- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Turbotax desktop software bug - PA non-resident work % calculation not working

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax desktop software bug - PA non-resident work % calculation not working

I live in another state and worked in PA in 2023 for about 5 weeks,.. but my PA employer withheld taxes for my resident state. There is a method for calculating the percentage of work days in PA vs total days in Turbo Tax, however it does NOT work. There is a software bug and the software is not calculating correctly; nor am I able to manually enter the correct information direct in the form method. That also is NOT working correctly.

See below for some images of what I'm experiencing.

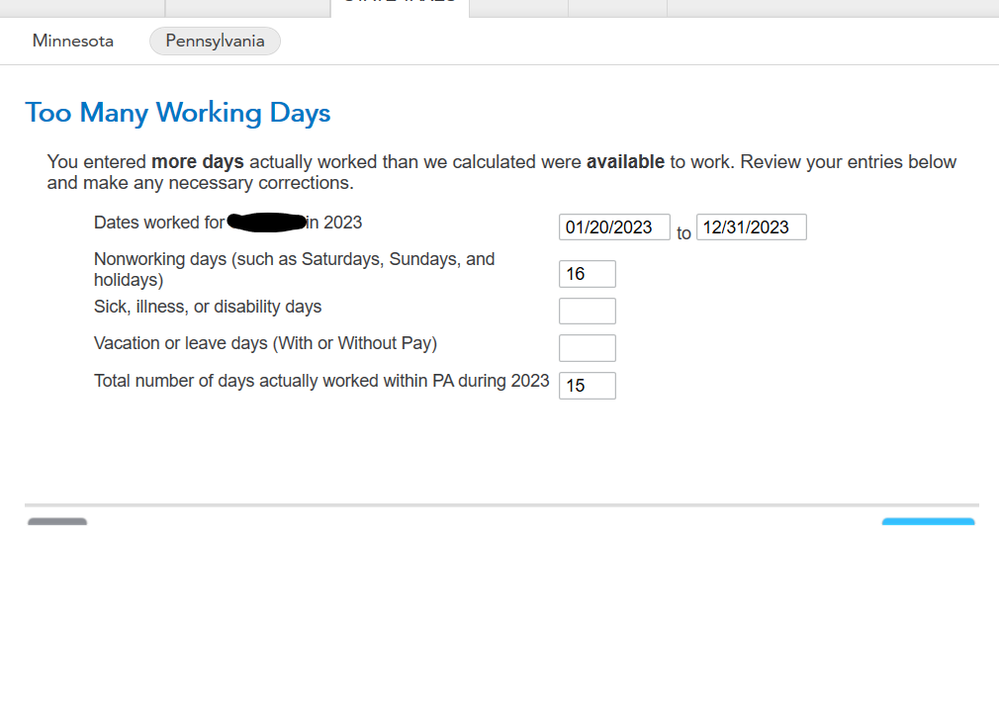

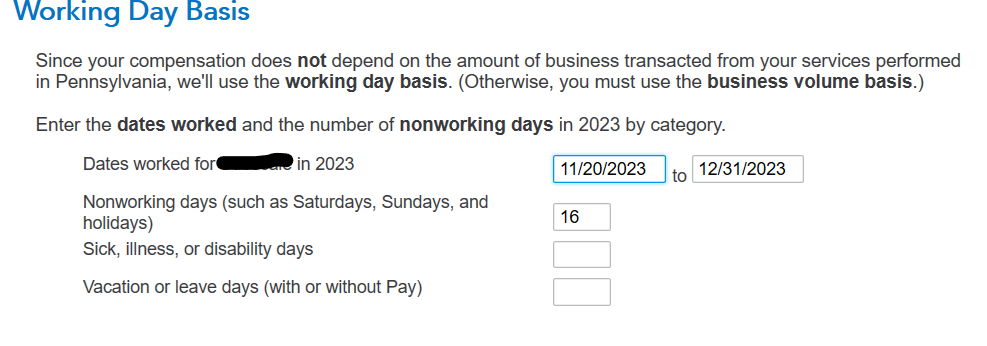

Below is screen shot of dates worked for company in 2023 in PA and the non-working days = 16.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax desktop software bug - PA non-resident work % calculation not working

I am going to assume you don't actually need to file a PA return. PA has a reciprocal agreement with several states where you don't file a PA return if you live in one of these states Indiana, Maryland, New Jersey, Ohio, Virginia, or West Virginia.

See Which states have reciprocal agreements? - TurboTax Support

Your employer would / should have included PA pay and tax otherwise.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax desktop software bug - PA non-resident work % calculation not working

thanks for your response. I live in Minnesota, which unfortunately does not have a reciprocity agreement with PA.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax desktop software bug - PA non-resident work % calculation not working

Hi there, were you able to get this to work/resolved? It is also not working for me. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax desktop software bug - PA non-resident work % calculation not working

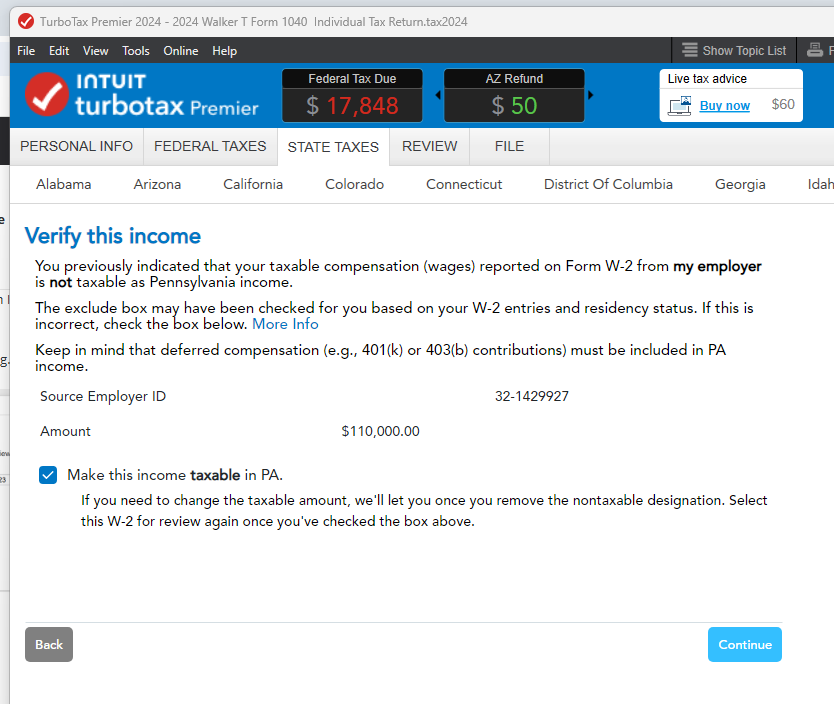

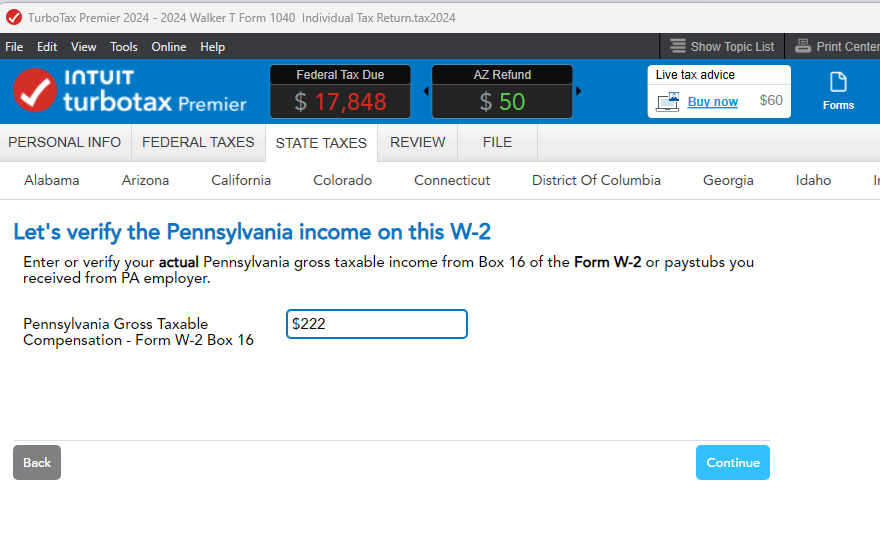

If the working days calculation is not working properly, you could choose YES on the 'Apportionment' page and you'll come to a screen where you can enter your actual Pennsylvania income. You can enter the amount of PA income you calculated as 'business income' on the screen prior.

First, indicate your W-2 income carried over from Federal is 'taxable in PA'. Then

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sjgarri

New Member

user17702309712

New Member

farrahdidio

New Member

VVessigault96

Returning Member

rmbiggs02341

New Member