- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- TurboTax is "doubling" my income while filing for PA taxes? I work in DE and live in PA. For some reason it's counting it twice and saying I owe double. Is this a glitch?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is "doubling" my income while filing for PA taxes? I work in DE and live in PA. For some reason it's counting it twice and saying I owe double. Is this a glitch?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is "doubling" my income while filing for PA taxes? I work in DE and live in PA. For some reason it's counting it twice and saying I owe double. Is this a glitch?

No, the only states that have reciprocity with Pennsylvania are Indiana, Maryland, New Jersey, Ohio, Virginia, or West Virginia. (Which states have reciprocal agreements?)

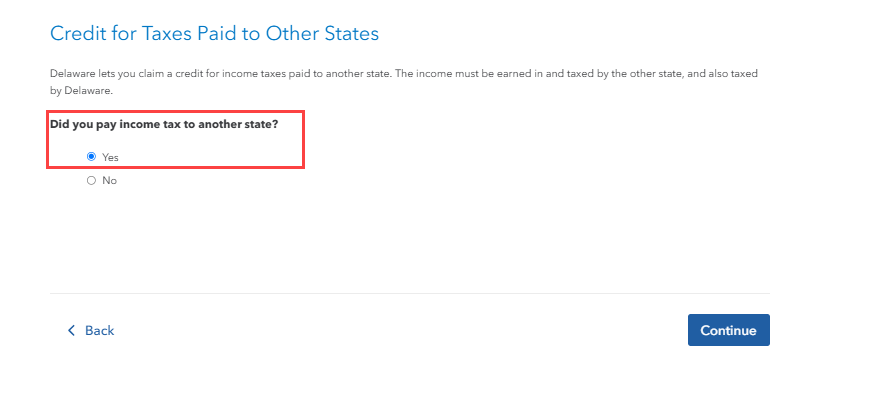

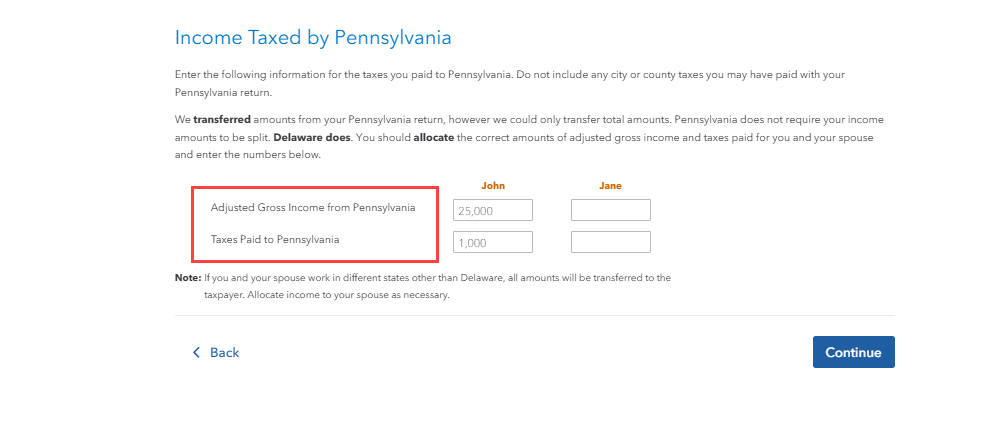

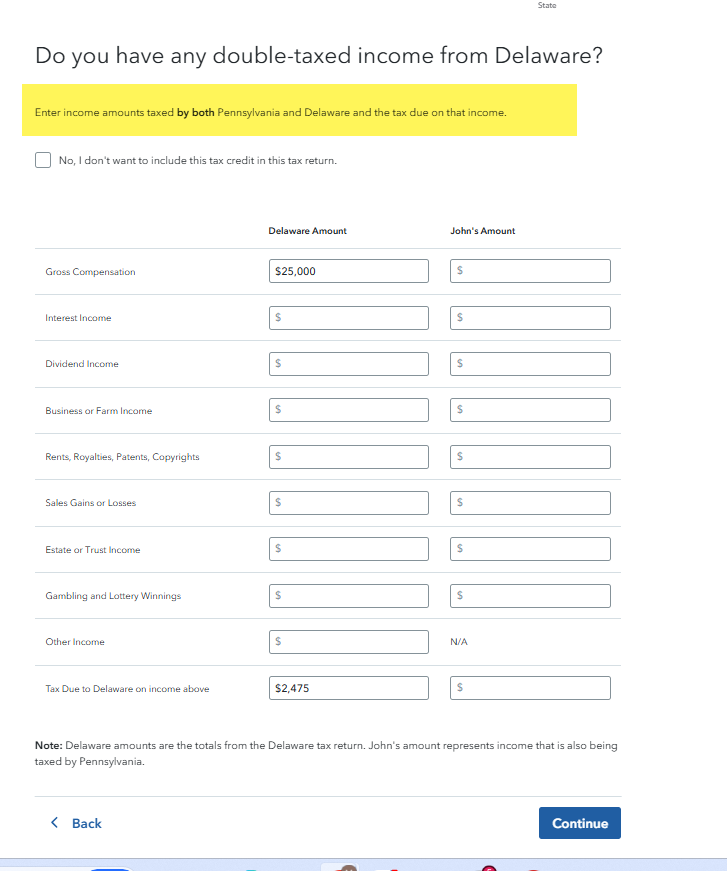

It is expected that it will "appear" your income is double, since you report $25,000 to each state. However, the credit for taxes paid to other states, will reduce your tax expense for Delaware. In order to report this, make sure after you check the box to take the credit for taxes paid to other states, you also report the income and Pennsylvania tax paid on the next screen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is "doubling" my income while filing for PA taxes? I work in DE and live in PA. For some reason it's counting it twice and saying I owe double. Is this a glitch?

Unless tax law has changed in the past 7 years that has never been the case.

I live in Pennsylvania but work in delaware. Delaware taxes me. And then when I fill out my taxes every other year on your competitors tax program I file for credits paid to another state.

I've never paid Pennsylvania in the Seven Years of Living here. On the competitors program once I click the box for credit for taxes paid to another state it neutralizes the tax I owed to PA.

I followed all of the steps that you were very kind enough to give me and it's still the same situation it's saying that I owe both income tax and this is incorrect.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is "doubling" my income while filing for PA taxes? I work in DE and live in PA. For some reason it's counting it twice and saying I owe double. Is this a glitch?

I apologize @timothyhoutman11 - I misread your question and answered as if you lived in Delaware, and worked in PA, but your situation is the opposite. Thus, the credit for taxes paid to other states, will reduce your tax expense for Pennsylvania. In order to report this, go to Pennsylvania- Taxes and Credits - Taxes paid to other states.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is "doubling" my income while filing for PA taxes? I work in DE and live in PA. For some reason it's counting it twice and saying I owe double. Is this a glitch?

No apology necessary!

But it seems like no matter what I do it keeps saying I owe money to pennsylvania. Even when I click the box for a credit for taxes paid to another state I don't get that special worksheet that is supposed to come up

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is "doubling" my income while filing for PA taxes? I work in DE and live in PA. For some reason it's counting it twice and saying I owe double. Is this a glitch?

I suggest that you delete both states at this point and start those returns over. Be sure to prepare your non-resident state first (DE) then prepare PA, where you should get the correct credit for taxes paid to another state.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

meenakshimishra

Level 2

meenakshimishra

Level 2

rodiy2k21

Returning Member

anonymouse1

Level 5

in Education

Lydia5181

New Member