- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: You should include any income and expenses from your prop...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello, I declare taxes in New York State but I have property/income abroad. What should I do?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello, I declare taxes in New York State but I have property/income abroad. What should I do?

You should include any income and expenses from your property abroad in your federal return (which will then flow to the New York return).

Enter it just as you would if the property was in the U.S. (rental property or second home).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello, I declare taxes in New York State but I have property/income abroad. What should I do?

You should include any income and expenses from your property abroad in your federal return (which will then flow to the New York return).

Enter it just as you would if the property was in the U.S. (rental property or second home).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello, I declare taxes in New York State but I have property/income abroad. What should I do?

@IreneS More specific version of this question specifically for NY State return: Have a second home abroad (in France). It is not rented out nor available for rent so Schedule E not relevant. If I itemize deductions on NY State return can I deduct property taxes paid in France on this property on my NY State return just as my friends who have Real estate property taxes in the USA on two homes deduct them on their NY state returns

ie can one deduct Real estate and property taxes from a second home ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello, I declare taxes in New York State but I have property/income abroad. What should I do?

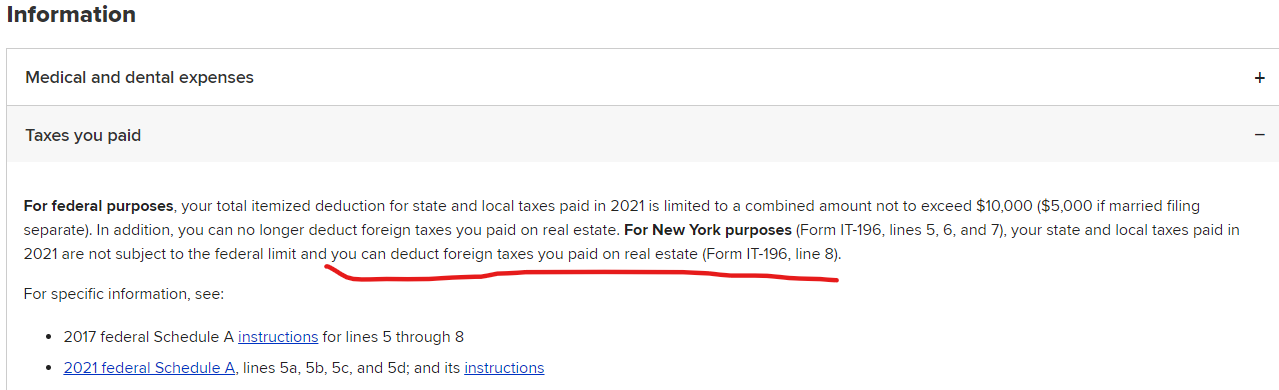

Foreign property (real estate) taxes aren't deductible in tax year 2018 through 2025 due to the Tax Cuts and Jobs Act. In 2017 and prior years, foreign property taxes could be deducted.

But for NYS income tax purposes, you can deduct foreign taxes you paid on real estate (IT-196, line 8), if you itemize the deductions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tinaspurgeon

New Member

justwanttofilemytaxes

Level 2

102296TLC

Level 2

user17669592079

Level 1

ron6612

Level 5