- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- State tax exclusions from municipal and us territory obligations Where do I enter on Virginia state tax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax exclusions from municipal and us territory obligations Where do I enter on Virginia state tax?

Edward Jones sent additional tax information Potential State Tax exclusions. How do I enter these on Virginia State Tax form?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax exclusions from municipal and us territory obligations Where do I enter on Virginia state tax?

You will indicate the portion of Dividends that are excludable on your Virginia Tax Return within the 1099-DIV section.

Follow these steps :

- Open your Tax Return

- Click on the Federal Tab at the Top

- Click "Continue"

- Click "I'll Choose What I Work On"

- Scroll down to the Investment Income section and click Start/Update next to Dividends on 1099DIV

- Click "Edit" next to your Edwards Jones 1099DIV

- Click "Continue"

- "X" the box that says "A Portion of these Dividends is US Government Interest"

- Click continue and it should take you to a box where you enter the US Government Interest (Click on Screenshot Below)

If this answer doesn't resolve your issue, please comment below so I can assist you further.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax exclusions from municipal and us territory obligations Where do I enter on Virginia state tax?

Thank you, Rachel. This was very helpful.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax exclusions from municipal and us territory obligations Where do I enter on Virginia state tax?

(Later NOTE: Starting with 2022 Federal taxes, tax-exempt dividends were moved to box 12 of a 1099-DIV.

This post refers to 2021 1099-DIV forms)

(IF you live in CA, MN or IL, there are severe restrictions on whether you can break out your own state $$ and any US Territory Bond interest from box 11 of a 1099-DIV form

............and note that Rachel's answer above is actually used for breaking out US Treasury bond interest that is included in box 1a of a 1099-DIV form, and not for State and US Territory bond interest in box 11 of the -DIV form)

______________________

So....For states that have an income tax

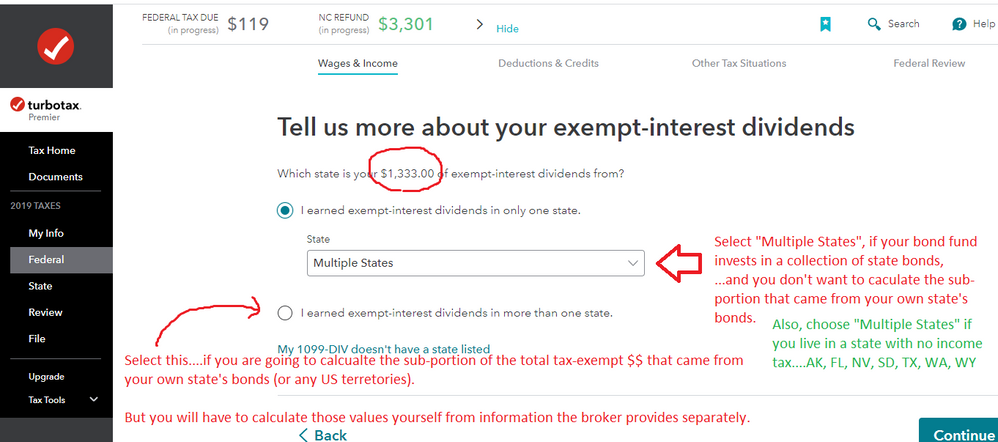

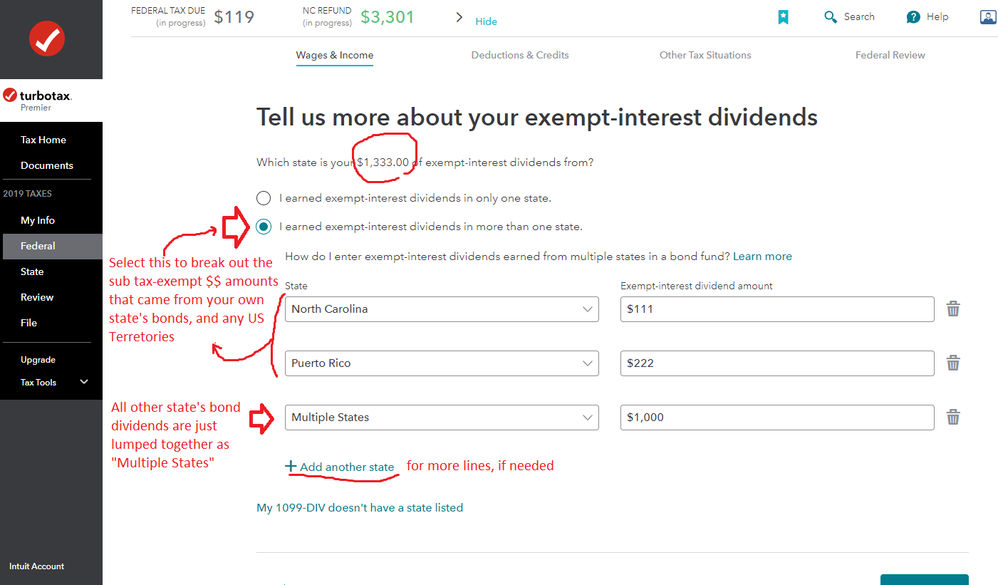

The actual allocation of box 11 $$ on a 1099-DIV to your own state, or any US territories, is handled on one of the pages following the main 1099-DIV form...see the examples below for an NC resident:

_____________________

___________________________

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

xsun226001

New Member

cindyjtp

New Member

Jacks-son

Level 3

dbarbera64

New Member

kk2015ct

New Member