- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Would you like to limit the special depreciation allowance for all activities by suspended passive and at-risk loss carryovers?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Would you like to limit the special depreciation allowance for all activities by suspended passive and at-risk loss carryovers?

Title says it.

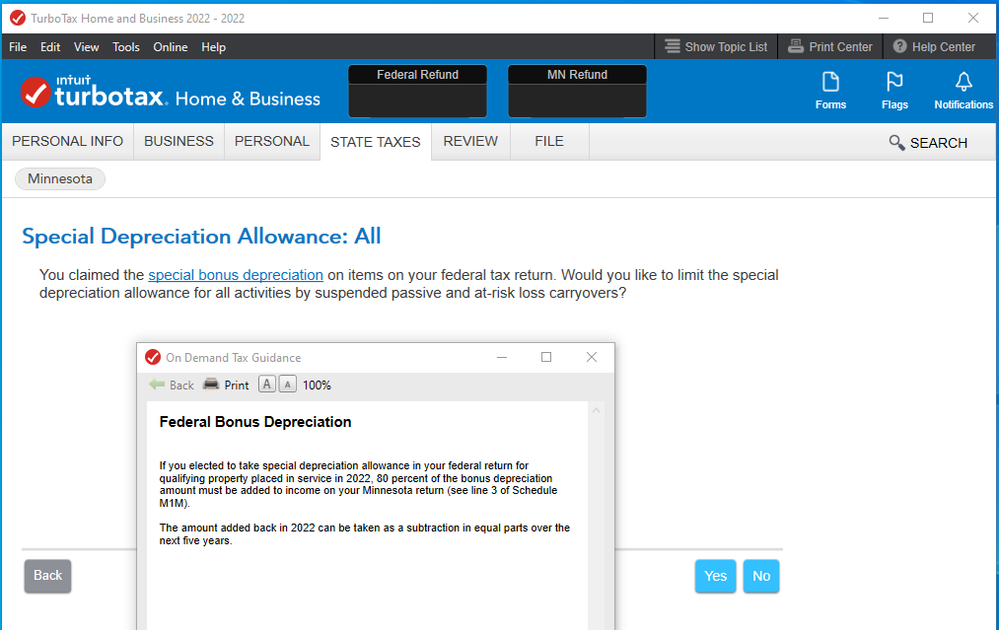

You claimed the special bonus depreciation on items on your federal tax return. Would you like to limit the special depreciation allowance for all activities by suspended passive and at-risk loss carryovers?

What is this asking? I popped the help item but it is not useful. Yes I took the special depreciation. Yes I understand that 80% of this is added as income. But what does the question mean? What is passive, at-risk etc? What are the ramifications of a yes/no answer?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Would you like to limit the special depreciation allowance for all activities by suspended passive and at-risk loss carryovers?

When you have a passive activity the losses that you can deduct from year to year can be limited by other income that you make. If you are not allowed to take a loss in the year that you generate it it is then 'carried over' or moved forward into the following year. Often these losses follow the activity until the day that it is sold so that you can only finally get the benefit of them when the activity has ended.

What that question is asking is "Do you want the accelerated depreciation to limit itself to what you can use this year OR would you like it to generate losses that you can't use that will have to be shown on all of your subsequent tax returns as long as you participate in this activity until you can use them?"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Would you like to limit the special depreciation allowance for all activities by suspended passive and at-risk loss carryovers?

When you have a passive activity the losses that you can deduct from year to year can be limited by other income that you make. If you are not allowed to take a loss in the year that you generate it it is then 'carried over' or moved forward into the following year. Often these losses follow the activity until the day that it is sold so that you can only finally get the benefit of them when the activity has ended.

What that question is asking is "Do you want the accelerated depreciation to limit itself to what you can use this year OR would you like it to generate losses that you can't use that will have to be shown on all of your subsequent tax returns as long as you participate in this activity until you can use them?"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kevin167

New Member

florence3

Level 2

lilly54

Level 4

go_dores

Level 2

VolvicNaturelle

Level 3