- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

(Later NOTE: Starting with 2022 Federal taxes, tax-exempt dividends were moved to box 12 of a 1099-DIV.

This post refers to 2021 1099-DIV forms)

(IF you live in CA, MN or IL, there are severe restrictions on whether you can break out your own state $$ and any US Territory Bond interest from box 11 of a 1099-DIV form

............and note that Rachel's answer above is actually used for breaking out US Treasury bond interest that is included in box 1a of a 1099-DIV form, and not for State and US Territory bond interest in box 11 of the -DIV form)

______________________

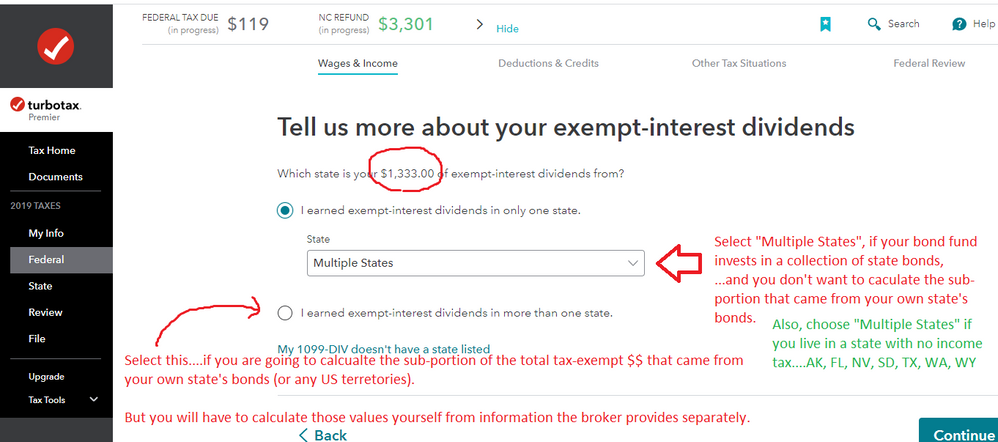

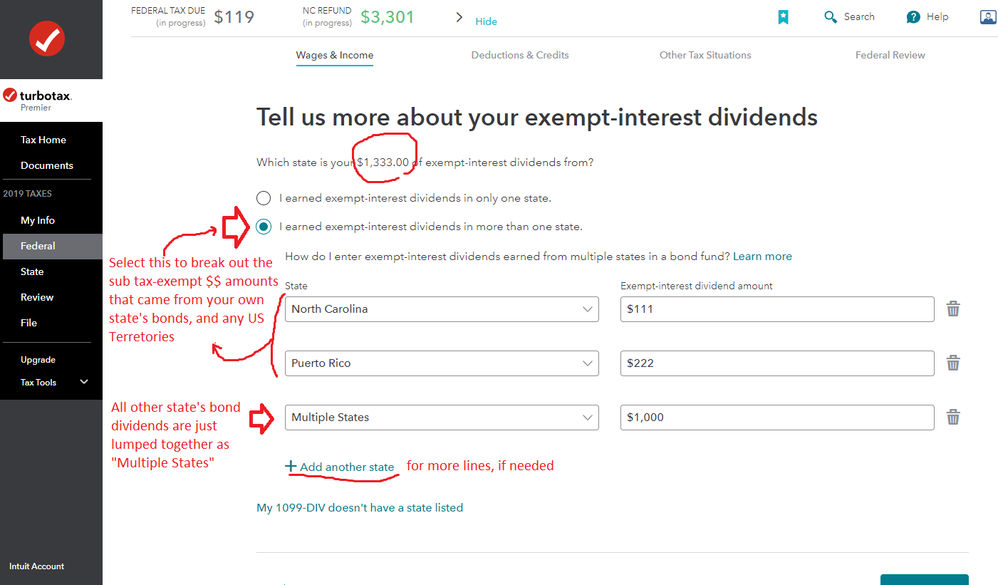

So....For states that have an income tax

The actual allocation of box 11 $$ on a 1099-DIV to your own state, or any US territories, is handled on one of the pages following the main 1099-DIV form...see the examples below for an NC resident:

_____________________

___________________________