- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

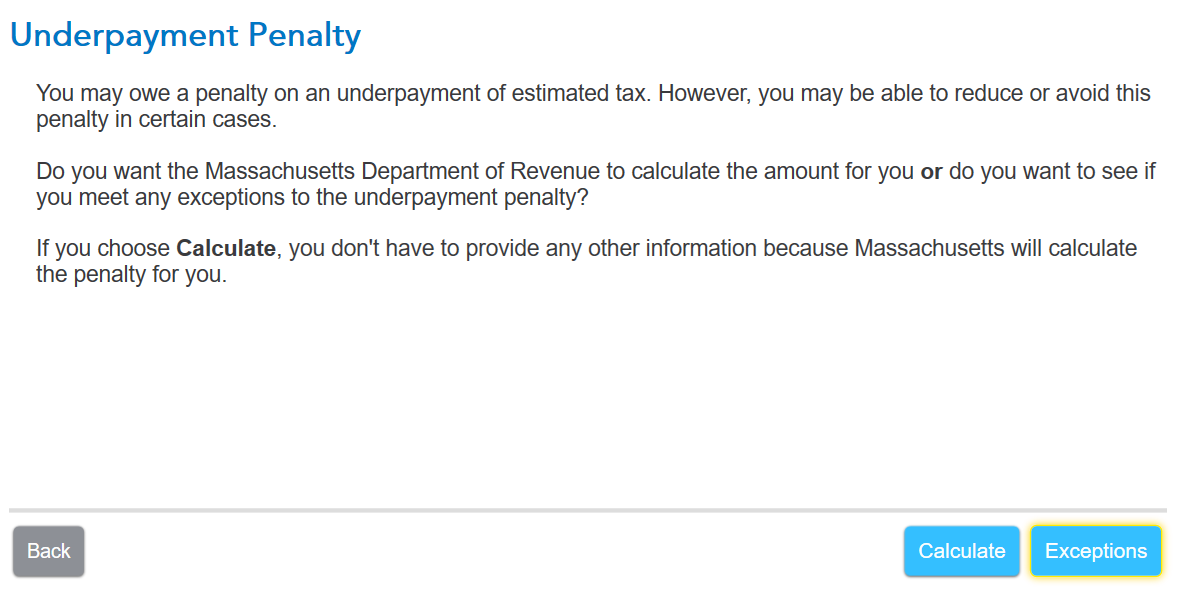

Estimating your underpayment penalty is a part of the Massachusetts calculation. On the screen, Underpayment Penalty, you would have had to choose between Calculate (to leave the penalty off your return and let Massachusetts calculate the amount of the penalty for you) or Exceptions (to determine if you meet any exceptions to the underpayment penalty). Your choice on that screen would determine whether an estimated penalty would appear on your return.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

June 20, 2025

5:06 PM