- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Why isnt it-2105 nys estimate form filled out in ttax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why isnt it-2105 nys estimate form filled out in ttax?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why isnt it-2105 nys estimate form filled out in ttax?

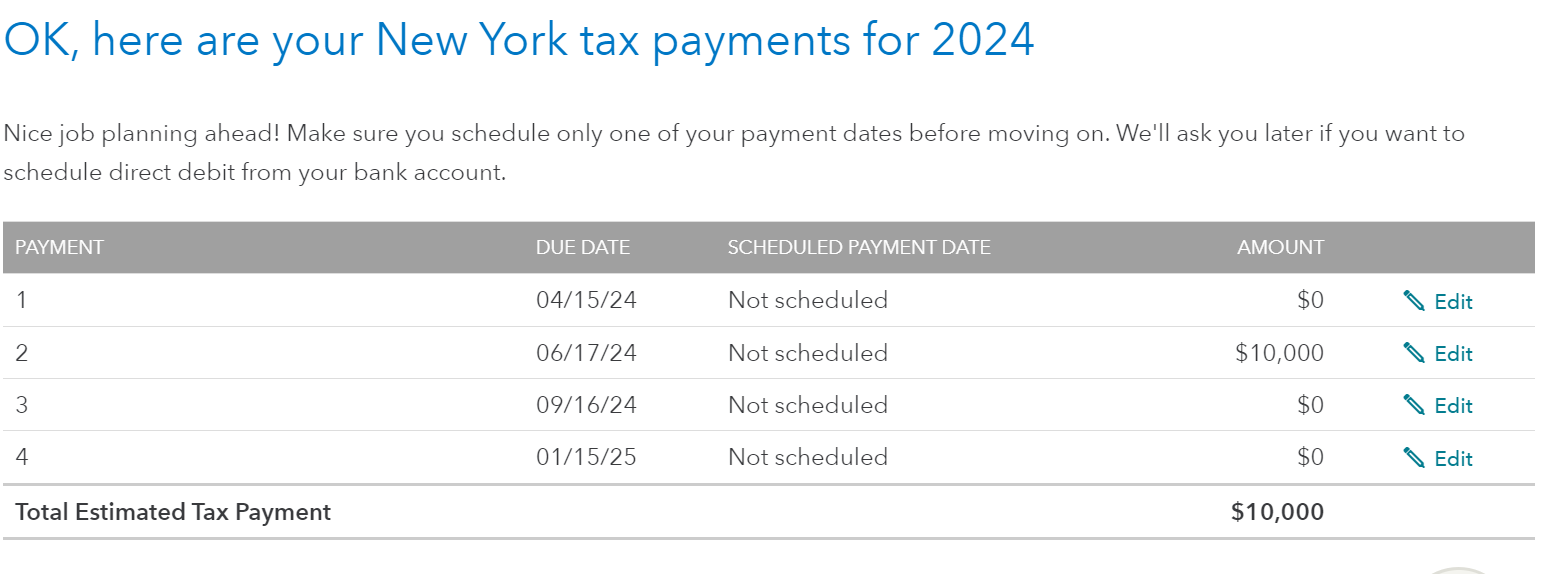

I was not able to recreate an issue with Form IT-2105. I was successful in creating one singular IT-2105 based on input on the screen, OK, here are your New York tax payments for 2024. On this screen, you must individually edit all of the quarters with just information in the quarter you want. I have attached a screenshot below.

Furthermore, on the actual Form IT-2105 (as shown below), there is no indication which form is for which quarter. You can use the estimate that was populated for the 4th quarter for the 2nd quarter. If the amounts don't seem to flow for you, you can manually write it on the form when you send it in.

Lastly, you can pay your estimate online. For more information, please go to Form IT-2105, Estimated Tax Payment Voucher for Individuals.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why isnt it-2105 nys estimate form filled out in ttax?

Although I specified 1 estimated payment of a specified amount to be made in June only the 4 th estimated form had my name etc on it and none of the forms had the amount that I specified. I used overrides to get what I wanted but obviously the program is not functioning correctly since it gives options but does not actually use them. I’ve been using ttax for decades but will probably try something else next year.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

cheycheyb12

New Member

darianmercado119

New Member

darianmercado119

New Member

pmc8969

New Member

darianmercado119

New Member