- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

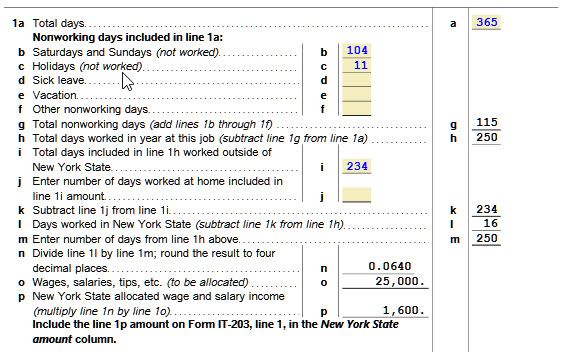

TurboTax allows you to allocate New York wages by percentage or days (IT-203-B). The percentage method is easier. However, New York has been pre-auditing taxpayers where your return is put on hold until you fill out a worksheet showing the number of days you worked in NY (it's basically the same as IT-203-B so you can head off a pre-audit by filling out IT-203-B).

To allocate New York wages:

- Go to the New York section in TurboTax Online.

- Continue until you come to New York Income Allocation.

- Say NO to Were all of your wages and/or self-employment income earned in New York State?

- On Your Form W-2 Summary, tap Edit next to your employer

- On Allocate Wages to New York, select Allocate by Number of Days

To Allocate by Number of Days,

- Start with 365 days

- Fill in your total Saturdays and Sundays (not worked), along with Holidays (not worked), Sick leave, Vacation and Other nonworking days for the entire year (both inside and outside NY)

- In Outside of New York, enter your total work days minus 16

- Don’t fill anything in Worked Outside of New York at Home. This is for someone who is telecommuting to a New York office.

January 22, 2023

7:40 AM