- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Worked in NY 16 days for my company and IT-203-B form

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Worked in NY 16 days for my company and IT-203-B form

Hi all,

I work full time for a large corporation. This year I travelled and worked in NY for 16 days. My company already took out the amount they said I owed in taxes to NY ($245). The question is I'm not sure how I fill out IT-203-B as I only have the info that I worked there 16 days. Do I just put total days employed at my company at 365 and then just say my days work in NY were 16 or do I have to fill out holidays, vacations,etc?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Worked in NY 16 days for my company and IT-203-B form

TurboTax allows you to allocate New York wages by percentage or days (IT-203-B). The percentage method is easier. However, New York has been pre-auditing taxpayers where your return is put on hold until you fill out a worksheet showing the number of days you worked in NY (it's basically the same as IT-203-B so you can head off a pre-audit by filling out IT-203-B).

To allocate New York wages:

- Go to the New York section in TurboTax Online.

- Continue until you come to New York Income Allocation.

- Say NO to Were all of your wages and/or self-employment income earned in New York State?

- On Your Form W-2 Summary, tap Edit next to your employer

- On Allocate Wages to New York, select Allocate by Number of Days

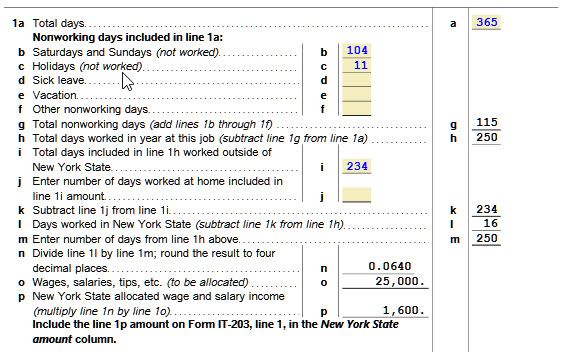

To Allocate by Number of Days,

- Start with 365 days

- Fill in your total Saturdays and Sundays (not worked), along with Holidays (not worked), Sick leave, Vacation and Other nonworking days for the entire year (both inside and outside NY)

- In Outside of New York, enter your total work days minus 16

- Don’t fill anything in Worked Outside of New York at Home. This is for someone who is telecommuting to a New York office.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Worked in NY 16 days for my company and IT-203-B form

TurboTax allows you to allocate New York wages by percentage or days (IT-203-B). The percentage method is easier. However, New York has been pre-auditing taxpayers where your return is put on hold until you fill out a worksheet showing the number of days you worked in NY (it's basically the same as IT-203-B so you can head off a pre-audit by filling out IT-203-B).

To allocate New York wages:

- Go to the New York section in TurboTax Online.

- Continue until you come to New York Income Allocation.

- Say NO to Were all of your wages and/or self-employment income earned in New York State?

- On Your Form W-2 Summary, tap Edit next to your employer

- On Allocate Wages to New York, select Allocate by Number of Days

To Allocate by Number of Days,

- Start with 365 days

- Fill in your total Saturdays and Sundays (not worked), along with Holidays (not worked), Sick leave, Vacation and Other nonworking days for the entire year (both inside and outside NY)

- In Outside of New York, enter your total work days minus 16

- Don’t fill anything in Worked Outside of New York at Home. This is for someone who is telecommuting to a New York office.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Worked in NY 16 days for my company and IT-203-B form

Thanks for the info. So, the $245 they took out of my check for NY taxes was just a guestimate? I really don't know how that number came up except they said I worked 16 days there.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Worked in NY 16 days for my company and IT-203-B form

Your employer does have a method they use to determine the amount they need to withhold for New York (NY) while you were working there. You just need to use that number in your W2 for state tax withheld in NY. This is actually what they paid to the state of NY on your behalf. It would be like your federal withholding, in that, it is an estimated tax amount that may be required based on the earnings for the period.

You may or may not owe additional tax, likewise you may receive a refund for overpayment. Once you allocate the days as indicated in the previous answer, you will see the actual tax liability and refund or balance due for NY.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Worked in NY 16 days for my company and IT-203-B form

Thanks. Seems like alot to pay NY for 16 days. Guess it makes me glad I don't live in a state with high state income tax.

Seems like it would be easier to let the company put in the W-2 what you actually made while your stay in NY instead of your whole yearly amount and you have to figure out the rest.

Anyway, I appreciate the help.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ashley-evans2460

New Member

ssanchirico

Returning Member

smorton64

New Member

FLPatsfan

New Member

OldHarley41

Returning Member