- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Where do I claim credit for the composite tax paid on my behalf on a partnership if I have to file individual return as CA nonresident due to other income sources?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I claim credit for the composite tax paid on my behalf on a partnership if I have to file individual return as CA nonresident due to other income sources?

According to the FTB Publication 1067 Guidelines for Filing a Group Form 540NR, I would have to file an individual tax return because there are other income sources separate from the group nonresident return

Since I have to file the individual tax return that includes all source income including the partnership income, where do I claim credit for the composite tax paid so that I am not taxed twice (once on the group return, and again on the individual tax return)?

Exception: The individual may discover after the group return was filed that he or she did not qualify to be included in the group nonresident return. For example, the individual had income from other California sources that were not reported on any other group nonresident return. The individual must file a return on a

separate basis reporting all his or her California source income. Having other sources of California losses will not disqualify the individual from being included in a group nonresident return.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I claim credit for the composite tax paid on my behalf on a partnership if I have to file individual return as CA nonresident due to other income sources?

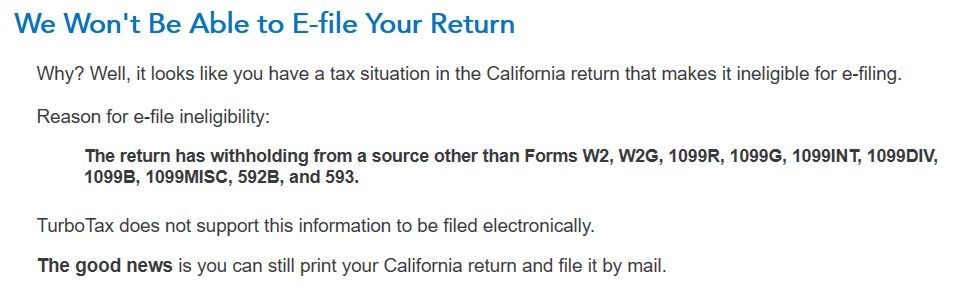

I think I may have figured out where to enter the composite taxes paid on my behalf, but maybe an expert can confirm. However if I do so, I won't be able to e-file the California state return.

I entered the composite taxes paid on my behalf under

Federal Taxes > Deductions & Credits > Estimates and Other Taxes Paid > Withholding not already entered on a W-2 or 1099 > State Withholding

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

slpmom

Level 1

jeangould638

New Member

k4man10

New Member

cmakuch1

New Member

john14verse6

Level 1