- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

No. I researched this by creating it in a return and did get it to subtract. The key is to tell the Massachusetts state return that the pension is exempt after also taking steps in the federal return.

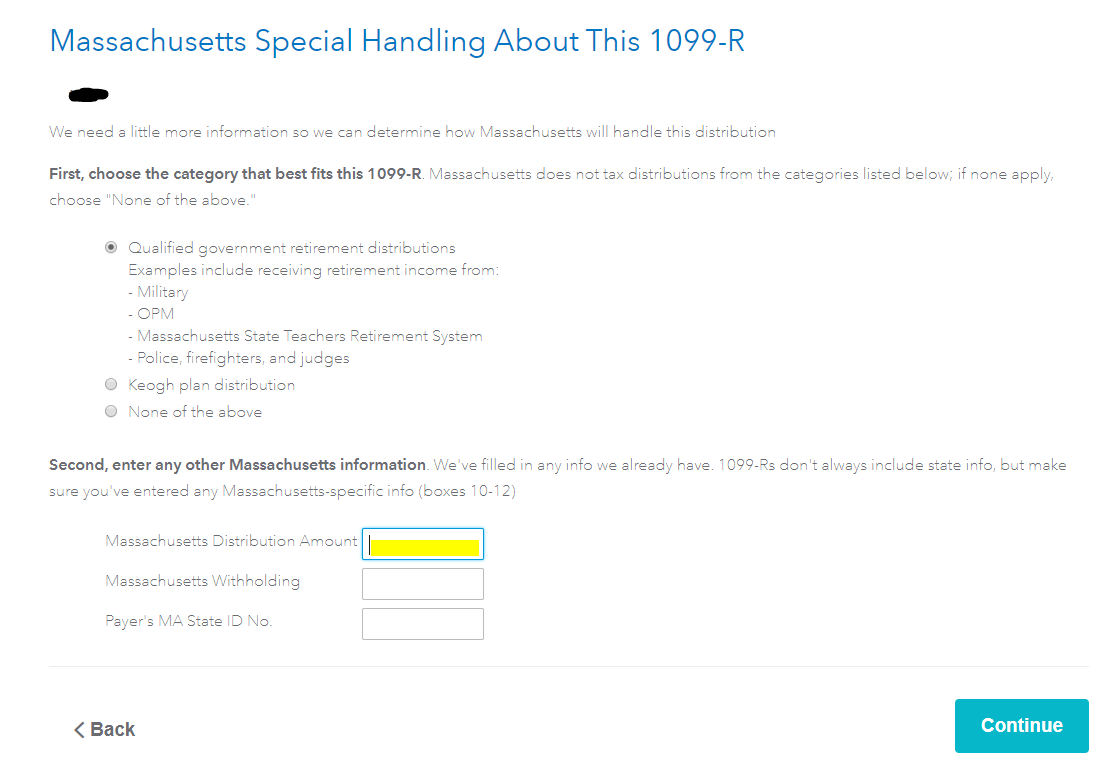

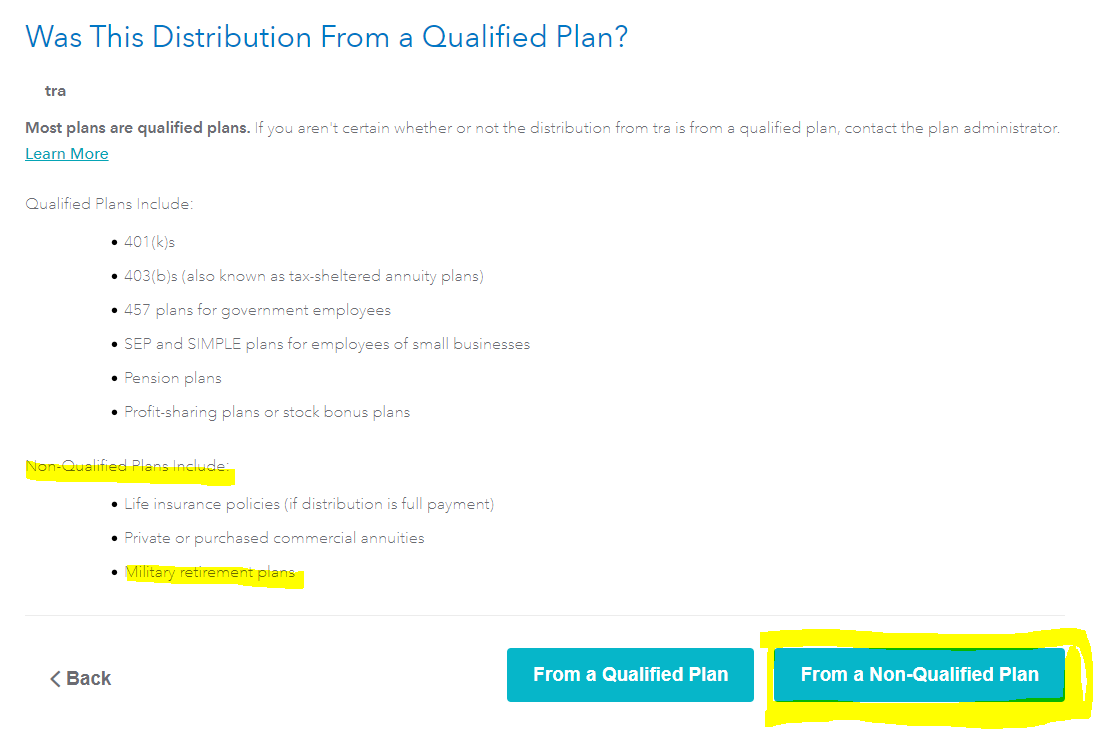

See the screenshots that you will find during the federal interview following the 1099-R input, assuming a distribution code of 7, normal distribution.

The first screen is for special handling of the 1099-R where the amount will be included and the pension will be identified as a qualified government retirement document. Leave the Massachusetts Distribution Amount blank and click Continue.

Second, the pension will be identified as Non-qualified.

The entries above should properly identify the military pension.

If there is still an error, then the third entry is done in the Massachusetts interview. You will identify the exempt portion.

However, if this entry is made, it will be an override. The Massachusetts return will have to be paper-filed.

See 2019 Massachusetts Form 1 Instructions beginning on page 9, middle column under What pensions are exempt? which confirms your findings, yes US Military Pensions are exempt:

Pension income received from a contributory annuity, pension, endowment or retirement fund of the U.S. Government or the Commonwealth of Massachusetts and its political subdivisions.

Noncontributory pension income or survivorship benefits received from the U.S. uniformed services (Army, Navy, Marine Corps, Air Force, Coast Guard, commissioned corps of the Public Health Service and National Oceanic and Atmospheric Administration) are exempt from taxation in Massachusetts.

[Edited 3/23/2020 | 10:00 AM PST]