- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Trouble reporting Foreign Earned Income on 540NR: Schedule CA

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trouble reporting Foreign Earned Income on 540NR: Schedule CA

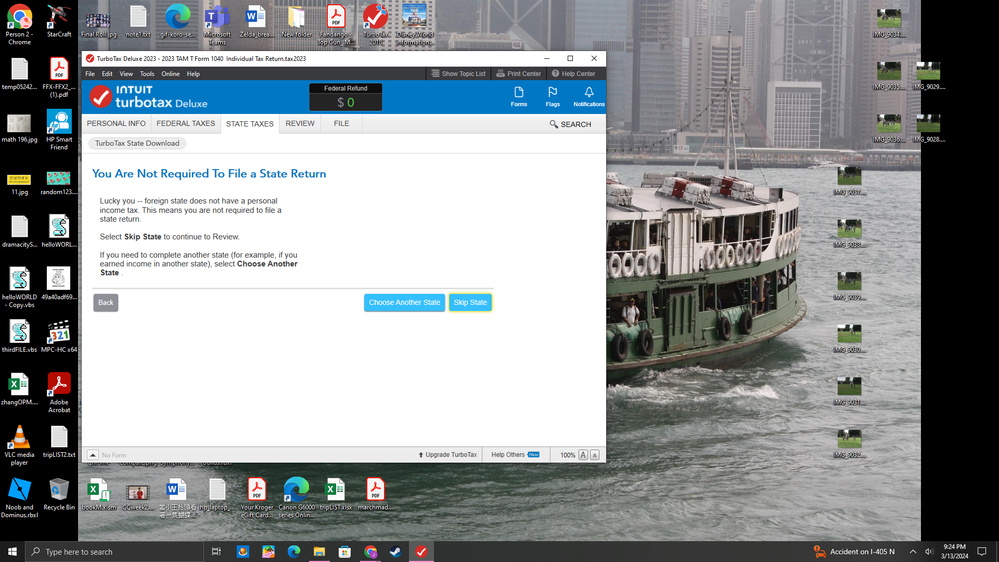

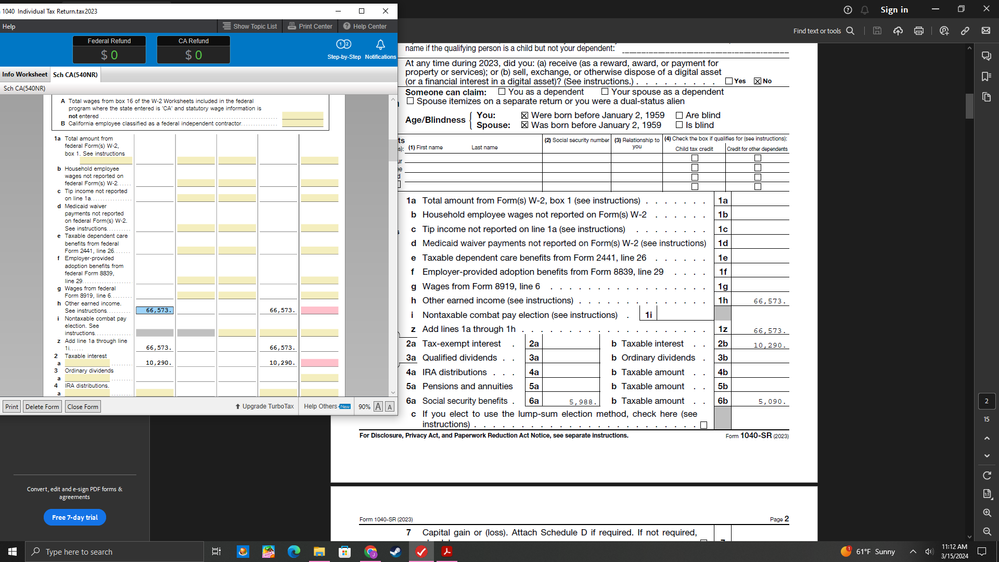

In the past years, Turbo Tax helped me moved the Foreign Earned Income (qualified for exclusion for Federal) to 540NR. But this year, it even told me that I don't need to report CA state tax return. When I insist on adding CA State tax return, it placed the Foreign Earned Income (FEI) into "combat zone foreign earned income exclusion" which is not true. Hong Kong, China was not a combat zone in 2023. So I followed an advice from this community and click on "forms" on the upper right corner to look at the schedule CA. It listed the FEI in column A but I can't edit it to become 0 so that I can move the amount to column C.

What can I do? What should I do? Thanks in advance.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trouble reporting Foreign Earned Income on 540NR: Schedule CA

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trouble reporting Foreign Earned Income on 540NR: Schedule CA

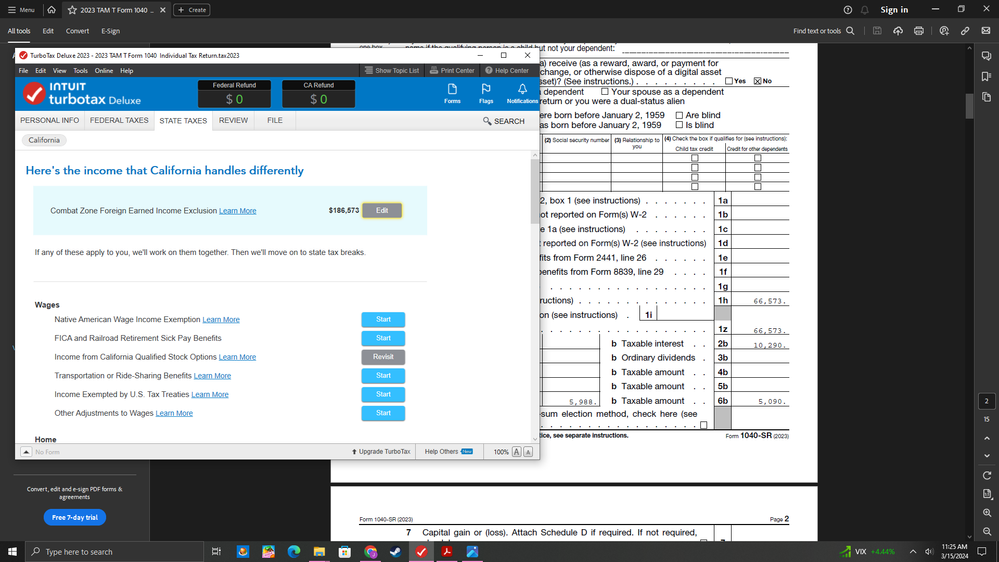

I'm actually confused why it says "combat zone foreign earned income exclusion" is $186,573. Where did they get that number?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trouble reporting Foreign Earned Income on 540NR: Schedule CA

Never mind. I figure out my mistake now. The FEI does not need to be taxed in CA so it should be in column A. The $183k shown on the "Combat Zone FEI exclusion" is hinting to me that I made a mistake on Form 2555 because I accidentally reported the FEI 3 times. I don't know why Form 2555 line 23 had "NIL" therefore forcing me to put a number there. Once I deleted "NIL", it lets me move on. So now I'm reviewing both 1040 and 540NR again for any mistake before filing. Thank you for reading.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

maya-cooper-brill

New Member

midtowncpa

Level 2

LidiaTapia

New Member

Rockpowwer

Level 4

JLGTT

Level 1