- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Spouse with non-resident Massachusetts tax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Spouse with non-resident Massachusetts tax

Hi everyone,

We live in New Hampshire and my spouse and I filed married filing jointly on our federal tax return via Turbotax (2021, done and accepted). I work in New Hampshire and she (my spouse) works remotely for a company in Massachusetts. She will need to file a non-resident Massachusetts tax return.

Prior posts have mentioned that we should file separately for her (my spouse) Massachusetts return. After I filed our federal return (married filing jointly), I created in Turbotax a mock return for married filing separately for my spouse and obviously did not file for federal again. I proceeded to the Massachusetts state portion of my spouse's return. It is now asking the following in Turbotax:

"We need some information from your spouse's (referring to me, NH resident, NH job) 2021 tax return. Massachusetts wants to make sure both of you are reporting the same income and family information.

Enter your spouse's (referring to me, NH resident, NH job) federal total income and adjusted gross income (AGI). Then enter the total household dependents below to including your spouse's (referring to me, NH resident, NH job) dependents.

Am I going about this the correct way and what should I enter? Since we filed jointly on federal, how can I provide my AGI individually?

Thank you

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Spouse with non-resident Massachusetts tax

Both of your AGI's will be the same since you file a joint federal return. The joint AGI is the only number the IRS will have for both you and your wife.

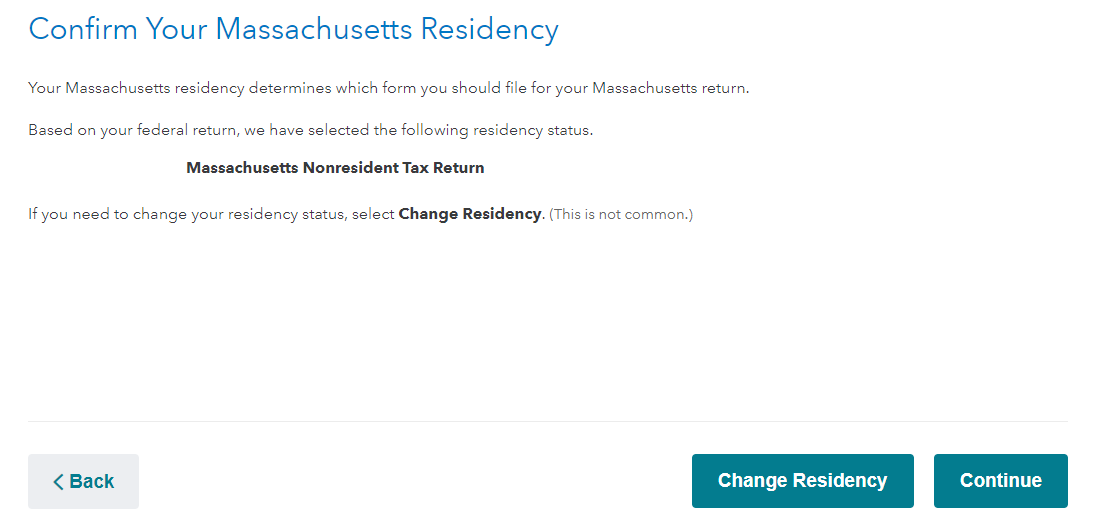

Yes, it sounds like you are doing it correctly, as long as you are filing the Non Resident Return. When you first entered into the MA program, you should have gotten the screen that says "Confirm your Massachusetts Residency" and this page should have said Non Resident

States, as well as the IRS, require spousal information when people file separate just to make sure you are both not claiming same expenses and that your returns make sense together, even though, you will not be filing a state return for MA.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Spouse with non-resident Massachusetts tax

Thank you for your response. Yes we are filing the Massachusetts non-resident return for my spouse (because we do not live there but her company is there), married filing separately. We filed the federal return married filing jointly and have a joint AGI.

The Massachusetts return is now asking for my individual AGI. The blacked out annotations in the image refers to me.

How do I find out what my AGI is when we filed jointly? Should I make a mock married filing separately return for myself and use that number?

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Spouse with non-resident Massachusetts tax

Yes, generate a mock MFS return for yourself to include the information on your spouse's MFS MA return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Spouse with non-resident Massachusetts tax

Thank you I did just that. Now I am getting this prompt on my spouse's Massachusetts non-resident return.

The reason is my income from New Hampshire.

What is a good response in tax "language" that I can put into my spouse's Massachusetts non-resident return? We live in New Hampshire and my income is from New Hampshire. I don't want Massachusetts to think there is some discrepancy and cause problems in the future.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Spouse with non-resident Massachusetts tax

You are both residents of New Hampshire and only one spouse has MA source income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Spouse with non-resident Massachusetts tax

Did this explanation work?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

fastesthorse

Level 1

Sanchez11danny

New Member

mariam-hassan1895

New Member

mariam-hassan1895

New Member

Filing2024

New Member