- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- TurboTax State didn't catch underpayment of estimated taxes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax State didn't catch underpayment of estimated taxes

I just received a notice that the State of Massachusetts is charging me a penalty and interest for not paying enough in estimated taxes during the year. Why didn't TurboTax catch this when I filed my return? It did such a calculation for the federal taxes; I would have expected it to be part of the state calculation as well.

Thanks,

Hal

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax State didn't catch underpayment of estimated taxes

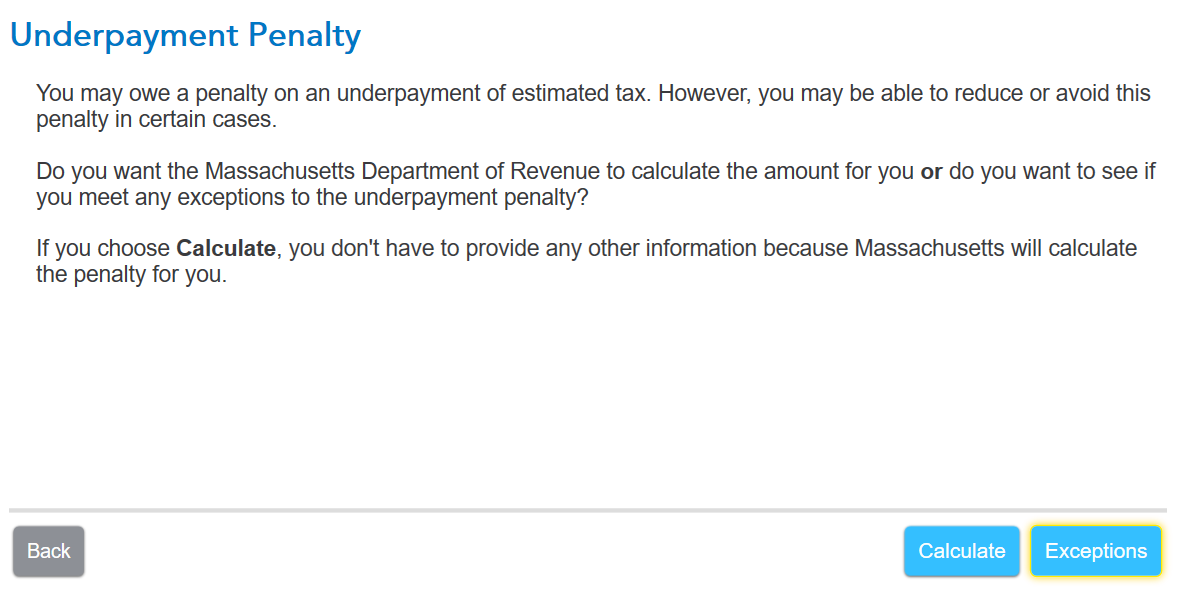

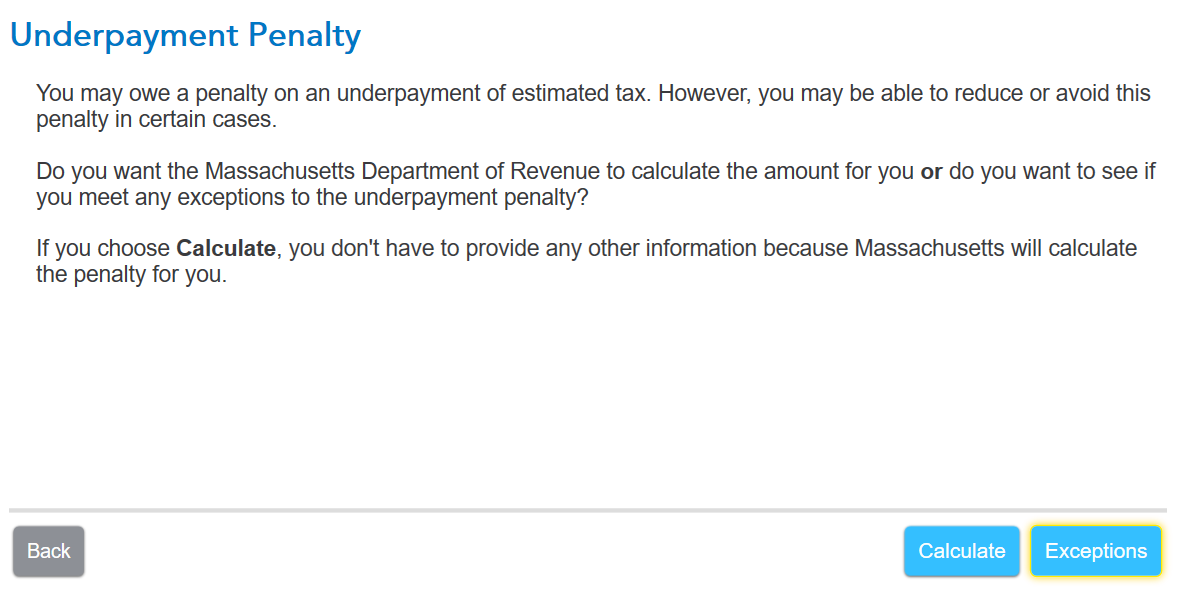

Estimating your underpayment penalty is a part of the Massachusetts calculation. On the screen, Underpayment Penalty, you would have had to choose between Calculate (to leave the penalty off your return and let Massachusetts calculate the amount of the penalty for you) or Exceptions (to determine if you meet any exceptions to the underpayment penalty). Your choice on that screen would determine whether an estimated penalty would appear on your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax State didn't catch underpayment of estimated taxes

Estimating your underpayment penalty is a part of the Massachusetts calculation. On the screen, Underpayment Penalty, you would have had to choose between Calculate (to leave the penalty off your return and let Massachusetts calculate the amount of the penalty for you) or Exceptions (to determine if you meet any exceptions to the underpayment penalty). Your choice on that screen would determine whether an estimated penalty would appear on your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax State didn't catch underpayment of estimated taxes

Hi Lena,

Thanks for your reply and explanation. Seeing the TurboTax screen jogged my memory and you are right that I was presented with this question. I also remember finding it confusing. I was pretty sure I didn't qualify for any exceptions to the underpayment penalty, so I didn't see the point of providing more information. Unfortunately, what that meant was that I interpreted the statement "Massachusetts will calculate the penalty for you" as TurboTax will use the Massachusetts rules to calculate the penalty. I certainly did not understand it to mean that the calculation would occur after submission of the tax return and I would then get a bill!

While we strive to make accurate estimated tax payments (the penalty plus interest was under $70), it is a challenge when the final payment is due January 15th and we don't get our 1099s until weeks later.

Thanks again,

Hal

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

elgato81

Level 2

sakilee0209

Level 2

mschipani87

New Member

paul22mcintosh

New Member

douglasjia

Level 3