- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Use Tax (California form 540)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

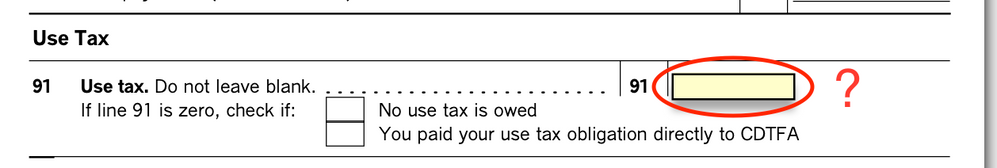

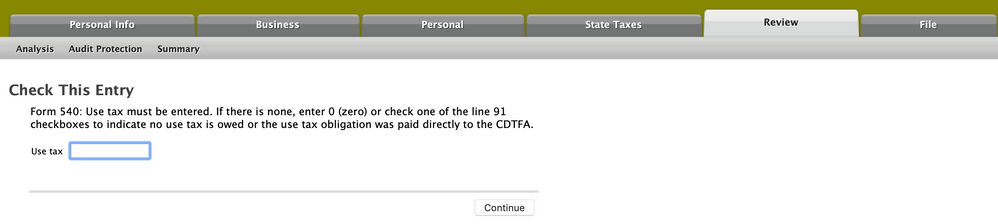

Use Tax (California form 540)

Turbo Tax requested I fix a few errors - one of these errors has something to do with Use Tax. I think I place a zero in this box - but I'm not sure. See the attached screen captures.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Use Tax (California form 540)

Enter 0 if there is no Use tax.

The use tax has been in effect in California since July 1, 1935. It applies to purchases of merchandise for use in California from out-of-state sellers and is similar to the sales tax paid on purchases you make in California. If you have not already paid all use tax due to the California Department of Tax and Fee Administration, you may be able to report and pay the use tax due on your state income tax return CA Franchise Tax Board.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Use Tax (California form 540)

If Use tax is 0, check the box No use tax is owed to clear the error.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Use Tax (California form 540)

Do I put zero in the box? Or, do I put something else in the box?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Use Tax (California form 540)

Enter 0 if there is no Use tax.

The use tax has been in effect in California since July 1, 1935. It applies to purchases of merchandise for use in California from out-of-state sellers and is similar to the sales tax paid on purchases you make in California. If you have not already paid all use tax due to the California Department of Tax and Fee Administration, you may be able to report and pay the use tax due on your state income tax return CA Franchise Tax Board.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Use Tax (California form 540)

How do I get form 540 mailed to me if I had lost it ?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ggnodak

New Member

michelle-pinedo

New Member

weafrique

Level 2

SB2013

Level 2

lixiang

Level 2