- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Virginia Part Year Resident (760PY) TurboTax Error

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Virginia Part Year Resident (760PY) TurboTax Error

I was a part year resident in Virginia, moved away end of January 2022. TurboTax says I should receive a full refund of all my Virginia income tax that was withheld from January. I looked at the forms version to check the math as it didn't seem correct. On form 760PY, Line 17 (Tax amount from Tax Rate Schedule) is calculated at 0 (as in $0 should be due to VA). When I look at the Tax Table, it shows tax would be due on the amount that I earned for the one month there in Virginia. Can anyone familiar with Virginia 760PY help me out here and let me know if I'm looking at this wrong? It seems like a programming error...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Virginia Part Year Resident (760PY) TurboTax Error

You might be looking up the income you earned instead of the taxable income. A part year resident received a standard deduction and exemptions. Line 16 shows your taxable income.

Reference: 760PY Instructions

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Virginia Part Year Resident (760PY) TurboTax Error

Hello @AmyC!, thank you for your response!

I used line 16 to enter the tax table. Married filing jointly, $17,451 on tax table shows amount due is $745. Withheld was $964. I understand the difference in refund would be $219, but TurboTax says the full $964 is refundable. I don't see what I am missing...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Virginia Part Year Resident (760PY) TurboTax Error

I would like to take a deeper look at this. However, I need a diagnostic file which is a copy of your tax return that has all of your personal information removed. You can send one to us by following the directions below:

TurboTax Online:

Sign into your online account.

Locate the Tax Tools on the left-hand side of the screen.

A drop-down will appear. Select Tools

On the pop-up screen, click on “Share my file with agent.”

This will generate a message that a diagnostic file gets sanitized and transmitted to us.

Please provide the Token Number that was generated in the response.

TurboTax Desktop/Download Versions:

Open your return.

Click the Online tab in the black bar across the top of TurboTax and select “Send Tax File to Agent”

This will generate a message that a diagnostic copy will be created. Click on OK and the tax file will be sanitized and transmitted to us.

Please provide the Token Number that was generated in the response.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Virginia Part Year Resident (760PY) TurboTax Error

I"m receiving an error that is stopping me from filing, which says

fed form 1098 point not reported. However, 1098 is entered.

I lived 8 months in VA and moved and reported 3 months in TX

Please advise if you can assist. thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Virginia Part Year Resident (760PY) TurboTax Error

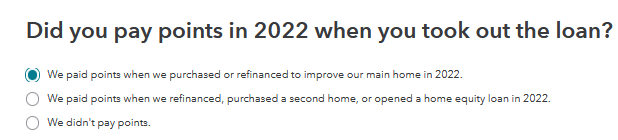

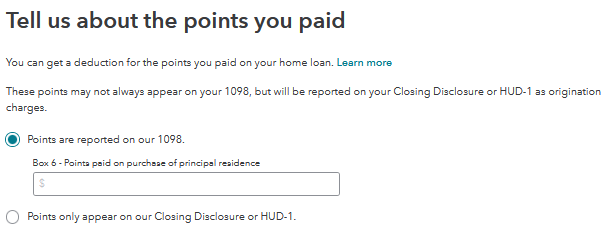

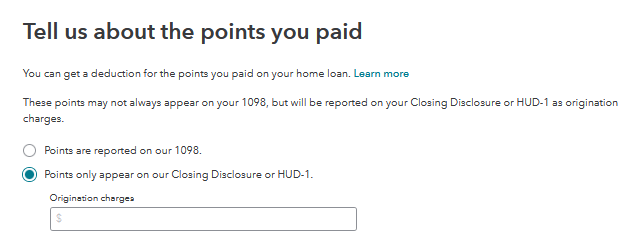

This sounds as if it has to do with reporting points or prepaid interest for your Form 1098, but the amount is entered a few screens after the main form. Please return to the Form 1098 in Deductions and Credits, and Home. You will see this screen in the interview. Please be sure you complete this part and then Continue until you are back on the main Deductions and Credits screen.

Then either the points are reported from Box 6 of your Form 1098.

Or from your Closing paperwork.

If this does not completely solve the problem, please let us know if this message is during Review for the federal or the state return, or when you try to e-file, so we may better assist you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dc20222023

Level 3

VAer

Level 4

ajm2281

Level 1

rodiy2k21

Returning Member

marcmwall

New Member