- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- State tax withheld but I never worked in that state!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax withheld but I never worked in that state!

Hello, I worked for a MA employer... but I never worked in that state (remote employee). I worked from NH where there is no state income tax. The MA employer withheld MA state taxes, but when I fill out the MA return and specify that all my income was earned outside of MA... it still says I owe the tax. What am I doing wrong?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax withheld but I never worked in that state!

You need to file non-resident MA return. Make sure you've filled out the Personal Info section correctly:

- With your return open, select My Info in the left-hand menu.

- Then, on the Personal info summary screen, scroll down to Other State Income, and select Edit.

- At the Did you make money in any other states? question, answer Yes and make sure your nonresident state(s) are selected from the drop-down.

When preparing a nonresident return solely to recover erroneous tax withholdings, enter 0 on the screen that asks for the amount of income earned in that state. This will eliminate your tax liability for that state, resulting in a full refund.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax withheld but I never worked in that state!

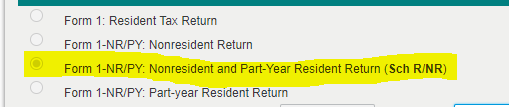

Thanks! Yes, right after I posted.. I found that I could change the form to "Nonresident and Part Time resident" (Form1-NR/PY).

The problem is that Turbotax keeps asking me to put in the date range when I resided in MA... but I NEVER resided in MA. I left them blank and I'm now showing a full refund of the MA state taxes withheld.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax withheld but I never worked in that state!

OK, this is the only form choice that is refunding all my state income taxes withheld.. is this the right one?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax withheld but I never worked in that state!

The correct choice is the one above the one you chose. "Form 1 - NR/PY Nonresident" since you never lived in MA.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax withheld but I never worked in that state!

The problem is that once I choose that... it goes from $1350 refund (which is what they withheld).... to $43 tax due! I don't know what's wrong.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax withheld but I never worked in that state!

MA is one of the states that you pay tax in even if you never physically went to MA. See Example 2 in the Out of State Employers FAQ below.

Convenience of the Employer Rule

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax withheld but I never worked in that state!

But it says this right below "Example 2":

In these cases, you need to file a nonresident return to recover the erroneous withholdings. On the nonresident return, declare earnings of $0 so you can get a full refund for the taxes your employer withheld. You should also tell your payroll department so they fix this in the future.

How do I do this??? (FYI, I no longer work for the employer)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax withheld but I never worked in that state!

MA's COVID income-sourcing rule expired on September 13, 2021.

"For the period beginning after September 13, 2021, wages paid to a nonresident employee will no longer be sourced based on where the employee worked prior to the COVID-19 state of emergency. Instead, the wages for such period will generally be sourced based on where the employee’s work is actually performed."

Bottom line: For tax year 2022, a non-resident of MA who never physically works in MA has no income tax obligation to the state of MA on that work income.

If in that circumstance MA income taxes were mistakenly withheld, the taxpayer should file a non-resident MA tax return, showing the withholding but allocating zero income to MA.

Income from work physically performed in NH is NH-source income, not MA-source income. Location of the employer is irrelevant.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax withheld but I never worked in that state!

I also found this on the Mass.gov DOR website:

If your employer mistakenly withheld Massachusetts income tax, file a Massachusetts Nonresident/Part-Year Resident Return, Form 1-NR/PY, to request a refund. Submit a letter from your employer along with the return, which verifies that you didn't work in Massachusetts.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax withheld but I never worked in that state!

MA uses Form 1-NR/PY for both non-residents and part-year residents. I would submit the version that results in a full refund of the withheld MA taxes, since that is the correct outcome.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax withheld but I never worked in that state!

I figured it out!

There was a question asking to "apportion your state taxes". While I was clicking "Yes" each time, I didn't realize that I needed to hit edit next to each W-2 employer listed and put that I worked "0 days" in MA.

Once I did this, the refund jumped to the amount withheld and I was able to complete the MA state return with NO ERRORS. Yipee!!!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

michellegriffin01

New Member

Leilaniroy123

New Member

leighrose992

New Member

mjkitty859

New Member

user17674895133

New Member