- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Why is line 26-total st tax w/d total indiana local income tax withheld doesnt match with indiana local withholding entered on federal return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is line 26-total st tax w/d total indiana local income tax withheld doesnt match with indiana local withholding entered on federal return?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is line 26-total st tax w/d total indiana local income tax withheld doesnt match with indiana local withholding entered on federal return?

You might want to contact Support for this issue. How do I contact TurboTax? (intuit.com)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is line 26-total st tax w/d total indiana local income tax withheld doesnt match with indiana local withholding entered on federal return?

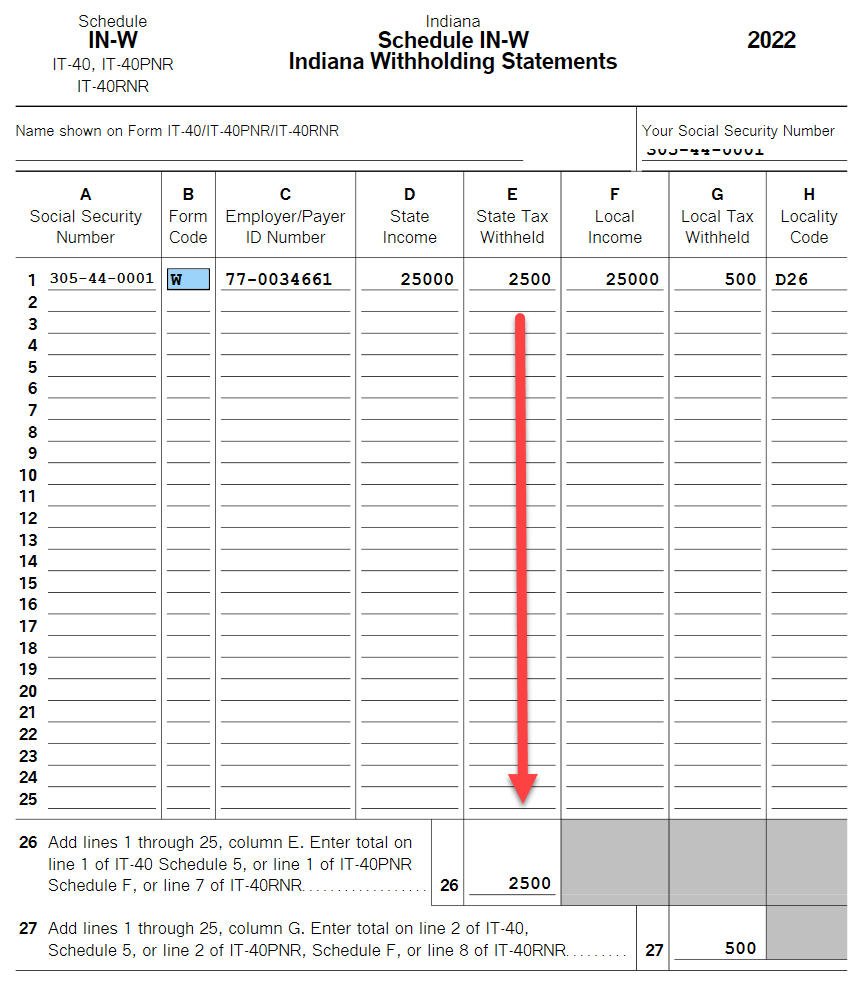

Line 26 is on what form? Is this an Indiana form or a Federal form?

Indiana taxpayers can have multiple local tax authorities or counties on one W-2. Are there more than one counties or tax authorities involved? Please clarify.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is line 26-total st tax w/d total indiana local income tax withheld doesnt match with indiana local withholding entered on federal return?

Line 25 only includes state tax withheld. Line 27 is for local tax. Additionally lines 26 and 27 will only pick up Indiana tax, so if you have Kentucky local tax, for example, it will not be added to Schedule IN-W.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is line 26-total st tax w/d total indiana local income tax withheld doesnt match with indiana local withholding entered on federal return?

So what line on the federal return is this suppose to match?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is line 26-total st tax w/d total indiana local income tax withheld doesnt match with indiana local withholding entered on federal return?

The state tax that was withheld is entered into the program while you are in the Federal Section of TurboTax.

The amount is entered by entering forms, such as your W-2.

If you had state tax withheld which is not on a tax form, that could also be entered, but this would be very uncommon.

There is no line on your Federal Tax Return 1040 which will mirror that number, however IF YOU ITEMIZE deductions, rather than taking the STANDARD DEDCUTION, State Taxes Paid will be listed on Schedule A.

If you take the Standard Deduction, State Taxes paid won't be listed on the Federal 1040, but will flow to the state portion of the program

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is line 26-total st tax w/d total indiana local income tax withheld doesnt match with indiana local withholding entered on federal return?

Had the same problem. This is what I did to fix the error (I'm using TurboTax Premier on Windows 10): Federal Taxes --> Deductions & Credits --> Estimates and Other Taxes Paid --> Other Income Taxes --> Other Income Taxes Paid in 2023 --> Withholding Not Already Entered on a W-2 or 1099 --> State Withholdings --> enter the amount withheld so that it matches up with the Line 26 error you received.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

daupet1

New Member

kac42

Level 2

rsherry8

Level 3

dpa500

Level 2

granitegator

New Member