- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Turbo tax version of the Massachusetts has an error

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax version of the Massachusetts has an error

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax version of the Massachusetts has an error

I believe TurboTax has an error in the Massachusetts Form 1. The error is regarding nontaxable Military pensions. The Mass tax code indicates the following. “US Military pensions, which are included in Federal Gross income, are excluded from Massachusetts gross income”. Upon examining the TurboTax Form 1, it shows the pension dollars in the Pensions and Annuities Smart Worksheet. By choosing the “Type” box and clicking G, it should make it Tax exempt. Going down to Line 4 the pension amount is still included as Taxable by including it in gross income. Referring to line 37 the tax due includes the taxable portion for the Exempt pension. Therefore, the Military pension is not excluded from Massachusetts gross income IAW the Massachusetts tax code.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax version of the Massachusetts has an error

No. I researched this by creating it in a return and did get it to subtract. The key is to tell the Massachusetts state return that the pension is exempt after also taking steps in the federal return.

See the screenshots that you will find during the federal interview following the 1099-R input, assuming a distribution code of 7, normal distribution.

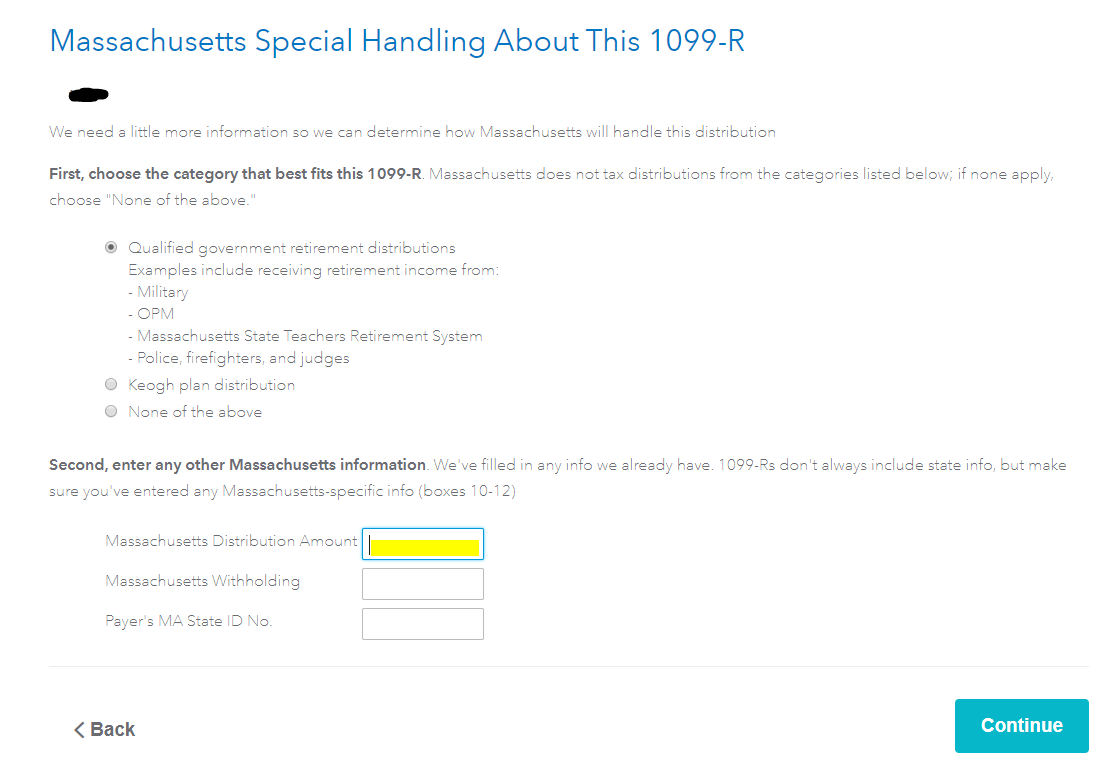

The first screen is for special handling of the 1099-R where the amount will be included and the pension will be identified as a qualified government retirement document. Leave the Massachusetts Distribution Amount blank and click Continue.

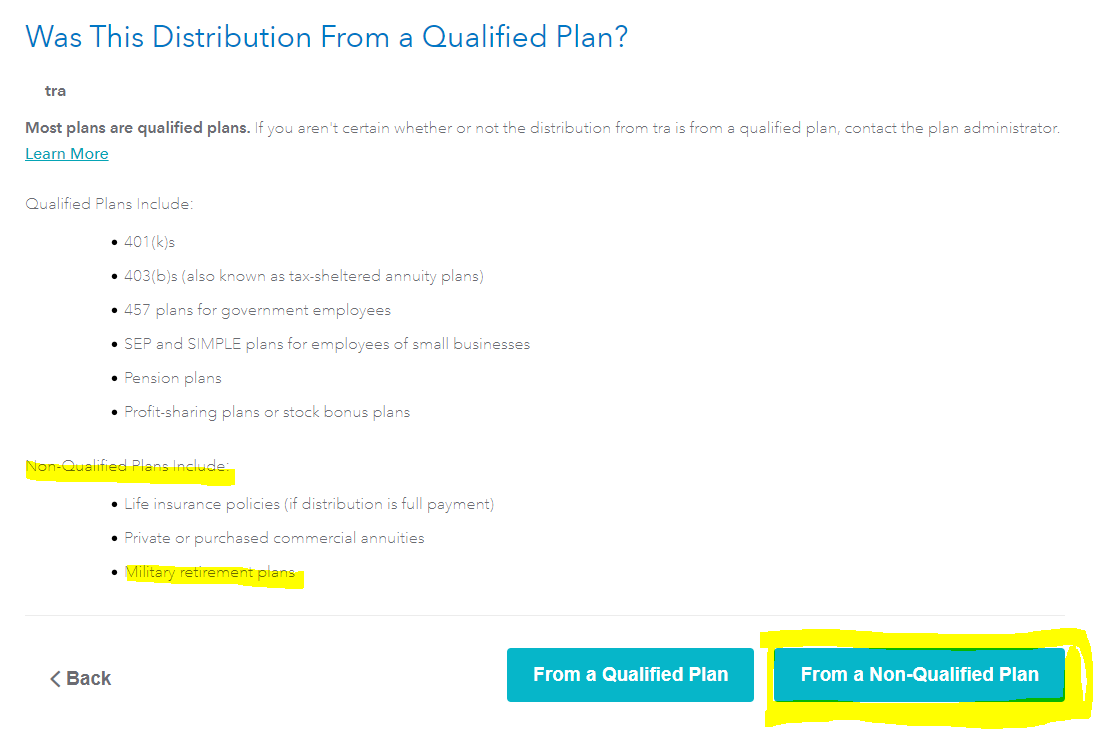

Second, the pension will be identified as Non-qualified.

The entries above should properly identify the military pension.

If there is still an error, then the third entry is done in the Massachusetts interview. You will identify the exempt portion.

However, if this entry is made, it will be an override. The Massachusetts return will have to be paper-filed.

See 2019 Massachusetts Form 1 Instructions beginning on page 9, middle column under What pensions are exempt? which confirms your findings, yes US Military Pensions are exempt:

Pension income received from a contributory annuity, pension, endowment or retirement fund of the U.S. Government or the Commonwealth of Massachusetts and its political subdivisions.

Noncontributory pension income or survivorship benefits received from the U.S. uniformed services (Army, Navy, Marine Corps, Air Force, Coast Guard, commissioned corps of the Public Health Service and National Oceanic and Atmospheric Administration) are exempt from taxation in Massachusetts.

[Edited 3/23/2020 | 10:00 AM PST]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax version of the Massachusetts has an error

I don't understand, if I am paying for turbotax why isn't the software working. I have been taking a military exemption for military pay for years. Why is this year different and I have to mail in a return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax version of the Massachusetts has an error

After completing the first screen. I continued onto the next screen. My 2nd screen was different from what you had shown. My screen indicated: "What did you do with the money from Office Of Personnel Management". I'm wondering why two different screens? So I'm guessing I need to go to "Pension Adjustment-Federally Taxable.

So my question to you is. Do I include the figure amount shown on my Form 1099-R under: "2a Taxable Amount" into the box that indicates: Non-taxable Massachusetts Pensions

Thank You

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax version of the Massachusetts has an error

I am also having this issue and am using the online version. I have already paid for the MA filing. Is there a way to fix the bug?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax version of the Massachusetts has an error

That was the answer I was hoping someone could answer. I ended up requesting a refund fot the MA filinh

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax version of the Massachusetts has an error

Is the amount shown on my Form 1099-R (Box 2a Taxable amount) the figure that's put into the Non-taxable Massachusetts Pensions box?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax version of the Massachusetts has an error

This doesn't work because the entry G in box 7 removes the federal tax in addition to the state tax. The MA pension are only MA non taxable

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax version of the Massachusetts has an error

I went thru the whole routine noted above and it works....BUT, my pension is not military. So it doesnt work for me. I entered my wifes 1099-r, she was a teacher. Hers was identical to mine and hers was not charged state tax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax version of the Massachusetts has an error

I also had this error.

For some reason it was populating the box with a 0 as I had no tax-exempt portion.

If you remove the 0 and leave it blank it works.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax version of the Massachusetts has an error

I am in the same situation, but I was a DoD civilian employee enrolled in the Thrift Saving Plan which is a qualified retirement fund by the US Government. Does the same applies to me as below?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax version of the Massachusetts has an error

The income from most private pensions or annuity plans is taxable in Massachusetts. Certain government pensions are exempt under Massachusetts law

Below is a link to Massachusetts which shows which plans are taxable and which are not taxable. Distributions from Federal employee Thrift savings plans are taxable when distributed.

MA tax treatment of retirement plan

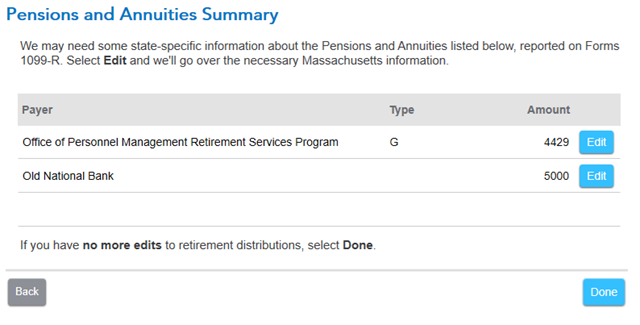

In TurboTax, the screen Pensions and Annuities Summary in the Massachusetts state tax return shows the taxable pension with no entry under Type.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax version of the Massachusetts has an error

I need to make a Pension Adjustment so it will reflect on he MA State taxes. The program is not allowing me to get to this page per below. I even deleted the 1099R and re-inputed including Smart Check without any luck. Please provide instructions to get to Pension Adjustment - Federal Taxable Page. Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax version of the Massachusetts has an error

Once you have determined that your return is indeed exempt, you can follow these steps to make sure it is entered correctly in TurboTax:

- Select the “Federal Taxes” tab

- Select the “Income” tab

- Select “5. IRA and Pension Distributions” Add or Edit button

- Enter the pension information (payer’s name, gross distribution, etc.)

- Continue through the interview until you get to the screen titled “Select Your State” and select Massachusetts

- Continue to the next screen and indicate whether the pension is:

- Federal government pension that I contributed to

- Military and survivors’ pension

- MA state or local govt pension that I contributed to

- Certain state court judges’ pension

- Select the “State Taxes” tab and complete the Massachusetts interview

- If one of the 4 options were selected in step 6 above, the pension is excluded from Form 1, line 4, and an explanatory statement is attached to your Massachusetts return with the reason for excluding the pension

Review the link below for more detailed information:

Massachusetts Nontaxable Pension

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

CWP2023

Level 1

f4tq

Level 2

titan7318

Level 1

csktx

Level 1

SterlingSoul

New Member