- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

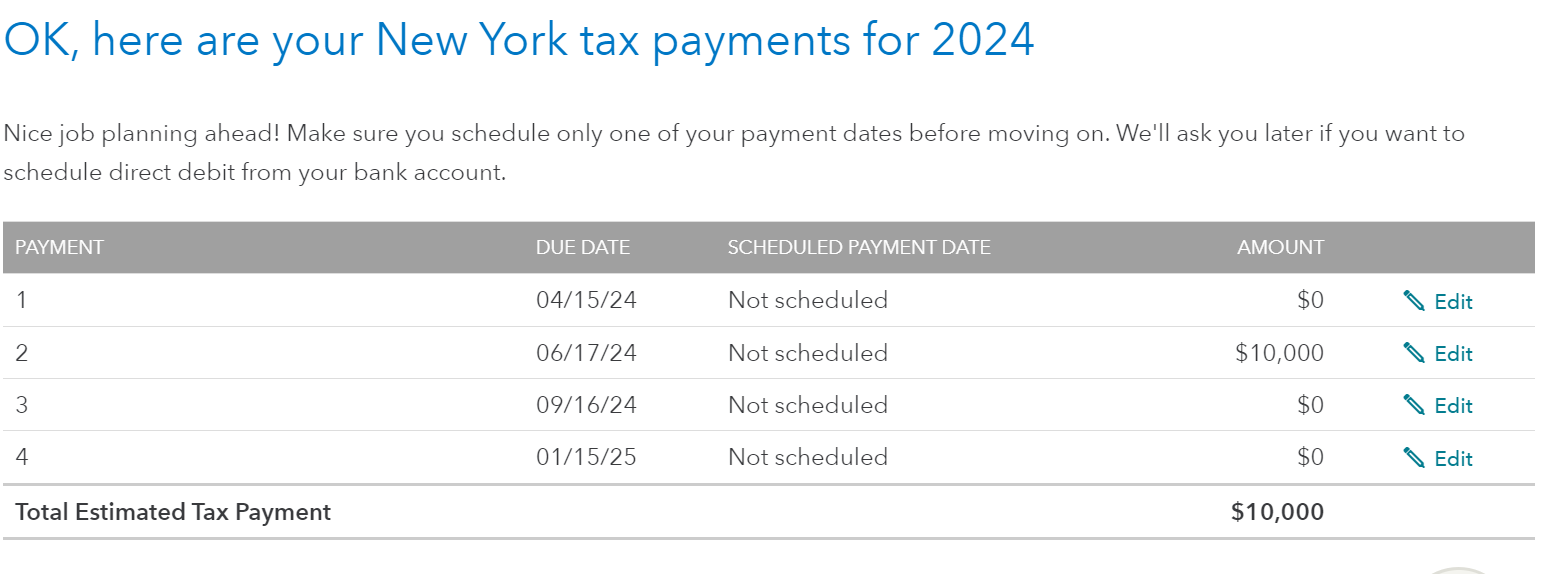

I was not able to recreate an issue with Form IT-2105. I was successful in creating one singular IT-2105 based on input on the screen, OK, here are your New York tax payments for 2024. On this screen, you must individually edit all of the quarters with just information in the quarter you want. I have attached a screenshot below.

Furthermore, on the actual Form IT-2105 (as shown below), there is no indication which form is for which quarter. You can use the estimate that was populated for the 4th quarter for the 2nd quarter. If the amounts don't seem to flow for you, you can manually write it on the form when you send it in.

Lastly, you can pay your estimate online. For more information, please go to Form IT-2105, Estimated Tax Payment Voucher for Individuals.

**Mark the post that answers your question by clicking on "Mark as Best Answer"