, you have the ability to offer proof that your original calculation was correct, but you must respect the deadlines in the letter, otherwise you lose your opportunity to appeal the assessment.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 tax audit

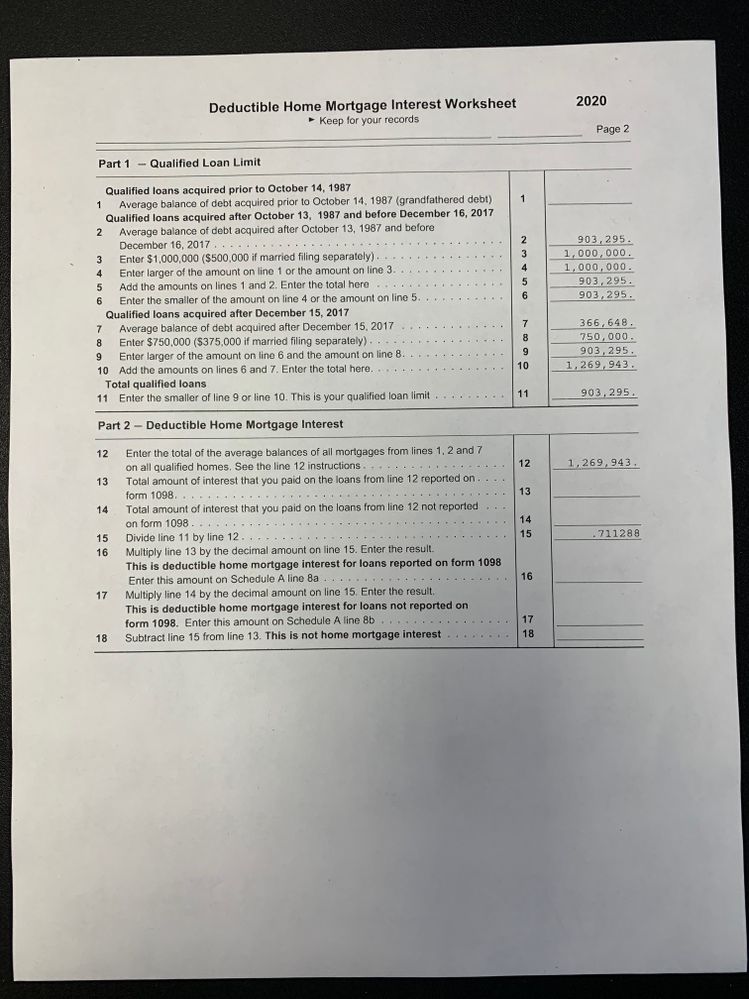

Thanks Mike.

Mortgage balance on house 1 is $892,258.86

Mortgage balance on house 2 is $366,640.00

Total interest paid in 2020 = $37,976.10

I calculate the deductible ratio to be 0.709, and thus the claimable amount to be $26,925.00

The problem is that while the TurboTax 2020 calculated all the way to the deductible ratio, it never reduced the interest amount, but rather entered $37,976.10 on my return.

Also, the final check on T'Tax never picked this up.

I attach the T'Tax worksheet, which leaves the interest blank, though is it inserted it in the tax return.

I compile my return by using the step-by-step system in the program.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 tax audit

I omitted to add that it was a letter from the IRS that I received, with no request to pay, just that "We are auditing your 2020 tax return and need you to send additional information to support the following items claimed on your return - Schedule A Interest"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 tax audit

@grich01R wrote:

I omitted to add that it was a letter from the IRS that I received, with no request to pay, just that "We are auditing your 2020 tax return and need you to send additional information to support the following items claimed on your return - Schedule A Interest"

OK, it looks like turbotax calculated 0.711 instead of 0.709, I'm not going to try and chase down the difference.

If Turbotax really did enter the full $37.9K on line 8a of schedule A instead of the adjusted $26.9K, that definitely seems like a program fault. This is what I would do at this point.

1. Save a copy of your original tax return and your original turbotax data file in a safe place, before making modifications. If you filed online, you can download the data file, if you filed on your computer, it will be in your Documents folder someplace with a name like "John Smith tax.tax2020". You need the original, unmodified file for your guarantee claim.

2. Prepare an amended return with the correct interest amount. If Turbotax still calculates it incorrectly, manually enter the correct amount.

3. Write a letter back to the office that requested the information. Include a letter of explanation, your new calculations, and a copy of the amended return. Don't send the amended return to the address for filing amended returns, just send it to the office that sent the audit letter. If you owe additional tax, pay that amount online -- don't include a check with the letter. Go to www.irs.gov/payments and make a direct payment. Select the most appropriate reason (letter number or tax assessment or amended return), form 1040, and 2020. Just pay the tax amount, not any penalties or late fees or interest. In your letter that explains the adjustments, include the fact that you made a payment online. Send the letter using a mail service that has tracking and proof of delivery.

3a. If the IRS indicates they want to see proof of your interest payments and mortgage balances, you should also include copies of your mortgage statements or the annual summary from the mortgage lenders. My guess is they think your balance was more than allowable. If you admit your balance was more than allowable and you provide a correction, they might not need proof of the actual balance, but they might want it anyway.

3b. You can try calling the office that sent the notice. If you get through, and explain what happened, they might be willing to accept a letter of explanation without needing all the proofs. Or they might have different instructions for you.

3c. You should double-check the allowable interest deduction using the actual instructions for 2020. They are here. https://www.irs.gov/pub/irs-prior/p936--2020.pdf

3d. Remember that you need to look at the average balance for the year. If your January outstanding principal balance was $900,000 and your December balance was $880,000, then the worksheet will use the average of $890,000. That may explain why the figures you cite are slightly different than Turbotax's calculation.

4. Wait and see what happens. If the IRS sends another letter assessing penalties or interest for late payment, pay it (to stop the fees from growing) and then file a claim with the Turbotax Accuracy Guarantee. If Turbotax agrees it was their fault the wrong interest deduction was claimed, they should reimburse you for the late fees.

(You mail the letter but make the payment online so the payment doesnt get lost, and because the sooner you make the payment, the less interest you owe. You must file the accuracy claim within 30 days of getting a bill for interest and penalties, and you can't file the claim until you actually get a bill, which is why you wait instead of doing it now, and why you only pay the tax and wait for a bill for late fees. There's a chance the IRS won't bill you.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 tax audit

@grich01R - did you complete the return via Online or CD / Download:

if by download, open up the tax return to the same form and see if it is now correct (I appreciate if you did this via online, that is not possible).

If you entered the interest from the 1098 form and the interest appears on your Schedule A, that would suggest this situation is a 'bug'. The software should have pulled the interest from form 1098 onto the worksheet.

Suggest calling TT as when you amend, there will probably be a penalty / interest involved and the TT guarentee should cover it. They don't cover the additional tax, though.

and I just saw @Opus 17 response as I completed the above. Totally agree with @Opus 17

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 tax audit

Thanks for the valuable and informative replies, guys.

I have always prepared via CD, on my laptop, with the Deluxe version.

I have all my TurboTax files back to 1998!

I have opened the 2020 version 3 or 4 times in the last week, and the numbers have not updated (though the program has loaded updates each time).

I will save the files as uploaded electronically to the IRS and rename the original so that it doesn't get overwritten.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 tax audit

If TurboTax deducted the total interest but you and IRS agree that only a fraction is deductible.

prepare an attachment that shows your calculation of the fractional part that is deductible and the part that is not deductible, based on rules in Pub 936 which you can reference.

you could supply an updated Schedule A.

If you interpret 936 correctly, IRs would accept that and make the necessary changes to your tax return.

OR, ask the IRS to do the calculation for you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 tax audit

@grich01R - I also have the Deluxe version for 2020 (CD / download).....i was able to replicate the bug..... I punched in each loan via the step-x-step process and after completing the 2nd loan, Turbo tax stated "you are getting a deduction of $26,000", but when I look at the Schedule A, there is $37,000 posted!

I was able to pull up the Deductible Home Mortgage Interest Worksheet and it correctly calculated 71% and $26,000 of interest. it states this interest should be applied to Line 8a of Schedule A, but when I look at Schedule A, line 8a has $37,000.

I tried 4 use cases and here is the problem: if NEITHER average loan balance EXCEEDS the cap for its time frame, the result is incorrect. and this is EXACTLY what @grich01R has on his tax return

use cases: I punched these 4 permutations into Deluxe download for 2020. In three cases, the reduced interest correctly posted to Schedule A. In one case - which is similar to @grich01R 's case, the reduced interest did NOT correctly post to Schedule A, even though the Work sheet calculated the reduced interst with the instuction to apply the result to Schedule A

Pre 12.15.17 loan $1,000,000 and post 12.15.17 loan $750,000 incorrect result (neither loan exceeds its respective cap)

Pre 12.15.17 loan $1,000,001 and post 12.15.17 loan $750,000 - correct result (one loan above its cap)

Pre 12.15.17 loan $1,000,000 and post 12.15.17 $750,001 - correct result (one loan above its cap)

Pre 12.15.17 loan $1,000,001 and post 12.15.17 $750,001 - correct result (both loans above its respective cap)

Definately a bug!!!!! I suspect affects every taxpayer who had multiple loans with one prior to 12/15/17 and one after 12/15/17, and neither loan was above the cap for its respective time frame has the bug.

if you contact TT Support, I wonder what their response is......

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 tax audit

Thanks for this.

Glad to hear I am not dreaming it up.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 tax audit

One step you can do now is to go to the help menu and select "Send file to agent." This uploads an anonymous copy of your file to the customer support and gives you a token number. In any correspondence with Turbotax, you can reference that token number so they can see the file with the error. If @NCperson posts his token number here (or private-messages it to @grich01R ) thats another factoid you can add to your guarantee case.

Unfortunately, support won't take the guarantee case unless you actually get a bill for penalties and interest, and there is no way to force Turbotax to look into the bug until that happens, but getting token numbers may help proving the case later.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 tax audit

Also FWIW, there were several reports of mortgage calculation errors for tax year 2020. "Champs" have access to a sub-forum where turbotax posts "containment articles" when a bug is recognized, they give the date for the fix or other information. Unfortunately, I can't check on the details because all the old containment articles are coming up "access denied". But it may be that this bug is already known and you just need to make your claim when you get the bill.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 tax audit

I tested the 'bug' from 2020 and set up the same use case in Deluxe 2021.......it worked correctly, so the bug was fixed for tax year 2021.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 tax audit

I am not getting audited, but I did get an email from TurboTax that this bug may have impacted my return. They gave me a number to call and showed me how to fix it. If you haven't got a solution, let me know and I will tell you what button to push to fix it.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

taxgirl621

New Member

179Wolfe

New Member

RedFive

New Member

alaskan-buckeye

New Member

Chuckycarlos

New Member