in Education

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- 1098-T Tuition is not recognized after input for my dependent child.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098-T Tuition is not recognized after input for my dependent child.

I have been using Itemize Deduction for years. The 1098-T tuitions paid for my children have been benefitting since they are in colleges. The very first time it wasn't recognized when is for 2019 tax year. I asked a CPA and answered because Trump changed the tax law. OK, I had no choice but take it. Now I am having the same concern again. Why the 1098-T Tuition paid for my child doesn't get me any tax break? I answered all prompted point normally. Is there anywhere item I need to trigger from the software? How can get the $15,600.+ worth of a tax credit this year, 2021 tax year? Can any expert or previous users who know the answer that is a TurboTax issue or Tax Law issue to help out of my concern? Thanks in advance.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098-T Tuition is not recognized after input for my dependent child.

Form 8863 hasn't changed in years except for the income limits. To qualify for the maximum deduction, only $4,000 must be paid out of pocket, per student. The AOTC can only be claimed 4 years per student.

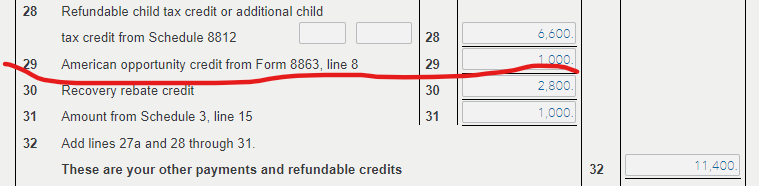

The AOTC is then divided up into two different refund areas. Lines 25 and 29 will combine to reach the full refund of $2,500 per student. Line 25 is the nonrefundable portion, up to $1,500 used to reduce tax liability. Line 29 is the refundable portion, up to $1,000.

Once the AOTC has been used for 4 years, you can switch to the Lifetime Learning Credit. It is a nonrefundable credit up to $2,000. Information about both credits are listed. See:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098-T Tuition is not recognized after input for my dependent child.

If you have been eligible for a tax credit in previous years, but are not seeing the tax break this year, your income may now be too high to be eligible to take the credit. For a Married Filing Jointly couple, the maximum income is $180,000.

Check the guidelines for eligibility that are included in the chart in this TurboTax help article.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098-T Tuition is not recognized after input for my dependent child.

Thanks for the response Patti. However, it is not my case. My MFJ total taxable income is below $135,000. Is there any other area can be looked at?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098-T Tuition is not recognized after input for my dependent child.

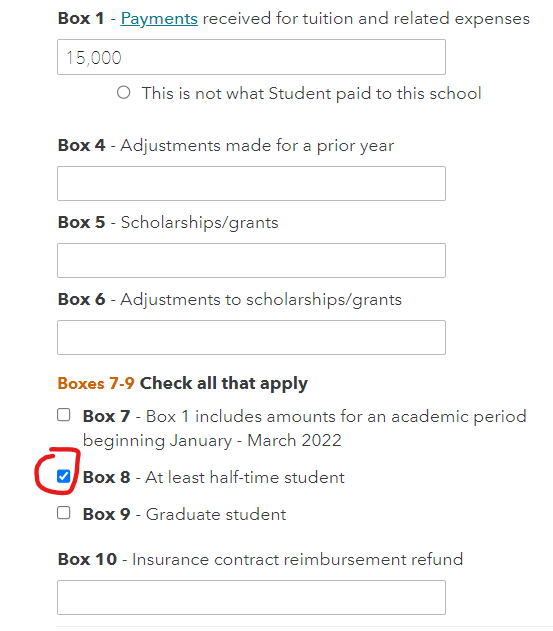

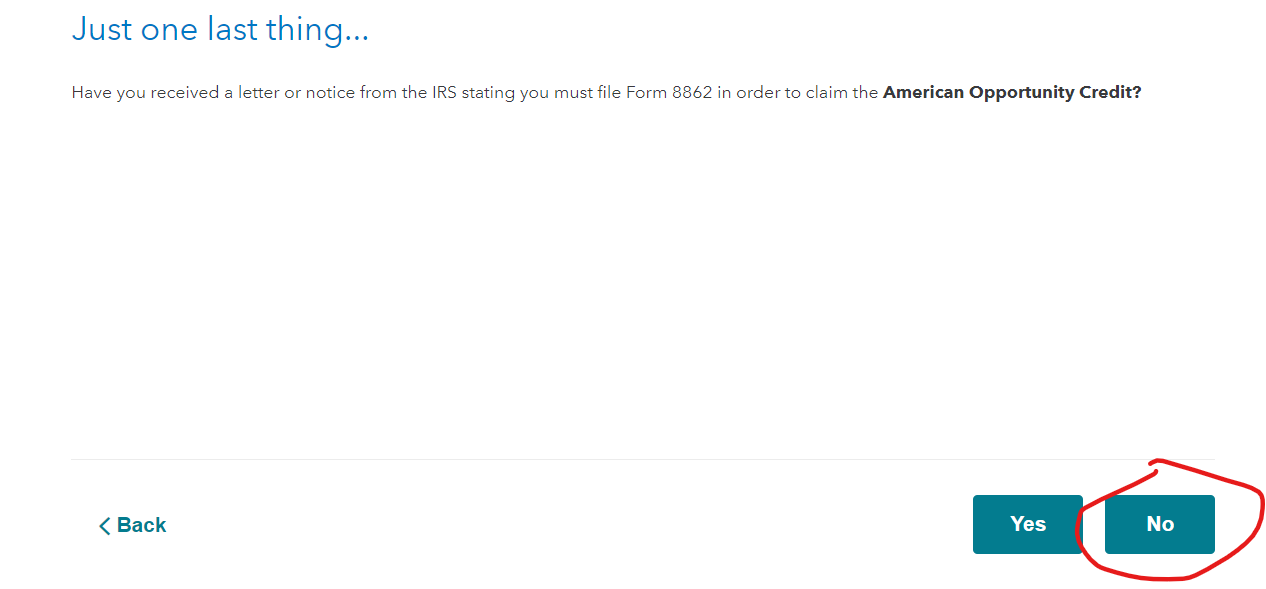

See if you checked box 8 to indicate your student is at least a half-time student. And answer the questions on the screens that follow.

To check to see if you received the AOTC, go to Tax Tools >> Tools to open the Tools Center, View Tax Summary >> Preview my 1040. Line 29 has American opportunity credit if you qualify. See screenshots below.

Is Box 5 amount greater than Box 1 amount? It could be another reason.

@G Li

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098-T Tuition is not recognized after input for my dependent child.

Thanks Fangxia!

I do see $1,000 of AOTC on line 29 on form 1040. In 1098-T, box has $15,000.+ and box has only $1,140, if I am looking at the right place for the amount in box 5 vs. box 1 and input correctly. More advice please.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098-T Tuition is not recognized after input for my dependent child.

If you have 1,000 on line 29 on your 1040, you received the full American Opportunity Tax Credit.

There is nothing more for you to do or apply for.

The amount of expenses the credit is based on is not the same as that amount of the credit. You got the full credit.

The American Opportunity Tax Credit would be the same for a taxpayer with 4,000 expenses as it is for a taxpayer with 15,000 of expenses.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098-T Tuition is not recognized after input for my dependent child.

Appreciate your response Chris.

Based on the answer from your reply, the total education expenses is only helped out to determine the qualification for AOTC, not used for an actual calculation figure of itemize deduction. Was there a tax law change from tax year 2019 or it has been this way for decades?

If I remembered it right, it was used for actual deduction calculation until I didn't get any credit from any education expenses when filed my 2019 tax return. I had been able to use it to get deduction (like the due or refund reflected by the dollars amount education expenses input) with my older child for a couple years of tax returns prior 2019 tax year. Would anyone be able to verify please?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098-T Tuition is not recognized after input for my dependent child.

Form 8863 hasn't changed in years except for the income limits. To qualify for the maximum deduction, only $4,000 must be paid out of pocket, per student. The AOTC can only be claimed 4 years per student.

The AOTC is then divided up into two different refund areas. Lines 25 and 29 will combine to reach the full refund of $2,500 per student. Line 25 is the nonrefundable portion, up to $1,500 used to reduce tax liability. Line 29 is the refundable portion, up to $1,000.

Once the AOTC has been used for 4 years, you can switch to the Lifetime Learning Credit. It is a nonrefundable credit up to $2,000. Information about both credits are listed. See:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

anonymouse1

Level 5

bgoodreau01

Returning Member

tenacjed

Returning Member

in Education

XS39lh0

Level 1

ATLTiger

New Member